Taking Stock: Favourable cues nudge market towards record highs; Sensex up 418 points, Nifty above 18,700

The BSE midcap index rose a percent and the smallcap index added 0.8 percent... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,265.32 | 158.51 | +0.19% |

| Nifty 50 | 26,033.75 | 47.75 | +0.18% |

| Nifty Bank | 59,288.70 | -59.55 | -0.10% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| TCS | 3,229.20 | 49.20 | +1.55% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,436.50 | -159.00 | -2.84% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38360.30 | 535.00 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 34986.10 | -118.90 | -0.34% |

The Nifty opened gap up today and has closed around the highs of the day. On the daily charts we can observe that the Nifty has resumed its upmove and successfully defended the crucial support zone of 18530 – 18500. On the upside the current upmove can extend till 18800 and beyond that 18889.

The momentum indicator on the daily and hourly time frame is providing divergent signals however price action is suggesting strength. In terms of levels, today’s gap area formed in the range 18630 – 18620 shall act as a crucial support zone while 18778 – 18800 shall act as an immediate hurdle zone.

As far as Bank Nifty is concerned, the index has witnessed buying interest from the support cluster of 44000 which coincided with the lower end of the rising channel and also the 20-day moving average (43980). We expect the Bank Nifty to continue with the positive price action for the next few trading sessions. Short term target is placed at 44500.

Nifty rose for the second consecutive session on June 13 aided by positive overnight cues. At close, Nifty was up 0.62% or 114.7 points at 18716.2. Volumes on the NSE were above recent average. Broad market indices rose more than the Nifty even as the advance decline ratio was up at 1.56:1.

Global equities were largely up on Tuesday, taking clue from an upbeat session on Wall Street ahead of key U.S. inflation data that could shape the outlook for Federal Reserve monetary policy. A cut in short-term lending rate for the first time in 10 months by the People's Bank of China (PBOC) helped to prop up risk sentiments.

Nifty rose smartly and closed almost at the intra day high on June 13. It could now face resistance from the 18778-18813 band in the near term while 18634 could offer support.

Markets rallied sharply and mounted bullish bets ahead of the US CPI data, Federal Reserve rate decision and ECB rate decision. If today’s bullish action is any indication, then Nifty's biggest support to watch for Wednesday’s session is placed at 18557 mark. On the upside, the index faces major hurdles at its all-time-high at 18888 mark.

Markets edged higher and gained over half a percent, tracking upbeat global cues. After a firm start, the Nifty oscillated in a range while maintaining positive bias and finally settled at 18,716.15 levels. All sectors, barring auto, contributed to the move wherein realty, FMCG and pharma were the top gainers. Besides, the continued outperformance of the broader indices kept the traders busy.

Participants are taking comfort from recovery in the US markets and prevailing buoyancy in midcap & smallcap space however the key is to hold 18,700 in Nifty for further surge else the move would fizzle out again. We recommend maintaining a positive tone but avoid going overboard citing the possibility of a rise in volatility ahead.

Nifty opened on a strong note after taking cues from strong global markets. The index tried to pick up momentum as the day progressed but was seen struggling in a consolidated move for the next couple of hours. The second half of the trading session brought fresh momentum to Nifty which was seen crossing 18700 with relative ease and closed near the high point of the day.

The immediate hurdle is seen at 18770 levels which once sustained can push the index towards 19000 levels. Comfortable writing was seen in 18700 and 18600 strike put options suggesting the dips are unlikely to be steep and any fall towards 18600 can see fresh buying in Nifty index.

Bank Nifty continued its struggle around 44150 levels. The index was trading in a range throughout the trading session with some traction seen towards the end of the day. The index has managed to sustain above its 21ema on daily charts which is expected to continue lending support and a close above 44300 can push it towards 45000 levels.

The sustained flow of better-than-expected domestic macro-economic data kept the market mood afloat, with the Nifty midcap trading to all-time highs. The domestic CPI data moderated closer to the RBI’s target due to tone-down in food inflation and a favourable base, which increased the likelihood of a rate cut by the end of the year. Attention now turns to the release of US inflation data and the upcoming FOMC announcement, where the view is optimistic on keeping rates on hold.

