Taking Stock: Nifty slips from Mt 12K, FM's economic package fails to boost sentiment

Sectorally, action was seen in IT, healthcare, FMCG while some profit-booking was seen in metals, telecom, oil & gas, and realty.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

The underlying short term trend of Nifty continues to be positive. Present consolidation pattern could end soon and Nifty could resume its uptrend in the coming sessions. The upside levels to be watched around 12250 for the next 3-4 sessions. Immediate support is placed at 11850.

Markets settled almost flat in a volatile trading session, taking a breather after the recent surge. The benchmark started with positive momentum led by optimism in global markets however profit-taking at higher levels gradually trimmed the gains as the session progressed. Even the announcements made by FM to stimulate consumer spending and capital expenditure failed to cheer investors’ mood. The Nifty settled marginally up to settle around 11,931 levels. The underperformance continued from the broader market indices as they lost in the range of 0.4-0.6%. On the sector front, defensive such asFMCG, IT and Healthcare ended in gains while all the other sectors ended lower wherein Oil & Gas, Metals and Telecom were top losers.

We believe, along with global cues, earnings announcements and macroeconomic data would dictate the market trend. Further, measures announced by FM to help revive the economy as well as spur demand would augur well for major sectors such asFMCG, Auto, Capital Goods, Banking etc. ahead. Amid all, we expect volatility to remain high thus traders should maintain extra caution in trade selection and risk management.

To sustain the market trend, a lot will depend on the size and effectiveness of the stimulus. Cash voucher and advance scheme, sops to government employees, failed to cheer the market as it did not provide the required boost to the economy as expected. It is anticipated that there will be more measures revealed in the future. The market will look forward, with high hopes on Q2 results and an end to the moratorium saga. IT, Banks and FMCG will be the sectors under focus, in the near-term.

Markets ended in the Green today on the back of measures announced to boost consumer demand. Today shall also be remembered for the tepid 19% gain over its issue price as leveraged HNI Investors booked losses for what indeed was a resounding response to the IPO of Mazagon Dock in terms of over subscription.

The Nifty took a breather after crossing the psychological 12000 mark. This does not change anything in the short to medium term time frame. The markets continue to show a bullish indication and are aptly positioned to achieve the levels of 12200-12300. With good support at 11750-11800, any correction can be utilised to go long on the index.

: After a strong start the benchmark indices erased some of the intraday gains but ended higher for the eight consecutive session on October 12 supported by the IT and pharma stocks.

At close, the Sensex was up 84.31 points or 0.21% at 40593.80, and the Nifty was up 16.80 points or 0.14% at 11931. About 927 shares have advanced, 1713 shares declined, and 184 shares are unchanged.

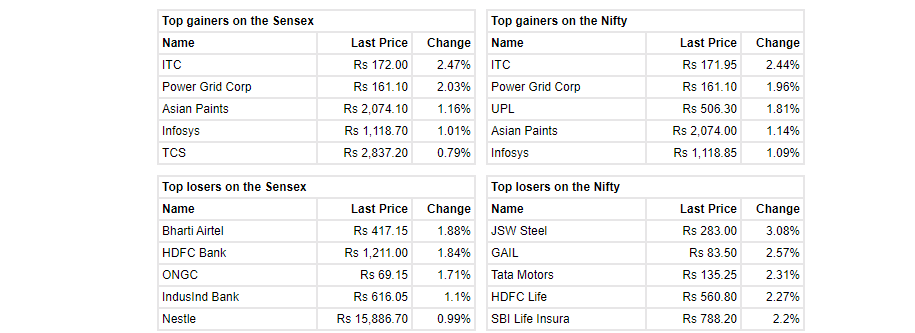

ITC, Infosys, UPL, Dr Reddy's and Asian Paints were among major gainers on the Nifty, while losers included Bharti Airtel, GAIL, JSW Steel, Tata Motors and HDFC Life.

Among sectors, except IT and pharma other sectoral indices ended in the red. BSE Midcap and Smallcap indices shed 0.4 percent each.

Finance Ministry, through Rs 730 bn fiscal package, tried to give impetus to consumer demand and pick up in infrastructure activities, which can give a push to GDP. In our view, announcement of Rs 370 bn capital spending package including Rs 250 bn spending from Central in roads & highways and defense sector till 31st Mar’21 bode well for infrastructure companies as this may result in sharp improvement in new ordering as well as pick up infra development works.

However, government’s effort to stimulate consumers demand by offering advances and cash voucher schemes looks to be short term in nature and lacks commitment to have a sustainable growth. This may lead to a kind of destocking led demand improvement ahead of festivals or fiscal end. However, it may not necessarily result in a sustainable recovery. This may not entice the market.

Oil prices fell on Monday as force majeure at Libya's largest oilfield was lifted, a Norwegian strike affecting production ended and US producers began restoring output after Hurricane Delta.

Research house maintained outperform call and raises target to Rs 130 from Rs 120 per share. SAMIL’s businesses could scale up post merger with Motherson.

Company says, 80% of SAMIL’s businesses are consistent dividend payers and SAMIL business can sustain future growth through internal accruals, reported CNBC-TV18.

Benchmark indices erased all the intraday gains and trading flat in the volatile trade.

At 14:38 IST, the Sensex was down 0.54 points at 40508.95, and the Nifty was down 11 points or 0.09% at 11903.20. About 837 shares have advanced, 1618 shares declined, and 151 shares are unchanged.

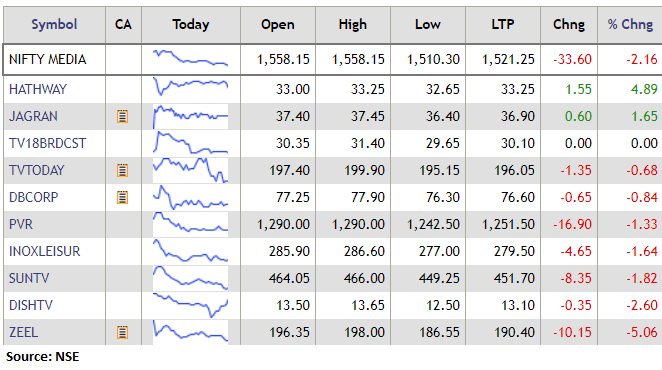

Multiplex will open from 15th October in most of the states of India after being shut down for 7 long months. As key regions of movie going audience Mumbai and Delhi is expected to open in November so in the initial few weeks, exhibitors will screen old hit movies. Recently, PVR management said that all the old films will be screened at hugely discounted rates. Although, all new content will be screened at pre covid rates. PVR CEO hopes to be back at pre-Covid levels by the end of the year.

We anticipate gradually recovery for the sector. There will be a lot of challenges for the multiplex business for the next couple of weeks. We are bullish on the multiplex stock considering that long term prospects of the business are still promising and stock prices have corrected ~40% due to Covid.