Equity benchmarks resumed their downward march on May 7 as rising cases of novel coronavirus, or COVID-19, and a delay in government stimulus dealt a blow to investor sentiment.

The Sensex closed the day with a loss of 0.76 percent at 31,443.38 and the Nifty settled 0.78 percent lower at 9,199.05.

"There is no respite in the number of domestic virus infections and the market is worried about a further extension in the lockdown, which could severely impact already weak corporate earnings and the economy.

The Indian market is expected to trade volatile, tracking domestic news regarding the spread of infections," said Vinod Nair, Head of Research at Geojit Financial Services.

We have collated 14 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance level for NiftyAccording to pivot charts, the key support level for the Nifty is placed at 9,157.35, followed by 9,115.65. If the index starts moving up, key resistance levels to watch out for are 9,259.3 and 9,319.55.

Nifty BankThe Nifty Bank closed 1.03 percent lower at 19,491.80. The important pivot level, which will act as crucial support for the index, is placed at 19,296.93, followed by 19,102.07. On the upside, key resistance levels are placed at 19,721.93 and 19,952.07.

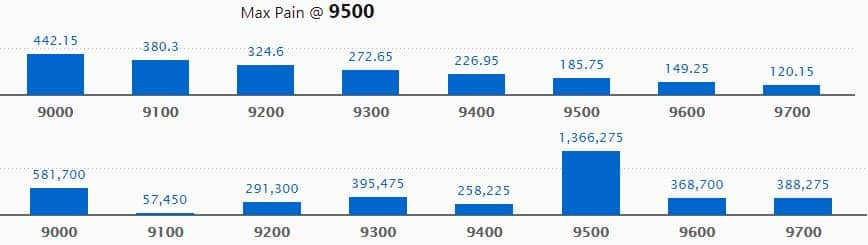

Call option dataMaximum call OI of 13.66 lakh contracts was seen at the 9,500 strike. It will act as crucial resistance in the May series.

This is followed by 9,000, which holds 5.82 lakh contracts, and 9,300 strikes, which has accumulated 3.95 lakh contracts.

Significant call writing was seen at the 9,500, which added 1.08 lakh contracts, followed by 9,600 strikes that added 72,750 contracts.

Call unwinding was witnessed at 8,700, which shed 4,875 contracts.

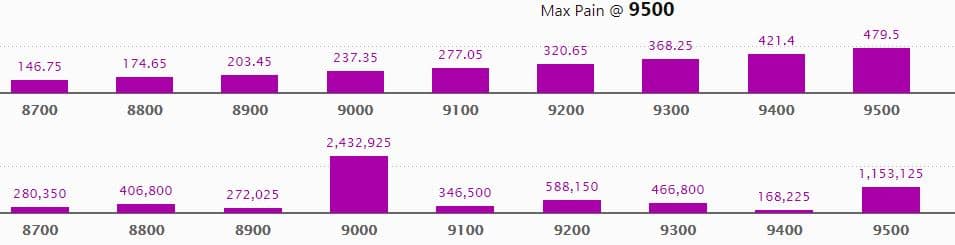

Maximum put OI of 24.33 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,500, which holds 11.53 lakh contracts, and 9,200 strikes, which has accumulated 5.88 lakh contracts.

Significant put writing was seen at 8,700, which added 71,850 contracts, followed by 8,800 strikes, which added 52,200 contracts.

Put unwinding was seen at 9,300, which shed 53,100 contracts, followed by 9,500 strikes that shed 43,725 contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

