June 29, 2020 / 13:59 IST

A health crisis that slowly took the shape of a financial crisis across the world is threatening the portfolios of investors. Many have seen double-digit drawdowns in their portfolio, and the losses are worse for those who were overweight on small & midcap stocks. To survive a COVID-19 like crisis, investors would need stocks that are fundamentally strong and can withstand a weak economic cycle for a few quarters, said experts. With COVID-19 related economic downturn staring us down, we are likely to witness the first-ever economic contraction in India in FY21 since the economic liberalisation of 1991. Elara Capital in its latest report on ‘India Strategy’ highlighted that they have studied the “fundamental metrics that matter during the crisis” to make an informed portfolio choice. While the pandemic and its consequent impact on the economy, industry, and companies continue to unfold, Elara believes that there is merit in looking at historical data to analyse the performance of portfolios characterised by key fundamental attributes. Elara Capital has analysed 20 key fundamental factors categorised into -

GROWTH (sales, EBITDA, PAT, and EPS);

RETURN (ROE, ROCE, ROOA, Delta ROE, Delta ROCE, and Delta ROOA);

MARGIN (EBITDA, EBIT, PAT, Delta EBITDA, Delta EBIT, and Delta PAT);

CASH FLOW (FCF growth and CFO & FCF yield);

FINANCIAL LEVERAGE (net debt/equity) to draw insights on how the fundamental based portfolios performed over the last 21 years (FY00 to FY20) and also how they coped with economic cycles.

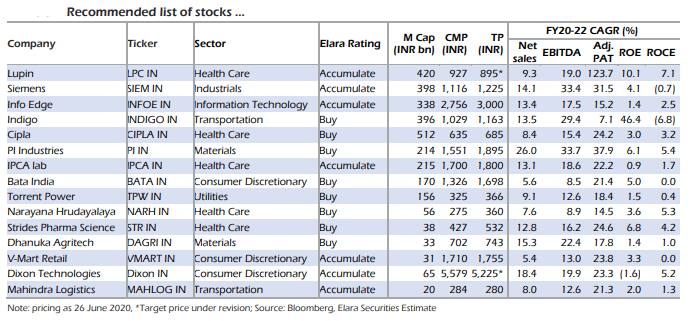

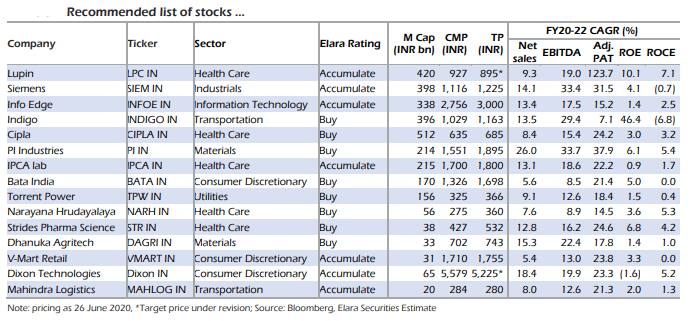

Recommended stocks: Elara Capital dug into their coverage universe (211 stocks, 180 ex - fin) to identify the “Crisis Crusaders”. It looked at companies that have a combination of high PAT growth (36% weight), the high delta in ROE (33% weight) and high sales growth (31% weight) during FY20-22. Elara Capital ranked their largecap, midcap, and smallcap universe individually, comparing companies within the market cap classification for the final rank The Final list of stocks is among the top 5 ranks in each market cap category that have been rated “Buy” or “Accumulate” by analysts of Elara.

Large caps: Lupin, Siemens, Info Edge, Indigo, Cipla

Mid Caps: PI Industries, IPCA Lab, Bata India, Torrent Power, Narayana Hrudayalaya

Small Caps: Strides Pharma Science, Dhanuka Agritech, V-mart Retail, Dixon Technologies, Mahindra Logistics

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!