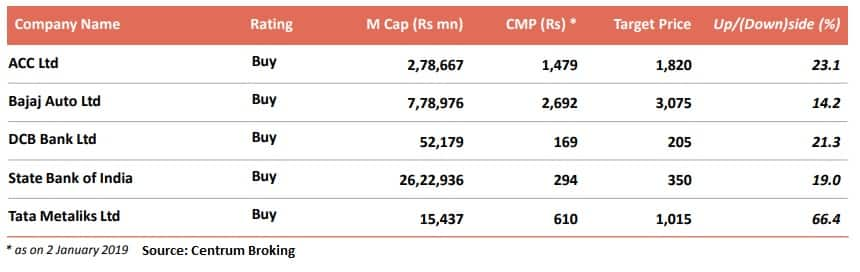

After a deep-dive analysis into business fundamentals, earnings outlook coupled with a margin of safety on valuations and corporate governance standards, Centrum Broking has come out with stock ideas with 1-year investment horizon.

The inherent high volatility in the markets keeps making risk-reward highly, and many times irrationally, favourable for some high-quality businesses. Keeping this market inefficiency in mind, the brokerage firm came out with their top five high conviction ideas, said a report by Centrum Broking.

These are sound businesses characterised by high operating and free cash flow generation coupled with good ROEs and high dividend payout ratios.

Here is a list of top five high-conviction picks from Centrum Broking that investors could look at in January for a time horizon of 1 year:

ACC: Buy| Target: Rs 1,820

We like ACC owing to its attractive valuations amid healthy cashflow generation and return ratios. The recent announcement for a major capacity increase after a long pause of almost a decade affirms the promoters focus on growing India business.

Rising industry utilisation should bolster pricing power, recent material supply agreement with Ambuja and sustenance of recent correction in diesel and petcoke prices should further provide profit tailwinds.

Bajaj Auto: Buy| Target: Rs 3,075

We like Bajaj Auto as it is one of the leading 2W and 3W players and the largest exporter of both 2Ws and 3Ws from India.

On the export front, the company has a market share of 40 percent+ in South Asia and the Middle East and 25 percent in Latin America. In 21 countries, which contribute 85 percent of its export sales, Bajaj is among the top two players.

In the era of premiumisation, a strong product portfolio entailing iconic brands like Pulsar, Avenger, and KTM augurs wells for the company.

Considering some pains (high cost of ownership, CV and tractor cycles may peak, BSVI implementation, etc.) in the domestic auto market, Bajaj Auto is safely placed with 40 percent sales exposure to export markets.

DCB Bank: Buy| Target: Rs 205

DCB Bank with is a well-defined product portfolio and customer segment stands to gain from the under-penetrated and under-served retail (self-employed) and SME segment, its key area of presence.

The recent past has seen loan growth accelerate and the momentum should continue. While H1FY19 have seen margins decline, we believe the same is set to inch upwards given 70-95 bps increase in MCLR rates since March 2018.

Our calculation suggests that the newly added branches have started to break-even. This is evident in reducing cost/asset ratio.

Capital position remains strong and supplements strong loan growth. We see DCB Bank report 1.1 percent RoA/14 percent RoE by end-FY20E.

State Bank of India: Buy| Target: Rs 350

State Bank of India is best placed to capitalise on the growth opportunity following a) improved credit environment, b) favourable bond yield movement and c) recovery from NPA accounts.

Loan growth has been on the rise (domestic loans grew 11.1 percent in Q2FY19 ) and we see traction therein to continue. The reduced slippages, loan growth acceleration, and a stable interest cost have seen margins inch higher. We see NIM inching towards 2.7 percent by end-FY20E (vs 2.5 percent for FY18).

Slippages have been on a decline, trends are set to remain encouraging in H2FY19 as well. While we see credit cost remain high, the softening in G-sec yield (down 55-60bps since September 2018) will see investment provisions reverse and in turn lower the overall provisioning charge.

We also see SBI report strong trading gains in Q3FY19, and valuations continue to remain attractive.

Tata Metaliks: Buy| Target: Rs 1,015

We like Tata Metaliks (TML) as its DI pipe business boasts of an industry-leading cost structure, solid demand drivers and strong entry barriers.

With commissioning of PCI project by Q4FY19E coupled with several other productivity improvement initiatives, TML is expected to continue delivering steady earnings growth over FY19-20E despite limited volume growth as its plants are running at 100 percent+ utilisations currently.

TML also has plans to expand its market share in the high margin DI pipes business from 11 percent currently to 18-20 percent range in 3-5 years and we expect management to announce expansion towards the same soon.

We see valuations attractive at FY19E P/E of 8.7x with reasonable scope for a re-rating given the strong balance sheet and attractive return ratios.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.