September 19, 2022 / 16:36 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets managed to gain over half a percent in a volatile trading session, taking a breather after the recent slide. The Nifty index witnessed a swift rebound in the first hour after the initial fall and remained range bound thereafter. Meanwhile, the sectoral trend was mixed wherein banking, FMCG and auto witnessed buying interest while realty, energy and metal were on the back foot.

We expect choppiness to continue amid the feeble global cues so it’s prudent to place positions on both sides. Banking and financials are doing well on the expected lines and we’re seeing selective buying in auto and FMCG also on dips. On the flip side, mostly stocks from the IT and pharma space trading with a negative bias. Participants should align their positions accordingly.

September 19, 2022 / 16:36 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty entered short term correction mode in the last week. Continuing with the bearish momentum from the last week, the index slipped in the initial trade on September 19. It went down to test the 40 DEMA, which brought in some buying support. As a result, the Nifty bounced towards the 20 DMA, which acted as a cap for the day.

The overall structure shows that the index is forming a minor degree bounce after the first leg of decline in the last week. This minor degree bounce is expected to be followed by the next leg down. Thus sell on rise will be the preferred strategy from short term perspective. The index is likely to stumble near 17700-17800. The next leg down is expected to bring the index down to 17400 – 17200.

September 19, 2022 / 16:34 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty has remained range-bound as investors await the FOMC outcome, due this week. On the lower end, Nifty found support above 17400, whereas bears protected the 17700 mark.

The trend is likely to remain sideward over the near term. Support is placed at 17350-17400, a fall below 17350 may trigger a correction towards 17000. On the higher end, 17700 may act as crucial resistance. A decisive move above 17700 may induce a rally towards 17900/18100.

September 19, 2022 / 16:32 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities:

Markets witnessed a smart recovery as Nifty gained traction amid a cautious tone. The recovery was seen even as investors reassess aggressive Fed tightening bets amid looming recession risks. Traders now look forward to the important FOMC monetary policy meeting on September 20-21.

Technically speaking, the biggest support to watch out will be at 17429 and below the same, Nifty could simply drift lower to 17161 mark. Nifty’s hurdles are placed at 17867 and then at 18115 mark.

September 19, 2022 / 16:06 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

While the undertone of the market remained volatile, a strong relief rally after the recent slump helped benchmark indices to rebound. While European markets and most of the Asian pack continued their downward spiral, the underperformance of the Indian markets last week prompted investors to buy the beaten-down stocks. Despite the recovery, markets may gyrate sharply intra-day amid global uncertainty.

Technically, after an early morning fall, the Nifty found support near 17450/ (which is double bottom support level) and bounced back sharply and hovered between 17580-17665 levels. If the index trades above 17550 then the pull back formation is likely to continue. Above which, the index could touch the 20-day SMA level at 17675. On further upside, the index may rally up to 17800. On the flip side, below 17550 the index could retest 17450- 17400 levels.

September 19, 2022 / 16:03 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The global market was expected to battle volatility as we approach the Fed policy announcement, while the latest inflation data remained above the estimates.

The policy tone indicates hawkish measures, suggesting elevated hikes, leading to the pull-out of FIIs money from the Indian equities.

However, this trend is expected to be short-lived, as future inflation trend forecast a clampdown, bringing stability in policy stance by the end of this year.

September 19, 2022 / 15:35 IST

Rupee Close:

Indian rupee closed marginally lower at 79.77 per dollar against previous close of 79.74.

September 19, 2022 / 15:31 IST

Market Close

Indian benchmark indices broke 3-day losing streak and ended higher with Nifty above 17,600.

At Close, the Sensex was up 300.44 points or 0.51% at 59,141.23, and the Nifty was up 91.50 points or 0.52% at 17,622.30. About 1665 shares have advanced, 1852 shares declined, and 127 shares are unchanged.

M&M, Bajaj Finance, SBI Life Insurance, Adani Ports and HUL were among major gainers on the Nifty, while losers included Tata Steel, Tata Motors, Britannia Industries, Power Grid Corporation and ICICI Bank.

Among sectors, Metal and Realty indices shed 1 percent, while FMCG and PSU Bank indices rose 1-2 percent each.

September 19, 2022 / 15:23 IST

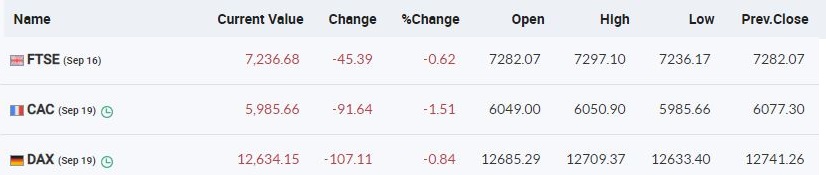

European Markets Update:

September 19, 2022 / 15:20 IST

Buzzing

SAL Steel is going to supply ferro chrome to AIA Engineering. For the same, it has entered into a supply agreement for 3 years with AIA Engineering on non-exclusive basis, while AIA Engineering has also agreed to provide a secured inter corporate deposit of Rs 125 crore to the company which will be used by the company to repay its loan or for working capital requirements.

SAL Steel was quoting at Rs 11.34, up Rs 0.54, or 5 percent on the BSE.

September 19, 2022 / 15:09 IST

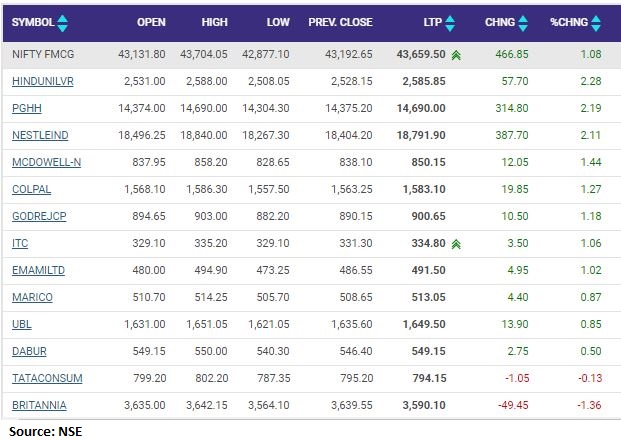

Nifty FMCG index rose over 1 percent supported by the Hindustan Unilever, Procter & Gamble Hygiene, Nestle India

September 19, 2022 / 15:04 IST

Shishir Baijal, Chairman and Managing Director, Knight Frank India:

The Prime Minister has reiterated the commitment towards the growth of logistics in India. One of the most important policies, the new Logistics Policy is a fine example of inter-ministerial collaboration.

This policy will further help integrate the supply chain making it more efficient driving down logistics and inventory costs and reduce bottlenecks at the same time make it more agile and responsive.

The Multi – modal logistics park, which identifies 35 locations covering the length and breadth of the country, will be instrumental in creating new centres of growth. We welcome the announcement and look forward to the growth of the sector.

September 19, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices were trading higher with Nifty holding above 17600.

The Sensex was up 314.03 points or 0.53% at 59154.82, and the Nifty was up 98 points or 0.56% at 17628.80. About 1568 shares have advanced, 1793 shares declined, and 101 shares are unchanged.