September 30, 2021 / 16:28 IST

Anindya Banerjee, DVP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities:

The spot rupee closed 7 paise higher on the back of strength in the US Dollar Index and weakness in domestic stocks. However, the gains were limited due to quarter end selling from IT companies and IPO-related inflows. Over the near term, we expect a range between 74.00 and 74.80 on spot levels.

September 30, 2021 / 16:06 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Investors booked profit on the expiry day due to lack of fresh triggers and tepid global cues. Benchmark Nifty is hovering within the range of 17,600-17,780 and on intraday charts it has formed a lower top formation which is largely negative. However, the medium term structure is still positive.

The intraday trading setup suggests 17,700 could act as a strong resistance level, and below the same the correction could continue up to 17,500-17,450 levels. On the flip side, beyond 17,700 the immediate hurdle would be the 17,750 level. On the contrary, any revival could lift the index up to 17,800.

September 30, 2021 / 16:01 IST

Palak Kothari, Research Associate at Choice Broking:

Technically, the Nifty has formed a bearish candle on a daily time frame though the index is taking support from 21-DMA. Closing below the same can show a correction in the next trading sessions.

Furthermore, the index has been trading below 21 & 50 HMA, which suggests some correction can be seen in the upcoming session.

Momentum indicator MACD is also showing negative crossover, which adds weakness in the counter. At present, the Nifty has immediate support at 17,500 while resistance comes at 17,900 levels.

September 30, 2021 / 15:53 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index closed the day at 17618 with a loss of half a percent and formed a bearish candle on daily chart. One more expiry ended on a positive note with gains of 6 percent. Going forwards immediate support is coming near 17,540-17,440 zone and if managed to hold above mentioned supports area one can expect a bounce & we may see prices to move again towards immediate hurdle zone of 17700-17800 zone.

Overall structure looks consolidating & on broader term we may see index to consolidate in the range of 17,300-18,000 mark & either side breakout will decide the final direction.

September 30, 2021 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Indian market opened on a flat note and slipped in the later half tracking weak global cues and fall in heavyweights. Worries over the US debt ceiling crisis and uptick in bond yield triggered further consolidation. The domestic market also got vigilant ahead the release of August’s core sector output data.

September 30, 2021 / 15:40 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some volatile movements and an attempt to hold the level around the Nifty 50 Index level of 17,600. The market shows that it is going to be crucial for the short-term market scenario to sustain above the 17,550-17,600 support zone.

If the market is able to sustain the level of 17,550-17,600, it can witness higher levels of 18,000. Technical indicator suggests, a volatile movement in the market in a small range between 17,600-18,000.

September 30, 2021 / 15:35 IST

Market Close:

Benchmark indices fell for the third consecutive session in the rangebound trading on September 30 amid F&O expiry.

At close, the Sensex was down 286.91 points or 0.48% at 59126.36, and the Nifty was down 93.10 points or 0.53% at 17618.20. About 1804 shares have advanced, 1393 shares declined, and 149 shares are unchanged.

Power Grid Corp, Axis Bank, Asian Paints, Eicher Motors and Hero MotoCorp were among the major losers on the Nifty. Bajaj Finserv, Bajaj Finance, Sun Pharma, NTPC and Tata Motors were among the gainers.

Mixed trend saw on the sectoral front, with buying was seen in the realty, pharma, power and PSU banking stocks, while selling was seen in the auto, bank, IT, metal names. BSE midcap and smallcap indices ended in the green.

September 30, 2021 / 15:21 IST

Aditya Birla Sun Life AMC IPO issue subscribed 85% on day 2

The initial public offering of Aditya Birla Sun Life AMC, a joint venture between Aditya Birla Capital and Sun Life (India) AMC Investments, has seen a subscription of 85 percent as it received bids for 2.35 crore equity shares against IPO size of 2.77 crore equity shares, the data available on exchanges showed. Click to Read More

September 30, 2021 / 15:18 IST

Sterling and Wilson Solar wins its first Waste-to-Energy project worth Rs 1,500 crore

Sterling and Wilson Solar has received the first order worth Rs 1,500 crore for its waste-to-energy business from a leading developer of energy assets in the UK and Europe, company said in its release.

At 15:11 hrs Sterling & Wilson Solar was quoting at Rs 400.70, down Rs 14.05, or 3.39 percent on the BSE.

September 30, 2021 / 15:08 IST

Tata Steel divests entire stake in NatSteel Holdings Singapore

T S Global Holdings (TSGH) Singapore, a 100% indirect subsidiary of Tata Steel Limited, today executed definitive agreements with TopTip Holding Pte Ltd., a Singapore based steel and iron ore trading company, to divest its 100% equity stake in NatSteel Holdings Pte. Ltd. for an Equity Value of USD 172 million (Rs 1,275 crores).

Tata Steel was quoting at Rs 1,287.80, down Rs 7.70, or 0.59 percent on the BSE.

September 30, 2021 / 15:00 IST

Market at 3 PM

Benchmark indices were trading lower with Nifty around 17,650 ahead of F&O expiry.

The Sensex was down 217.41 points or 0.37% at 59,195.86, and the Nifty was down 75 points or 0.42% at 17,636.30. About 1666 shares have advanced, 1331 shares declined, and 139 shares are unchanged.

September 30, 2021 / 14:51 IST

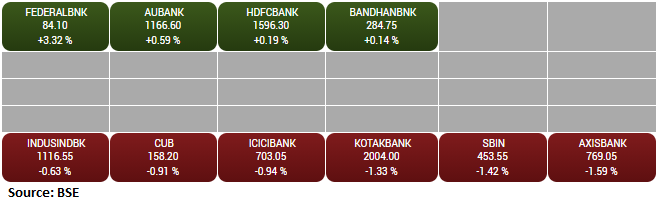

BSE Bankex index fell 1 percent dragged by the Axis Bank, SBI, Kotak Mahindra Bank