Markets witnessed a spectacular rally towards the close as bullish bets on realty, metals, and oil & gas stocks aided Sensex to close above the 63000 mark. Moderating inflation and strong IIP growth numbers coupled with expectations that the US Fed could hold interest rates steady in this week's FOMC meeting buoyed the sentiment.

Technically, the Nifty has formed a bullish candle on daily charts, which is largely positive. For bulls, 18600 would act as a sacrosanct support zone. As long as the index is trading above the same, the positive sentiment is likely to continue till 18800-18850. However, below 18600, the uptrend would be vulnerable and traders may prefer to exit from the long positions.

Indian rupee closed marginally higher at 82.37 per dollar against previous close of 82.43.

Benchmark indices ended higher for the second consecutive session on June 13 with Nifty above 18,700.

At close, the Sensex was up 418.45 points or 0.67% at 63,143.16, and the Nifty was up 114.70 points or 0.62% at 18,716.20. About 2040 shares advanced, 1446 shares declined, and 126 shares unchanged.

Cipla, Tata Consumer Products, Titan Company, Asian Paints and ITC were among the biggest gainers on the Nifty, while losers included Kotak Mahindra Bank, Adani Enterprises, HCL Technologies, M&M and Adani Ports.

All the sectoral indices ended in the green with realty up 3 percent, while FMCG, pharma, metal and PSU Bank up 1 percent each.

The BSE midcap index rose 1 percent and smallcap index added 0.8 percent.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 18724.30 0.66 | 3.42 0.67 | 2.24 18.70 |

| NIFTY BANK | 44128.60 0.42 | 2.66 -0.08 | 0.77 32.10 |

| NIFTY Midcap 100 | 34767.90 1.24 | 10.34 2.15 | 7.08 29.84 |

| NIFTY Smallcap 100 | 10609.40 0.72 | 9.02 1.86 | 8.18 23.26 |

| NIFTY NEXT 50 | 43278.50 0.95 | 2.59 1.60 | 6.07 17.47 |

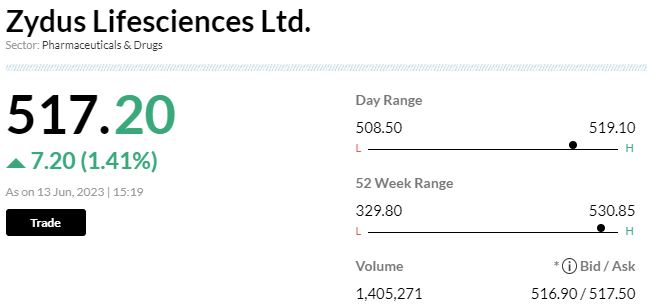

Zydus Lifesciences has received final approval from the United States Food and Drug Administration (USFDA) to manufacture and market Diclofenac Sodium and Misoprostol Delayed Release Tablets USP, 50mg/200 mcg and 75mg/200 mcg.

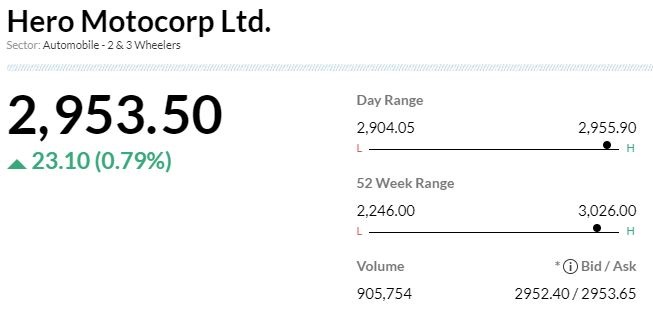

-Downgrade to sell rating, target at Rs 2,708 per share

-Successful implementation of strategy & recovery in entry segment remain key

-Aggressive plans in premium segment but competitive intensity is high

-Believe market share gains will remain a challenge due to high competitive intensity

-Expect company’s volumes to grow slower than industry