Shabbir Kayyumi

Narnolia Financial Advisors

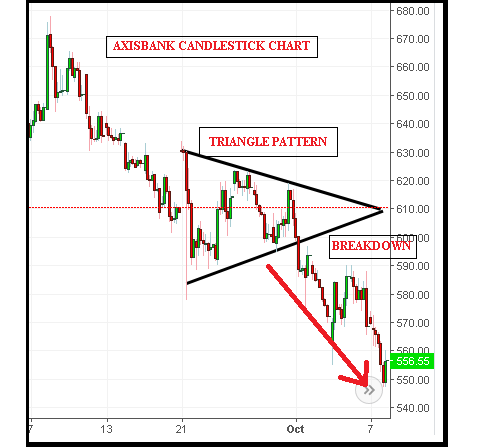

The triangle pattern is believed to be one of the most reliable & popular because its post pattern implications are faster than others. In the study of technical analysis, triangles fall under the category of continuation patterns. While the shape of the triangle is significant, of more importance is the direction that the market moves when it breaks out of the triangle.

What is ‘Triangle’ Pattern?

Triangle patterns are important because they help indicate the continuation of a bullish or bearish market. Usually with a triangle pattern, the price consolidation period consists of higher lows and lower high, forming the shape of a "triangle" when the resistance and support lines converge towards each other.

Triangle patterns are an integral part of technical analysis, but successful traders combine these techniques with technical indicators and other forms of technical analysis to maximize their odds of success.

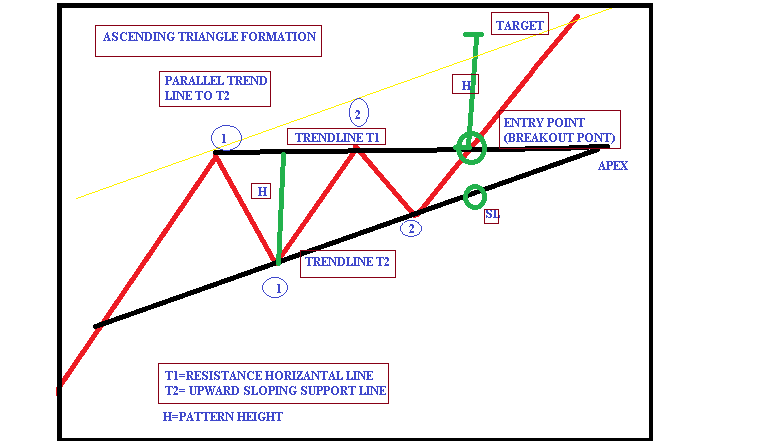

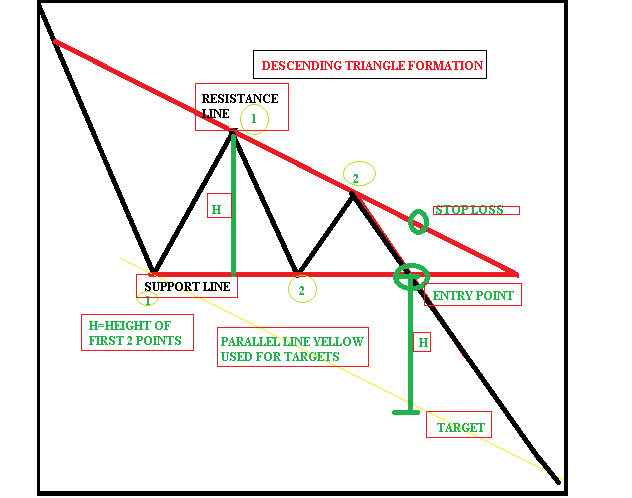

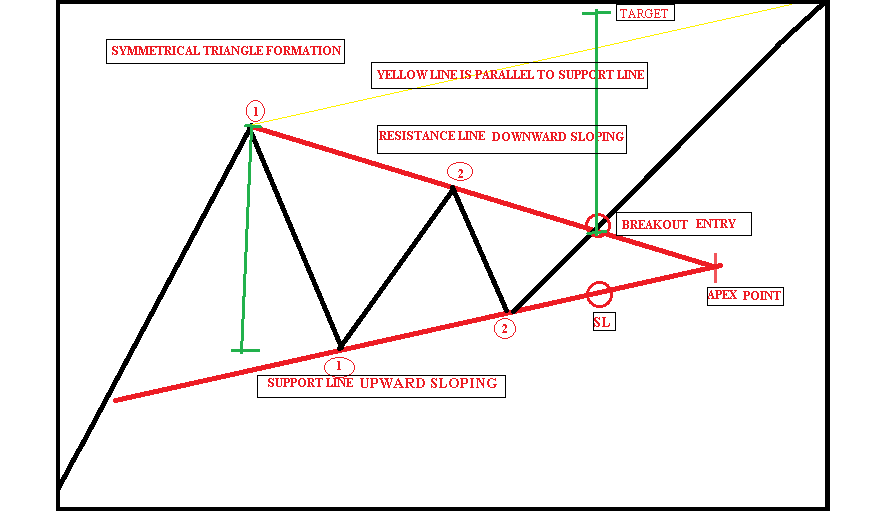

Calculations of target and stop loss

Entry Price = Breakout point just above upper trend line for buying and break down point just below trend line for short selling.

