Tech Mahindra shares fell nearly 5 percent intraday to hit a 15-month low on July 31, as global brokerages cut price target after weak set of earnings in June quarter.

The stock has already lost 27 percent in last three months, hitting Rs 609.30, the lowest level since April 4, 2018. It was quoting at Rs 620, down Rs 20.30, or 3.17 percent, on the BSE at 1014 hours .

The IT company's profit fell 15.3 percent sequentially to Rs 959 crore despite higher other income, impacted by subdued revenue and operating income.

Dollar revenue grew by 1.6 percent and revenue in constant currency slipped around a percent compared to previous quarter. At operating level, earnings before interest and tax fell sharply by 27 percent and margin contracted by 390 bps QoQ due to wage hikes, visa cost, rupee appreciation, and deal transition costs.

After the company's dismal performance in Q1 , brokerages slashed price target but remained positive on the stock on hope of recovery in the second half of FY20 and sharp correction in the past.

"Company's Q1 revenue & margin missed estimates, but deal wins were strong with soft margin outlook. Deal wins should translate to a growth recovery over Q2-Q4 FY20 but margin resilience is likely to be tested more. Company faced supply challenges, transition costs and initial digital margin deflation," said CLSA, which cut its revenue estimates by 1-3 percent & margin by 170-230 for FY20-22, as a result of which it slashed EPS estimates by 6-10 percent for FY20-22.

The brokerage retained outperform call on the stock but cut price target to Rs 740 from Rs 800 .

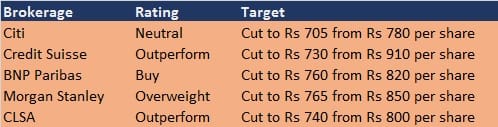

Here is what brokerages say about stock and earnings:

Brokerage: Citi | Rating: Neutral | Target: Cut to Rs 705

It was a weak quarter with communication & enterprise revenues declining QoQ, but deal wins were decent at $475 million for the quarter.

Management commentary remained optimistic and Citi expects a strong second half of FY20, but correlation between deals & growth across industry needs to be monitored.

Brokerage: Credit Suisse | Rating: Outperform | Target: Cut to Rs 730

Credit Suisse maintained outperform call on the stock but slashed price target sharply to Rs 730 from Rs 910, as Q1 was a weak quarter for margin, but telecom & deal wins were steady.

The brokerage is surprised by the weak margin and poor show of the non-telecom business. It incorporated the miss this quarter leading to 9-11 percent EPS estimates cut and reduced valuation multiple to 14x from 16x.

Brokerage: BNP Paribas | Rating: Buy | Target: Cut to Rs 760

BNP Paribas remained bullish on the stock, maintaining buy call but cut price target to Rs 760 from Rs 820 after slashing FY20-22 earnings estimates by 6 to percent on lower margin confidence.

The management largely retained its FY20 revenue outlook and significant portion of the margin drop can be recouped through FY20.

Brokerage: Morgan Stanley | Rating: Overweight | Target: Cut to Rs 765

Morgan Stanley has an overweight call on the stock, but slashed price target to Rs 765 from Rs 850 per share.

Q1 revenue was in-line but margin is below estimates. Robust deal pipeline gave company confidence for improved growth trajectory.

The brokerage cut its FY20, FY21 & FY22 EPS estimates by 5 percent, 4 percent and 4 percent, respectively.

Brokerage: CLSA | Rating: Outperform | Target: Cut to Rs 740

Company's Q1 revenue & margin missed estimates, but deal wins were strong with soft margin outlook.

Deal wins should translate to a growth recovery over Q2-Q4 FY20 but margin resilience is likely to be tested .

Company faced supply challenges, transition costs and initial digital margin deflation. Hence, CLSA cut its revenue estimates by 1-3 percent and margin by 170-230 for FY20-22, as a result it slashed EPS estimates by 6-10 percent for FY20-22.

Following the recent correction, it is inexpensive at 12x FY21 expected PE.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.