The S&P BSE small and midcap index slipped nearly 4 percent each compared t0 1.8 percent fall in the Nifty in the past four trading sessions. The carnage was big in individual stocks which fell up 20 percent in the same period.

The Nifty hit a fresh record high of 10,171 and closed at a fresh closing high of 10,147 on Tuesday, 19 September but soon after bears took control of D-Street and the index recorded bearish candles for four consecutive days.

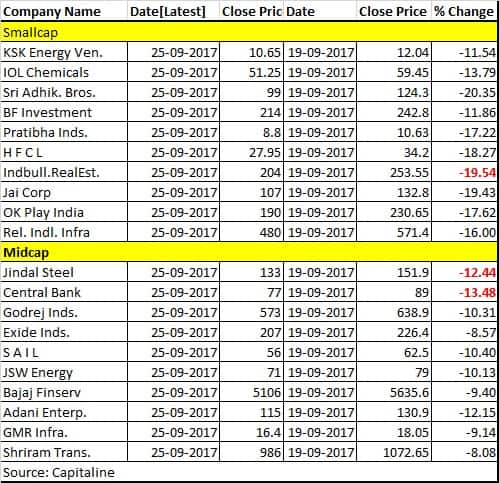

The Nifty Float Midcap index slipped 3.6 percent in the past four trading sessions led by fall in shares like Jindal Steel which plunged 12 percent, followed by Central Bank which was down 13 percent, and Adani Enterprises dropped 12 percent in the same period.

The Nifty Smallcap index fell nearly 4 percent weighed down by losses Indiabulls Real Estate 19 percent, followed by Jai Corp slipped 19.4 percent, and Sri Adhikari Brother plunged as much as 20 percent.

Investors are advised to stay with quality stocks and avoid leverage play at current levels especially when there is lingering concerns of growth and valuations have already ballooned to levels which most experts might call it stretched if earnings growth failed to pick up.

“The correction is more of a margin selling correction. It looks like leverages are getting out of the market, but recovery will also be swift in a bull market. If look back, in the year 2006, Sensex slipped over 33 percent but it recovered all of its losses in next two months,” A.K.Prabhakar, Head -Research at IDBI Capital told Moneycontrol.

“The bull market correction is the fastest and the recovery is equally strong. If investors have made their portfolio with quality in mid and smallcap stocks there is nothing to worry. Buy quality at current levels,” he said.

Prabhakar further added that the ongoing correction is likely to last for another 3-4 days but we still maintain our Nifty target of 10500 by Diwali.

Valuation is one big concern which is weighing on midcaps. Most of the mid and smallcap stocks rallied in anticipation of a swift recovery in earnings.

The liquidity argument which was driving asset prices higher will slow down. The foreign portfolio investors (FPIs) have already started taking out money from equity markets and flows from domestic investors have slowed down.

“Earnings growth currently in certain names is below expectations. The concern in such cases should arise if we understand that causes are structural in nature or market expectation about the earnings growth is higher compared to fundamentals,” Sachin Relekar, fund manager - equity at LIC Mutual Fund told Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.