Taking Stock | Sensex Falls 396 Points, Nifty Ends A Tad Short Of 18,000; Auto, IT Stocks Outperform

Mixed global cues are keeping the participants on the edge and the trend is expected to continue, say experts... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,267.66 | 449.53 | +0.53% |

| Nifty 50 | 26,046.95 | 148.40 | +0.57% |

| Nifty Bank | 59,389.95 | 180.10 | +0.30% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 852.10 | 27.75 | +3.37% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| HUL | 2,260.60 | -45.00 | -1.95% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10536.50 | 269.60 | +2.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 54490.80 | -128.85 | -0.24% |

Heating selling in late trades in banking, oil & gas, realty stocks weighed heavily on benchmark indices as higher inflation remains a key concern for markets. On intraday charts, the Nifty has formed a lower top formation which is broadly negative.

For day traders, 18060 would be the immediate resistance level, and if the index slips below the same the correction wave could continue up to 17900-17830 levels. On the other hand, 18060 would be the key intraday breakout level for the bulls, and above the same, the index could move up to 18100-181235 levels.

Markets edged lower in a volatile session despite stable global cues. Weakness in heavyweights from the sectors like banking and oil & gas dragged the benchmark lower however buoyancy in the auto and IT majors capped the downside. Finally, Nifty settled at 17,999.2; down by 0.6%. Amid all, a mixed trend was witnessed on the broader front wherein midcap ended lower and smallcap closed marginally in the green.

Mixed global cues are keeping the participants on the edge and we expect the trend to continue, at least in near future. Among the sectors, the continuous underperformance of the banking pack is dragging the benchmark lower while others help the index to cap the damage. In the current scenario, it’s prudent to stay light and wait for clarity.

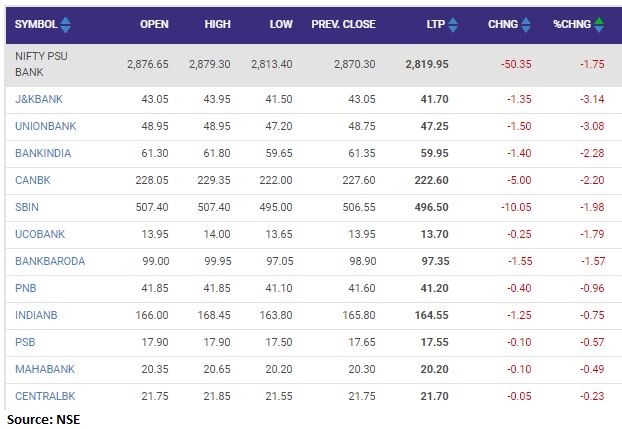

Benchmark Indices closed lower today with Nifty falling -0.61% and Sensex falling -0.65% today. PSU Banks and Pharma companies face some pressure today while strong buying is seen in Automobile stocks on the back of reports of improvement in chip shortage issue.

On the technical front, markets are trading around the key support zone of ~ 18,000 levels and if it sustains above this level for a few more sessions, we can see a good up move in the near term. Immediate support and resistance in Nifty 50 is 17,850 and 18,250 respectively.

After a positive opening, the index wiped out early losses and showed profit booking from higher levels, and closed the session at 17999.20 levels with a loss of 110.25 points. While Bank Nifty closed the session at 38307.10 level with a loss of 395.25 points.

Technically, the index has formed a bearish candle on the daily time frame, which shows weakness in the counter. On the hourly chart, the index has been trading with lower highs lower lows, which point out some corrections for the next trading session.

Furthermore, the index has given closing below 21 DMA as well as the Stochastic indicator is trading negative crossover, which points to weakness in the counter for the next trading sessions. At present, the index has a support level of 17800, while resistance is at 18250 levels.

The domestic market started trading between gains and losses before slipping into deep red with heavy selling in banking and pharma stocks.

RBI’s statement that equity market valuations is stretched added to the pressure, however Mid & Smallcaps outperformed.

Global markets remained mixed as the Biden-Xi meeting ended with both the parties appealing for more cooperation. European and US markets are trading almost flat ahead of the release of Eurozone Q3 GDP and US retail sales data.

Benchmark indices ended on negative note on November 16 with Nifty below 18000 dragged by the bank, pharma, oil & gas and metals stocks.

At close, the Sensex was down 396.34 points or 0.65% at 60,322.37, and the Nifty was down 110.30 points or 0.61% at 17,999.20. About 1496 shares have advanced, 1639 shares declined, and 122 shares are unchanged.

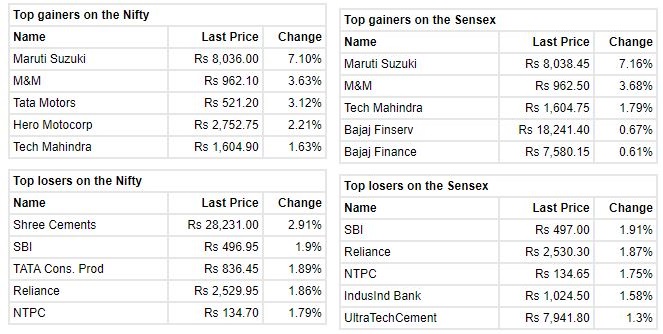

Shree Cements, Reliance Industries, Hindalco Industries, Tata Consumer Products, SBI were among the major Nifty losers. However, gainers included Maruti Suzuki, M&M, Tata Motors, Hero MotoCorp and Tech Mahindra.

Among sectors, the PSU Bank index shed 2 percent, while Nifty Bank, Energy and Pharma indices down 1 percent each. However, Auto index added over 2 percent. The BSE midcap index was down 0.22 percent, while the smallcap index ended with marginal gains.

As Investors try to figure out the valuation disconnect between the recently listed Digital entities versus their traditional counterparts who built distribution reach offline, the euphoria around the former seems to have set minds thinking.

As the street worries on inflationary pressures leading to companies raising prices and their consequent impact on demand, we saw a highly volatile trading session today. The auto sector though bucked the trend with Auto OEMs seeing good buying interest on reports of easing in chip and semiconductor shortages with the Auto Index up 3% in afternoon trade.

Foods and Inns has obtained approval from National Stock Exchange of India for the purpose of listing of its equity shares having face value of Rs 1 only on NSE's trading platform.

Foods and Inns touched a 52-week high of Rs 89.50 and was quoting at Rs 89.50, up Rs 4.25, or 4.99 percent on the BSE.

Foreign broking house Credit Suisse has maintained outperform rating on UltraTech Cement and raised the target price to Rs 9,250 from Rs 8,600 per share.

The house construction activity pick-up can drive positive surprise on cement demand, while this driver can turn around & drive demand for cement ahead of expectations.

UltraTech Cement was quoting at Rs 7,890.60, down Rs 156.05, or 1.94 percent.

Benchmark indices extended the losses in the final hour of trading with Nifty around 18000 level.

The Sensex was down 264.45 points or 0.44% at 60454.26, and the Nifty was down 76.60 points or 0.42% at 18032.90. About 1535 shares have advanced, 1546 shares declined, and 116 shares are unchanged.