The S&P BSE Sensex slipped over 300 points in trade which wiped out gains made in the last two trading sessions, amid reports of another missile launch by North Korea. However, there was plenty of action in individual companies as more than 100 stocks hit fresh 52-week high on BSE.

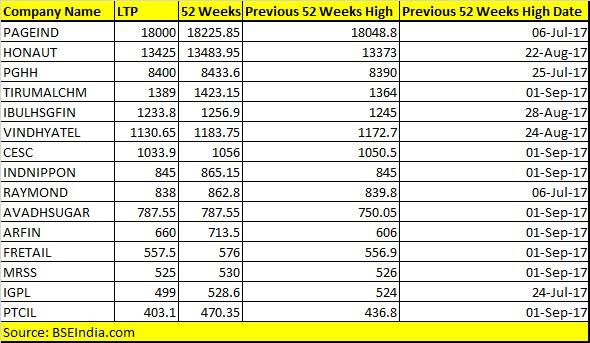

As much as 104 companies hit fresh 52-week high on the BSE which include names like Page Industries, Indiabulls Housing Finance, Raymond, Bata India, TVS Motors, Godrej Properties, Vedanta, Hindalco, VIP Industries, Indiabulls Venture Ltd, JM Financial, Bombay Dyeing etc. among others.

Out of 104 stocks as much as 41 stocks hit a fresh record high on the BSE which include names like Honeywell Automation, CESC, Future Retail, Majestic Research, Procter Gamble, India Nippon, South India Projects etc. among others.

At 01:00 pm, Sensex recouped some of the losses and was trading 225 points lower at 31,666. It hit a low of 31,560 and a high of 31,932 so far in trade today.

Markets across the globe including India started on a muted note after North Korea conducted its sixth and most powerful nuclear test on Sunday, prompting the threat of a "massive" military response from the United States if it or its allies were threatened, said a media reports.

Equity markets witnessed a knee-jerk reaction in the wake of rising geopolitical tensions between two nuclear nations. History suggests that whenever there is uncertainty, equity losses sheen and safe haven assets such as gold and Treasuries attract buying interest.

Tracking the momentum, 25 stocks hit a fresh 52-week low on the NSE which include names like JB Chemicals, Unichem Laboratories, Aditya Birla Capital, Religare Enterprises, ANG Industries, Ruchi Infrastructure, KSS etc. among others.

Over 90 stocks hit fresh 52-week low on the BSE which include names like Clariant Chemicals, Bank of Baroda, Suntek Wealth, Krishna Ventures etc. among others.

One big reason which might have fuelled selling in the markets is expensive valuations which have been bothering investors for some time now. The S&P BSE Sensex rose by about 20 percent so far in the year 2017 without much change in fundamentals.

India’s GDP growth slipped to a 3-year low of 5.7 percent in the June quarter weighed down by demonetisation and implementation of goods & services tax (GST). The earnings story for Q1, too, remain muted.

“The concerns on market valuation has been persisting with markets trading at boom time valuations across both benchmark and broader indices while the fundamentals reflect earnings recession,” Dhananjay Sinha, head (institutional research) at Emkay Global Financial Services told Moneycontrol.

“Over the past three years, corporate India has seen virtually no growth at an aggregate level. Such a scenario naturally generate worries about the sustainability of market exuberance. The situation is similar across the world with equity markets across both emerging markets and developed markets at peak levels even as earnings have remained stagnant since 2011,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.