December 05, 2018 / 15:32 IST

Market at Close

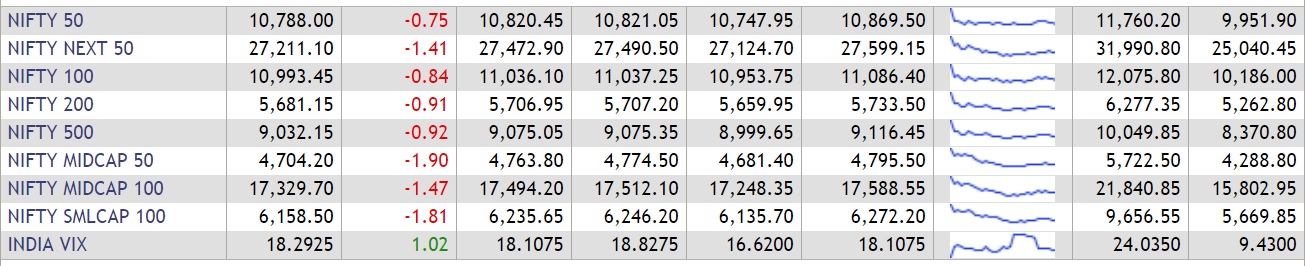

It’s a negative close for the market for second consecutive session as investors reacted to the stance on interest rates by the Reserve Bank of India. The Monetary Policy Committee (MPC) kept interest rates unchanged, but sharply cut the inflation targets for October-March.

However, equity benchmarks are off their low points as the Sensex had cracked over 300 points, while the Nifty tested 10,750-mark.

Selling was visible across all major sectors, with automobiles, banks, consumption, infrastructure, metals and pharma ending in the red. The Nifty Midcap was down over a percent.

At the close of market hours, the Sensex was down 249.90 points or 0.69% at 35884.41, while the Nifty was lower by 80.20 points or 0.74% at 10789.30. The market breadth was negative as 799 shares advanced, against a decline of 1,744 shares, while 145 shares were unchanged.

HUL and HDFC were the top gainers, while Sun Pharma, Tata Steel, and Hindalco lost the most.

December 05, 2018 / 15:27 IST

December 05, 2018 / 15:23 IST

MARKET OUTLOOK |

"As per Street expectations, the RBI has kept the repo rate unchanged. Some analysts on the street were expecting the RBI to give a dovish commentary and change the stance from neutral to dovish. However, since RBI had changed the stance in the last meeting itself, the probability of RBI maintaining its stance "calibrated tightening" were higher especially with elections around the corner. Even though RBI has maintained their stance, they have lowered their inflation expectations going ahead with crude prices falling and the soft CPI inflation numbers which we saw last month. I would not be surprised if we get a repo rate cut in the 1st half of 2019. On the growth side, RBI has maintained the GDP growth at 7.40% but has cited trade talks and slowing US GDP to be potential dampeners going ahead," Raj Mehta, Fund Manager, PPFAS Mutual Fund said in a statement.

December 05, 2018 / 15:22 IST

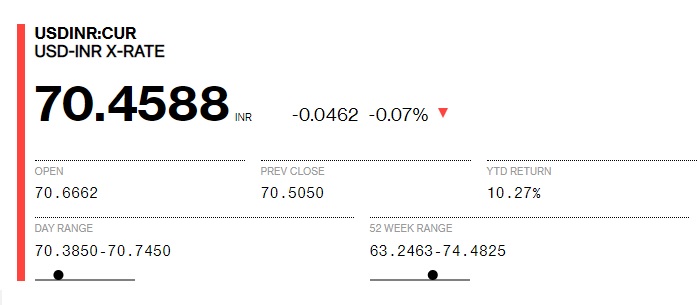

Image:Bloomberg.com

December 05, 2018 / 15:20 IST

Buzzing stock:

Non-banking finance companies' stocks, which come under Nifty Financial Services index that last 0.2 percent, were also under pressure. Barring Edelweiss Financial (up 3 percent), HDFC (up 2 percent) and HDFC Bank (up 0.65 percent), all other stocks were trading in the red.

M&M Financial, Indiabulls Housing Finance, Bajaj Finserv, Shriram Transport, Bajaj Finance, IIFL Holdings and Bharat Financial were down 1-5 percent.

December 05, 2018 / 15:13 IST

Results |

REC has reported a net profit of Rs 1,764 crore for the September quarter against Rs 1,408 crore posted during the same quarter of last year.

December 05, 2018 / 15:05 IST

RBI POLICY OUTCOME OUTLOOK

"The reduction in inflation forecast to 2.7% -3.2% from 3.9%-4.5% should have ideally lead to lesser hawkish monetary policy. As the shift in policy stance was done in the last meeting it was difficult for RBI to reverse the same. If one sees continued benign data on inflation front, then one can hope for increased liquidity from rbi going forward to support credit growth," Abhimanyu Sofat, Head of Research, IIFL Securities, said in a statement.

December 05, 2018 / 14:59 IST

Market Update

At 14:59 hrs IST, the Sensex is down 327.31 points or 0.91% at 35807.00, and the Nifty down 110.30 points or 1.01% at 10759.20. The market breadth is negative as 669 shares advanced, against a decline of 1,745 shares, while 148 shares were unchanged.

December 05, 2018 / 14:55 IST

December 05, 2018 / 14:53 IST

RBI MPC meet outcome highlights:

- Repo rate unchanged at 6.5%

- CPI inflation has been projected at 2.7-3.2% for October-March

- FY19 GDP growth target maintained at 7.4%

- October-March GDP Growth Forecast at 7.2-7.3%

December 05, 2018 / 14:40 IST

Market Update

Equity benchmarks have extended their losses, with the Nifty well below 10,800.

The Sensex is down 290.15 points or 0.80% at 35844.16, while the Nifty is down 101.40 points or 0.93% at 10768.10. The market breadth is negative as 702 shares advanced, against a decline of 1,686 shares, while 145 shares were unchanged.

Automobile, banks, consumption, infrastructure, metals and pharma are in the red, while the Nifty Midcap index is down around 2 percent.

HUL, HDFC, and HCL Technologies are the top gainers, while Sun Pharma, Vedanta, and Hindalco have lost the most.

December 05, 2018 / 14:37 IST

December 05, 2018 / 14:31 IST

RBI policy

The repo rate has been unchanged at 6.5 percent