After falling more than 800 points from its record high, the Nifty 50 showed around 177 points recovery from day's low of around 21,286 and closed with half a percent loss on January 18. If the index recovers further, then 21,550 is expected to be an immediate resistance, followed by 21,650-21,700 levels, while the immediate support is likely to be at 21,400, followed by 21,300 mark, experts said.

On January 18, the BSE Sensex declined 314 points to 71,187, while the Nifty 50 was down 110 points at 21,462 and formed High Wave kind of candlestick pattern on the daily charts, indicating the volatility.

The Nifty slipped below the rising trendline on the daily chart, suggesting a bearish trend reversal. Besides, the index has fallen below the critical near-term moving average. Now, "the trend is likely to remain weak as long as the index stays below 21,550," Rupak De, senior technical analyst, LKP Securities said.

He feels a decisive move above 21,550 might weaken the bears; until then, bears might control the market. "On the lower end, support is placed at 21,400. A drift below 21,400 might take Nifty for a revisit to 21,250-21,200," he said.

Chandan Taparia, senior vice president | analyst-derivatives, Motilal Oswal Financial Services too feels, till the Nifty 50 holds below 21,550, the weakness could be seen towards 21,300 and 21,250 zones, while on the upside hurdle shifts higher at 21,550 and 21,650 zones.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,332, followed by 21,272, and 21,175 levels, while on the higher side, it may see an immediate resistance at 21,486 followed by 21,586 and 21,683 levels.

Meanwhile, on January 18, the Bank Nifty saw yet another gap down opening and extended losses for third consecutive session, falling 351 points to 45,714. The banking index has formed bullish candlestick pattern with long upper shadow on the daily timeframe as the closing was higher than opening levels.

The index has recovered 283 points from day's low. "The index's immediate support is positioned at the 45,500-45,400 zone, and a successful defense of this level could trigger a rebound towards 46,500," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels despite potential short-term fluctuations, the broader trend continues to favour a "sell on rise" approach, suggesting caution and a likelihood of further declines if the mentioned resistance level is not convincingly breached.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,488, followed by 45,310 and 45,023 levels, while on the higher side, the index may see resistance at 45,783, followed by 46,242 and 46,529 levels.

As per the weekly options data, the 22,000 strike owned the maximum Call open interest, with 66.48 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 65.31 lakh contracts, while the 21,800 strike had 49.84 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 40.25 lakh contracts followed by 21,500 and 22,300 strikes adding 27.88 lakh and 25.02 lakh contracts, respectively.

The maximum Call unwinding was at the 20,000 strike, that shed 47,400 contracts followed by 20,500 and 21,100 strikes which shed 31,200 and 14,550 contracts.

On the Put front, the maximum open interest was at 21,000 strike, which can act as a key support area for Nifty with 52.51 lakh contracts. It was followed by 20,500 strike comprising 52.09 lakh contracts and then 21,400 strike with 41.39 lakh contracts.

Meaningful Put writing was at 21,400 strike, which added 23.66 lakh contracts followed by 20,200 strike and 20,500 strike adding 20.34 lakh contracts and 16.57 lakh contracts, respectively.

Put unwinding was seen at 21,800 strike, which shed 5.47 lakh contracts, followed by 21,600 strike which shed 3.99 lakh contracts, and 21,700 strike, which shed 3.55 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Godrej Consumer Products, InterGlobe Aviation, Britannia Industries, Bajaj Finance, and HDFC Bank saw the highest delivery among the F&O stocks.

A long build-up was seen in 44 stocks, which included Oracle Financial Services Software, Apollo Tyres, Mahanagar Gas, MCX India, and Indus Towers. An increase in open interest (OI) and price indicates a build-up of long positions.

