In technical analysis there are two types of indicators i.e. leading and lagging indicators.

In leading indicators, we will be discussing more about Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) which are useful for chart analysis.

Looking at leading indicators in conjunction with other types of data can help provide information about the future direction of the stock or index.

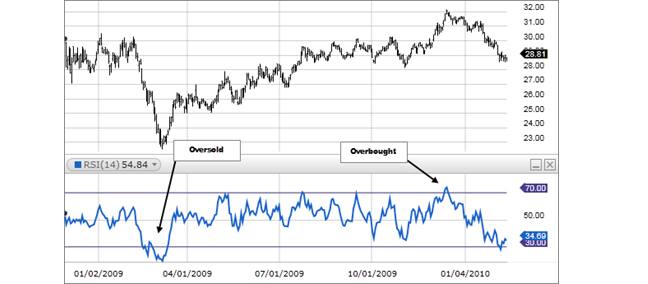

a) Relative Strength Index (RSI):The relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100. Traditional interpretation and usage of the RSI is that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price.

An RSI reading of 30 or below indicates an oversold or undervalued condition.

Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of that calculation is the MACD line. A nine-day EMA of the MACD, called the "signal line," is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals.

Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.