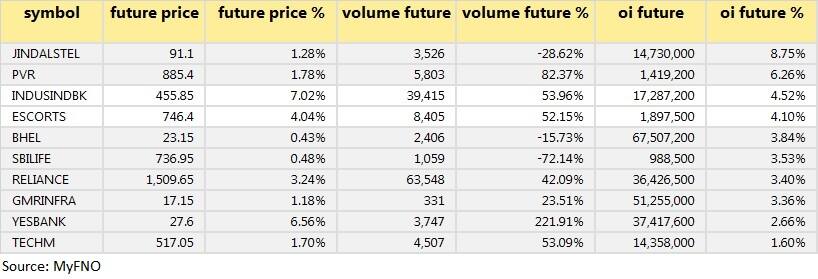

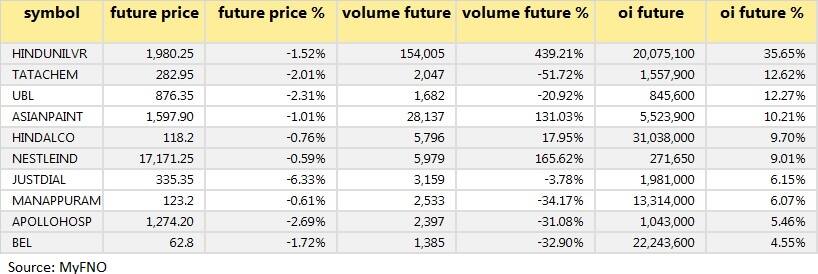

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

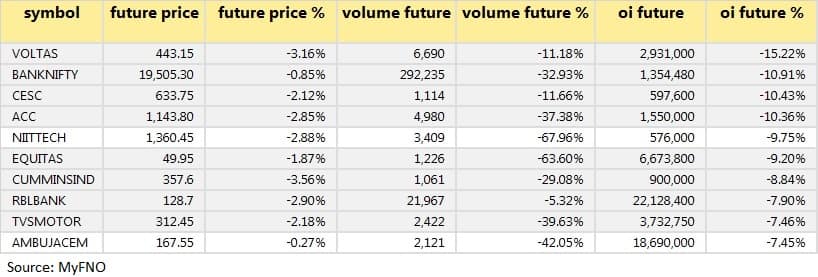

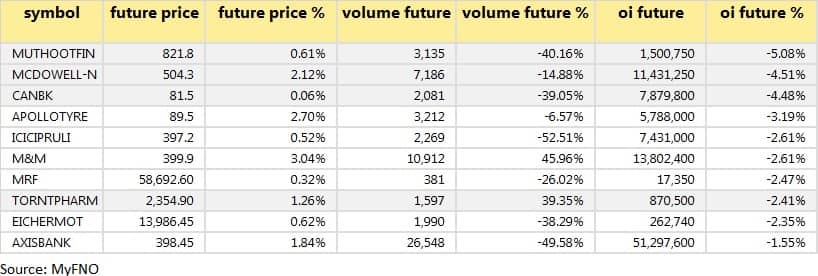

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

SBI Card, Shree Cement, Adani Gas, Reliance Capital, Reliance Infrastructure, Proctor & Gamble Hygiene and Swaraj Engines.

Stocks in the news RBL Bank Q4: Profit fell to Rs 114.36 crore versus Rs 247.18 crore, NII rose to Rs 1,021 crore versus Rs 738.72 crore YoY.

Gillette India Q3:Profit declined to Rs 52.38 crore versus Rs 87.76 crore, revenue fell to Rs 406.57 crore versus Rs 465.51 crore YoY.

Cyient Q4: Profit fell to Rs 45.2 crore versus Rs 176.6 crore, revenue down to Rs 1,073.6 crore versus Rs 1,162.9 crore YoY.

Hindustan Unilever: Societe Generale bought 1.29 crore shares at Rs 1,902 per share.

Apollo Pipes: Promoter Sameer Gupta acquired further 1,44,476 shares in the company at Rs 323.73 per share.

Sobha:Anamudi Real Estates bought 5,52,000 shares in the company at Rs 180.26 per share.

Fund flow

Foreign institutional investors (FIIs) and domestic institutional investors (DIIs) bought shares worth Rs 19,056.49 crore and Rs 3,818.41 crore, respectively, in the Indian equity market on May 7, provisional data available on the NSE showed.

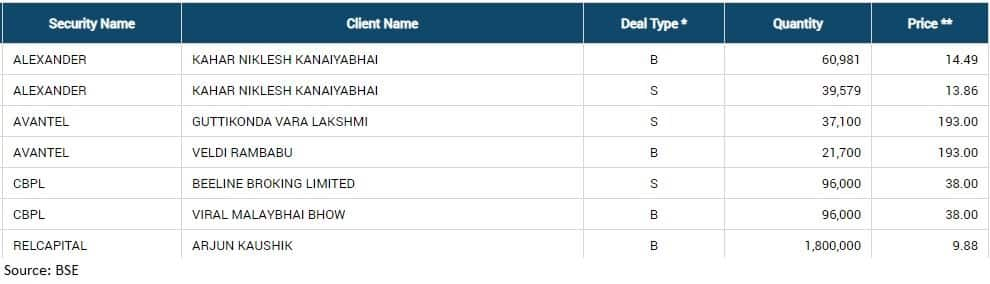

Horlicks and GlaxoSmithKline sold over 13.37 crore shares of HUL in the range of Rs 1,902.18-1,913.8 per share, as per the bulk deals data available on the National Stock Exchange. Societe Generale acquired 1.29 crore HUL shares at Rs 1,902 per share.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!