November 11, 2022 / 16:34 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty remained strong during the day following a gap-up start. On the daily chart, the index has moved above the previous consolidation.

The trend looks positive as long as the 18300 level is held on a closing basis. On the higher end, it may move towards 18600 over the near term. On the lower end, support is pegged at 18200/18000.

November 11, 2022 / 16:34 IST

Anmol Das, Head of Research, Teji Mandi

With the benchmark indices touching 52 week highs and the Nifty Bank Index touching new all time highs, we remain cautiously optimistic advising investors to be agile and aware of the recent and upcoming macroeconomic events in order to make dynamic decision-making both ways.

In the event of a sustainable rally and not to miss out on such opportunities, we advise to stay invested within the same portfolio while making stock specific decisions as per Q2 earnings. However, at these levels, we are equally aware of the downside of new stock entries as the earnings season is coming to an end, and there may be some profit booking in many sectors that have rallied significantly over the past couple of months.

However, with a delinked view from the global economic scenario, the domestic economy has performed much better than expected in the 2nd quarter results, which will help the very fundamental valuations of Indian equities look more attractive than their global peers.

November 11, 2022 / 16:31 IST

Arun Chulani, Co- Founder, First Water Capital Fund

The Sensex is back to around its all-time-high. This is a testament to India's current resilience both as an economy and market liquidity. While foreign funds and the hot money had initially opted to exit at the beginning of the year, this fortunately was almost matched by the domestic investor who has hopefully come of age. Hopefully, this funds-flow should strengthen through education and increased earnings.

However, while India seems to be a beacon on the international stage, we are clearly not out of the macro-woods as yet, so there may well be some spanners that we have to face. Hence, this is why we prefer to look at the long-term and find well-priced, good quality companies.

November 11, 2022 / 16:29 IST

Ajit Mishra, VP - Research, Religare Broking

Markets rebounded strongly and gained nearly 2%, tracking firm global cues. A sharp surge in the US markets triggered a gap-up start in the Nifty however selective participation from the index majors capped the momentum as the day progressed. It finally settled closer to the day’s high at 18349.7 levels.

The IT pack led the surge among the sectoral pack closely followed by metal and financials. Meanwhile, the underperformance continued on the broader front wherein both midcap and smallcap ended flat to marginally higher.

Markets have been maintaining a positive trend and recovery in the US markets is fuelling momentum at regular intervals. Since Nifty has reclaimed the 18,350 mark, we are now eyeing the record high in the index. At the same time, we’ve been observing selective participation, so stock selection holds importance. Besides, the underperformance of the broader market is also hurting the sentiment. Participants should align their positions accordingly and prefer stocks that are trading in tandem with the benchmark.

November 11, 2022 / 16:18 IST

Amol Athawale, Deputy Vice President - Technical Research, Kotak Securities

Across the globe, stock market investors cheered the softening of the US CPI data that led to a humongous rally on Dalal Street. Traders world over are now hoping that with the inflation level cooling, the US Fed may maintain status quo on rate hike in its December meeting before reversing the trend going ahead if the reading shows further moderation.

Technically, the Nifty not only cleared the short term resistance of 18300 but closed above the same which is broadly positive. A bullish candle on daily and weekly charts and range breakout formation is indicating further upside from the current levels.

For traders, 18200-18150 would act as key support zones. If the index trades above the same then it could move till 18500-18600. However, below 18150, the uptrend would be vulnerable.

November 11, 2022 / 15:50 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Global markets witnessed a rally, as the US CPI print softened and possibly enhancing hopes of some moderation in future rate hikes by the Central Banks. The US 10 year treasury yield also softened post US inflation coming in weaker than expected.

Sensex and Nifty saw positive returns this week whereas the BSE Midcap and the BSE Small-cap index witnessed marginal decline. On a sectoral basis, the BSE IT and the BSE Banker index were leading gainers, whereas the BSE Healthcare and the BSE Auto were under pressure. Meanwhile, Q2FY23 earnings performance has been ahead of expectations, driven by bank results.

The net FPI flows have been positive this week. Now, as we enter the last few days of result season, the market focus going ahead will gradually shift towards global and domestic macro data points, that includes inflation, Central Banks action, amongst others.

