Indian investor is always hungry for returns no matter what the market condition is. Anecdotal evidence suggests that there are as many as six stocks which have given a stellar return in the period starting from April – June not just in one year but for the last five years.

The S&P BSE Sensex is down by about 6 percent from its record high weighed down by both global as well as domestic factors. But, stocks which have outperformed market does not belong to Sensex or even from 'A' group category but more from the small and midcap space.

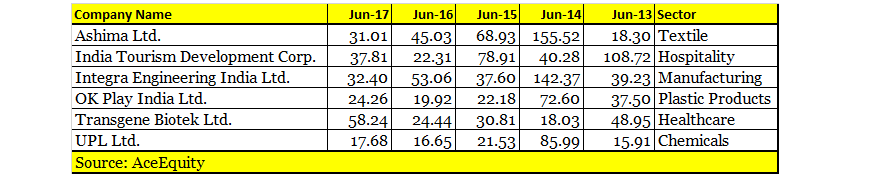

Consistent performance in the last five year in that three month put them ahead of bluechip stocks. Minimum these stocks have returned in the March quarter is 15 percent while on the higher side, the returns have gone to as much as 140 percent, according to data collated from AceEquity.

Stocks which have given stellar returns in the March quarter include names like Ashima Ltd, India Tourism Development Corporation, Integra Engineering, Ok Play India, Transgene Biotek Ltd, and UPL Ltd.

Ashima Ltd which belongs to the textile sector is one of India's leading 100 percent cotton fabric manufacturers. In a short span of 5 years, the Group has invested US$ 120 million in state-of-the-art technology and today is one of the foremost cotton textile players in the world.

The next stocks is from the tourism industry India Tourism Development Corporation which is an hospitality, retail, and Education company owned by the government of India, under the ministry of tourism. Established in the year 1996, it owns 17 properties under the Ashok group of hotels brand, across India.

The next stock which gave 142 percent return in the year 2013 belongs to the manufacturing sector. INTEGRA Engineering India Limited is engaged in manufacturing and sales of Railway control systems, and contract engineering and manufacturing for power and transport sectors.

The next outperformer belongs to the plastic product space which is in the manufacturing of plastic toys. OK Play is the largest manufacturer of plastic moulded toys, fun-stations, playground equipment and children’s furniture in India.

Transgene Biotek Ltd which has been a consistent performer in the June quarter of the last five years comes from the Healthcare sector. The product portfolio covers Oncology, Auto-Immunity, Drug Delivery and Biogenerics.

UPL from the chemical space is the most commonly known stock which has given a minimum of 15 percent return and a maximum of 21 percent return in the last five years. UPL is focused on emerging as a premier global provider of total crop solutions designed to secure the world’s long-term food supply.

What should investors do?The December quarter earnings were not as bad as was imagined by some experts on the D-Street and in a way has laid down the foundation for a bounce back in earnings in the following quarters.

Q3 FY18 saw a decent earning growth. Both at the Nifty level and a broader market level. The Nifty earnings grew at 7 percent as against the estimate of 12 percent, Edelweiss said in a report. The S&P BSE- 500 earnings growth has been at 11 percent.

Metals and Mining clearly stood out as top performers, followed by Consumer Staples, Auto Ancillaries. Pharma, Telecom, Textiles, Public Sector Banks have all been dragger.

"Corporate earnings are expected to improve over coming quarters as the impact of GST fades and consumption picks up. This, along with a continued shift in household savings from physical to financial assets, bodes well for equity markets," Sanjay Kumar, Chief Investment Officer, PNB MetLife India Insurance told Moneycontrol.

"The current fall and any further weakness in the near-term provide a window of opportunity to enhance allocation to good quality stocks," he said. Kumar is positive on Information Technology, private sector banks, Consumer Discretionary and Staples, Automobiles, and Engineering & Infrastructure.

Most analysts feel that the recovery cycle has already started the way December quarter results came out. Although December quarter earnings were a mixed bag, the fact that they are trending higher is encouraging with profit growth of 9 percent compared to last quarter’s 6 percent.

As many as 77 percent of the respondents feel that earnings have bounced back while the rest 23 percent feel that it might take a couple of more quarters, according to Moneycontrol poll of 15 analysts and money managers.

“If earnings start to improve it would have a positive impact on equities as well which should lead to some recovery in markets as well,” it indicated.

More than 70 percent of the respondents feel that the S&P BSE Sensex is on track to reclaim Mount 36K while 14 percent feel that it could hover in the range of 34000 to 36000. The rest 14 percent feel that it could slip below 34K towards the end of the year.

"We had a one year target of 36,000 for Sensex which was reached in the month of January itself. This target has been maintained subject to the full development of ongoing Q3 and changes in valuation given the global clampdown," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

"We continue to have a moderate outlook for equity during the year given premium valuation, increase in interest cost and reduction in liquidity. Till date, if you have lost the chance to reduce your exposure in high beta stocks then an uptick is likely in the near-term which can provide an opportunity to play in this volatility and restructure your portfolio accordingly," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!