Exit Price = the height of a triangle at its base, or widest part from the entry point.

Stop Loss = just outside the pattern on the opposite side from the breakout point. For example, if buying an upside breakout, place the stop loss just below the lower trend line and if going short on a downside break out, place stop loss just above the upper triangle trend line.

The risk-reward here would always be much better than 1:1 ad the stop loss is based on the smallest portion of the triangle whereas profit booking point is equal to the widest length of the triangle.

Formation of the Triangle Pattern

• A triangle forms when the price action narrows over several price swings. If trend lines are drawn along the highs and lows of the price action, the trend lines converge towards each other. This creates the appearance of the triangle.

• The supply line is the top line of the triangle and represents the overbought side of the market, when investors are going out taking profits with them, similarly the demand line is the bottom line of the triangle and represents the oversold side of the market.

• Since continuation triangles occur more often than reversal triangles, focus more on breakouts to the upside during uptrends and breakouts to the downside during downtrends

Types of Triangle

Here are three different types of triangles, and each should be closely studied, they all point specifically to price being in consolidation; however for trading purposes they are all the same, they just look different. These formations are, in no particular order, find detail explanation below.

Ascending triangle

• Ascending triangles are a bullish formation that projects an upside breakout

• An ascending triangle occurs when the lower trend line is rising while the upper trend line is horizontal.

• Price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support.

• The basic interpretation is that the pattern reveals that each time sellers attempt to push price lower, they are increasingly less successful, forming higher low.

• Price is already in an overall uptrend and the ascending triangle pattern is viewed as a consolidation and continuation pattern.

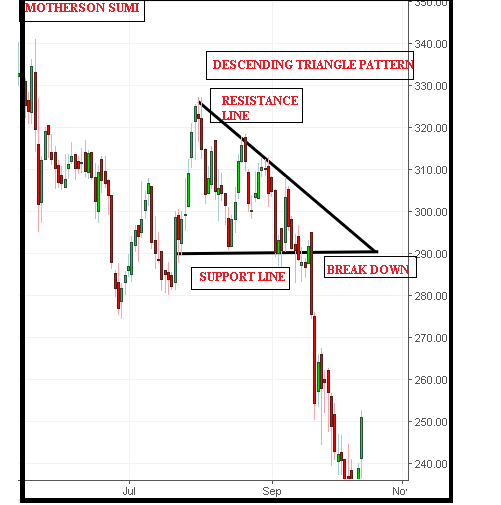

Descending triangle

• Descending triangles are a bearish formation that project a downside breakout.

• A descending triangle is when the upper trend line is sloped downward, while the bottom trend line is horizontal.

• Price is contained by a horizontal trend line acting as support and a descending trend line acting as resistance i.e. vice versa to ascending triangle formation.

• The descending triangle pattern is the upside-down image of the ascending triangle pattern.

Symmetrical triangle

• The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. The pattern contains at least two lower highs and two higher lows.

• These types of triangles can give breakout in both direction depending on their existing trend where price action grows increasingly narrow, may be followed by a breakout to either side, up or down.

• Symmetric triangles are created when both trend lines are converging towards each other.

• They indicate a period of congestion, represented by falling resistance trend line or rising support trend line with a horizontal support or resistance lines

• Symmetrical triangles can form within a small time frame or even a larger time frame, therefore make sure that if you trade symmetrical triangles, to check on the larger time frame symmetrical triangles that may have formed.

• Symmetrical triangle break outs can find more validity when accompanied by supporting candlestick price action patterns.

• The more price approaches the apex (where the trend lines converge), the bigger the chance of a break-out. The triangle pattern has completed when price breaks out of it, in either direction. Conservative traders may look for additional confirmation, of price action or indicators.

• One can wait for closing above break out point or closing below break down point for 2 days, to enter in strong trend, and stay away from fake breakout.

• Eventually, price breaks through the upside resistance and continues in an uptrend. Buyers can then reasonably place stop-loss orders below the low of the lower trend line.

Volume and Triangle pattern

Volume can also add further insight while trading these patterns. Volume is invaluable when confirming any of the three triangle pattern break out to upside or downside.

If volume isn’t present alongside patterns breakouts, then the resulting trading signal isn’t as reliable. It is observed that false or fake breakout of pattern is witnessed in absent of volume while pattern completion. Nevertheless observing volume, price action and indicators while breakout of triangle, will keep trader away from fake break outs.

Conclusion

• Triangle patterns are a commonly used-technical analysis tool and majorly a choice of breakout traders.

• The symmetrical triangle patterns are characterized by both rising support trend line and a falling resistance trend line.

• One of the important criteria to bear in mind when trading triangles is that there should be at least 4 points of reaction within the triangle.

• Triangle pattern trader should wait for the breakout confirmation by price action before adopting a new position in the market.

• The triangle pattern is also known as a bilateral pattern, which means that after a break-out the trend could either continue or reverse; however 9 times out of 10, the breakout will occur in the direction of the existing trend.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.