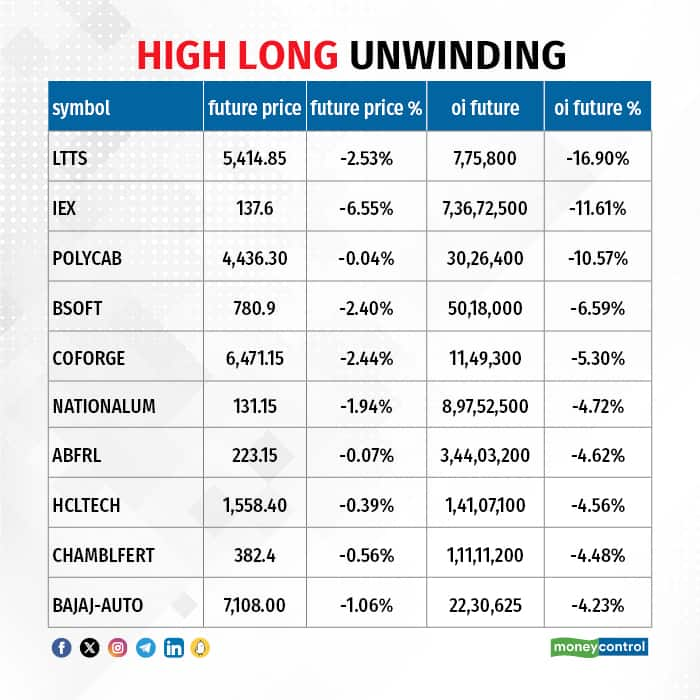

Based on the OI percentage, 44 stocks saw long unwinding, including L&T Technology Services, Indian Energy Exchange, Polycab India, Birlasoft, and Coforge. A decline in OI and price indicates long unwinding.

55 stocks see a short build-up

A short build-up was seen in 55 stocks including LTIMindtree, HDFC Bank, ICICI Prudential Life Insurance Company, Max Financial Services Company, and IndiaMART InterMESH. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 43 stocks were on the short-covering list. This included United Breweries, Astral, Aarti Industries, Dr Lal PathLabs, and Tata Consumer Products. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed to 0.94 on January 18, from 0.7 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Results on January 19 and January 20

Stocks in the news

IndusInd Bank: The private sector lender reported slightly better-than-expected earnings for the quarter ended December FY24, with standalone net profit growing 17.3 percent on-year to Rs 2,297.9 crore and net interest income rising 17.8 percent to Rs 5,295.6 crore.

Poonawalla Fincorp: The non-banking finance company has registered a massive 76.3 percent on-year growth in net profit at Rs 265.1 crore for October-December period of FY24. Revenue from operations during the same period grew by 52.1 percent to Rs 762.6 crore.

Metro Brands: The footwear retailer recorded a 12.6 percent year-on-year decline in consolidated net profit at Rs 97.81 crore for quarter ended December FY24, impacted by weak operating margin performance. Revenue from operations during the same period grew by 6.1 percent to Rs 635.5 crore compared to year-ago period.

Shoppers Stop: The department store chain registered a 41.3 percent on-year fall in consolidated net profit at Rs 36.85 crore for quarter ended December FY24, impacted partly by weak operating numbers and lower other income. Revenue from operations increased 8.8 percent YoY to Rs 1,237.5 crore in Q3FY24.

Supreme Petrochem: The polystyrene polymer producer recorded a 24.7 percent on-year decline in net profit at Rs 67.7 crore for October-December quarter of FY24, dented by tepid topline growth and disappointing operating performance. Revenue from operations grew by 0.6 percent to Rs 1,187.7 crore compared to corresponding period last fiscal.

Shalby: The multi-specialty hospital has acquired 87.26 percent stake in Sanar International Hospitals, Gurugram (PK Healthcare) for Rs 102 crore. This equity stake will be acquired within a period of one month, through primary infusion and secondary buy-outs.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) sold shares worth Rs 9,901.56 crore, while domestic institutional investors (DIIs) bought Rs 5,977.12 crore worth of stocks on January 18, provisional data from the NSE showed.

Stock under F&O ban on NSE

A total of 13 stocks are in the F&O ban list for January 19. The NSE has added Balrampur Chini Mills to the said list while retaining Aditya Birla Fashion & Retail, Ashok Leyland, Bandhan Bank, Delta Corp, Hindustan Copper, Indian Energy Exchange, Metropolis Healthcare, National Aluminium Company, Polycab India, PVR INOX, SAIL and Zee Entertainment Enterprises to the said list. Chambal Fertilisers & Chemicals was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.