The Indian market made strong gains on March 30, leading equity benchmarks the Sensex and the Nifty to close at a two-week high.

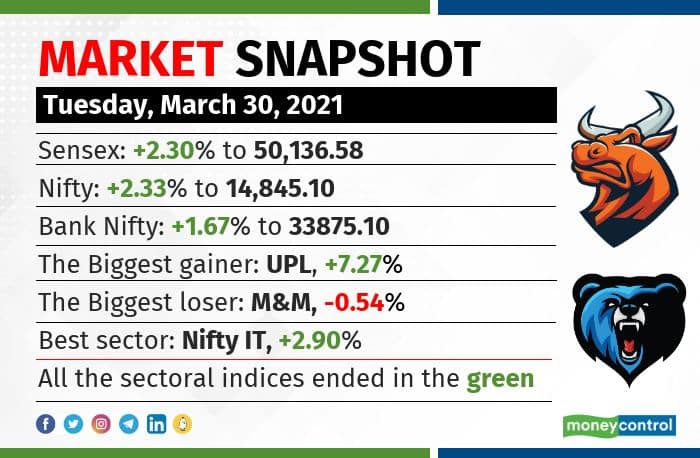

The biggest one-day gain in the last two months saw the Sensex jump 1,260 points and the Nifty50 touch 14,876.30, supported by across-the-board buying. At close, the Sensex was 1,128 points, or 2.30 percent, up at 50,136.58 and the Nifty gained 338 points, or 2.33 percent, at 14,845.10.

Mid-caps and small-caps underperformed their larger peers, as the BSE midcap closed 0.98 percent up and the smallcap index settled 1.30 percent higher.

The overall market-capitalisation of the firms listed on BSE rose to Rs 204.8 lakh crore from Rs 201.3 lakh crore in the previous session, making investors richer by Rs 3.5 lakh crore in a single day.

"Markets opened firm on strong global cues with Joe Biden slated to announce his $3 trillion infra package. Investors shrugged off the rising coronavirus cases in few states as the GoI prepares for a vaccine rollout on a larger scale. Steel & IT stocks led the bull charge, while FMCG stocks joined the party in late afternoon trade as the Sensex scaled past 50k," S Ranganathan, Head of Research at LKP Securities said.

The Indian market rallied despite a weaker rupee, rising COVID-19 cases and firming US bond yields.

Read more: Sensex, Nifty jump higher despite rising COVID-19 cases, stronger dollar; what's giving comfort to the market?Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities, said that except the depreciation seen on March 30, the rupee has remained steady even though the dollar index has been rising. Also, when the US 10-year bond yield spiked sharply, India’s remained quite stable.

These two factors could act in India’s favour and help Indian equities outperform their peers in the emerging markets, Oza said.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,267.66 | 449.53 | +0.53% |

| Nifty 50 | 26,046.95 | 148.40 | +0.57% |

| Nifty Bank | 59,389.95 | 180.10 | +0.30% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 852.10 | 27.75 | +3.37% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| HUL | 2,260.60 | -45.00 | -1.95% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10536.45 | 269.55 | +2.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 54490.80 | -128.85 | -0.24% |

All sectoral indices ended with gains, with IT stocks stealing the limelight.

BSE IT settled 3.51 percent higher, gaining from the rupee's weakness against the dollar. The Indian currency traded near a three-week low against the dollar. IT stocks gain on a stronger American currency as a major portion of their revenue comes in dollar.

BSE Teck gained 3.09 percent while metal, consumer durables, healthcare, FMCG and basic materials gained over 2 percent each.

More than 145 stocks, including APL Apollo Tubes, Adani Transmission, Godrej Industries, Grasim Industries, JSW Steel, Dr Lal PathLabs, Mindtree, Shree Cement and Tata Steel, hit their 52-week highs on BSE.

Nearly 250 stocks, including Hinduja Global Solutions, YES Bank, AU Small Finance Bank, Tata Steel Long Products and Vakrangee hit their upper circuits.

On the flip side, more than 330 stocks, including Adani Power, Suzlon Energy, Edelweiss Financial Services, Yaarii Digital Integrated Services, Future Lifestyle Fashions, Future Retail and Future Supply Chain Solutions, hit their lower circuits on BSE.

The stock of AU Small Finance Bank saw a volume spike of more than 500 percent, while Info Edge (Naukri) saw a volume spike of more than 300 percent.

Navin Fluorine International, Mphasis and UPL were among the stocks that witnessed long build-up. On the other hand, Info Edge, Mahindra & Mahindra Financial Services and Bandhan Bank were among those witnessing a short build-up.

Tech viewThe Nifty logged strong gains and formed a healthy bullish candle.

Chandan Taparia, Vice President- Retail-Research, Motilal Oswal Financial Services, said the index has been forming higher lows for the last two trading sessions while holding above 50-day EMA.

"Now, it has to continue to hold above 14,750 to witness an up-move towards 15,000 and 15,100 while on the downside, support exists at 14,600 and 14,500," said Taparia.

Manish Hathiramani, Proprietary Index Trader and Technical Analyst at Deen Dayal Investments, is of the view while the Nifty has successfully closed above its resistance zone of 14,700-14,800, crossing 14,950 on a closing basis will be a key factor.

"That would trigger a rally up to levels closer to 15,300. Until we do not get past 14,950, there is always a chance we take a U-turn from these levels and head southwards to 14,400. Extreme caution is advised at the current levels," said Hathiramani.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.