November 11, 2022 / 15:49 IST

Devang Mehta, Head - Equity Advisory, Centrum Wealth:

The lower than expected inflation print in the US triggered a rally across global equity markets. The US dollar also slumped against rival currencies while US bond yields fell sharply, as investors cheered the prospects of less hawkish moves by the US Federal reserve. Though too early to predict, but if the global volatility subsides & if the sentiment improves, India will receive a huge share of foreign institutional investments in addition to already strong domestic flows (SIPs close to 13000 Cr every month).

Our markets have been like a silver lining with good macros & micros amidst the global dark clouds of high inflation, interest rates & global recession fears. With 4 C’s namely Corporate profitability, Credit growth, Consumption (discretionary & luxury) & Capex on a northward trajectory, markets will reward investors who keep the faith and are here for the longer haul.

November 11, 2022 / 15:44 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The domestic market joined the global run as markets across the world cheered the lower-than-expected US inflation data. The US dollar slumped along with treasury yields as investors evaluated the likelihood of a less hawkish rate hike by the Fed.

Reduced treasury yields will aid to improve FII inflows. The rally of domestic market was led by IT stocks as recession fears reduced and HDFC twins after merger overhang.

November 11, 2022 / 15:40 IST

Rupee Close:

Indian rupee closed 100 paise higher at 80.81 per dollar against previous close of 81.81.

November 11, 2022 / 15:34 IST

Market Close:

Indian equity market ended sharply higher on November 11 with Nifty crossing 52-week, intraday.

At Close, the Sensex was up 1,181.34 points or 1.95% at 61,795.04, and the Nifty was up 321.50 points or 1.78% at 18,349.70. About 1769 shares have advanced, 1591 shares declined, and 131 shares are unchanged.

HDFC, HDFC Bank, Infosys, HCL Technologies and Tech Mahindra were among the top Nifty gainers, while lower were Eicher Motors, Hero MotoCorp, Britannia Industries, SBI and M&M.

On the sectoral front, Information Technology and Metal indices rose 2-3 percent each, while selling was seen in the auto, FMCG and PSU Bank stocks.

The BSE midcap and smallcap indices ended on flat note.

November 11, 2022 / 15:24 IST

Jefferies View On Ashok Leyland

-Maintain buy call, target at Rs 180 per share

-Q2 EBITDA rose 68% QoQ led by higher-than expected gross margin

-Q2 volumes up 14% QoQ while ASPs are flat QoQ

-Gross margin expanded 130 bps QoQ while margin is up 210 bps QoQ

-EBITDA/vehicle rose 47% QoQ, reported CNBC-TV18.

Ashok Leyland was quoting at Rs 147.75, up Rs 1.10, or 0.75 percent on the BSE.

November 11, 2022 / 15:18 IST

Rupee Updates:

Indian rupee erased some of the intraday gains but still trading higher by 86 paise at 80.95 per dollar against previous close of 81.81.

November 11, 2022 / 15:12 IST

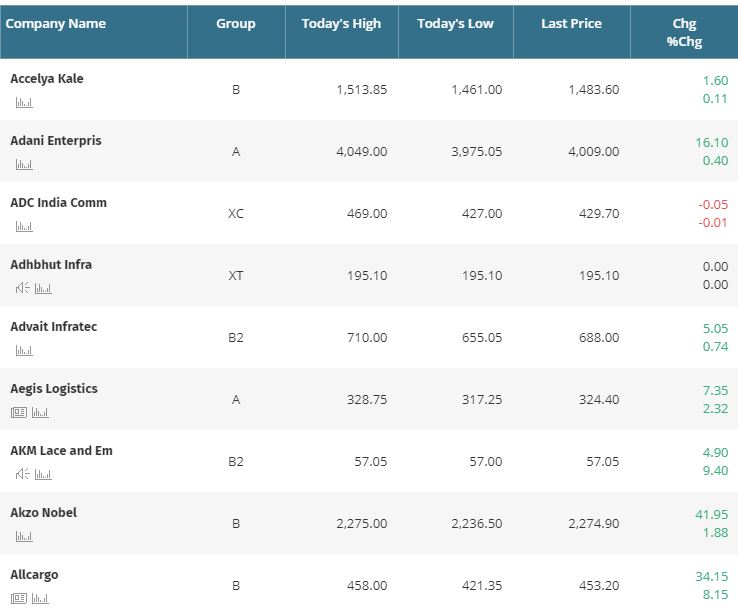

Here are the stocks that have touched their 52 week highs during the day. Click to get complete list