Taking Stock | Nifty Ends Above 15,700 Led By Pharma, Financials; Mid, Smallcaps Outperform

Among sectors, metal, pharma and PSU bank indices were up 1-2 percent. BSE midcap and smallcap indices rose a percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

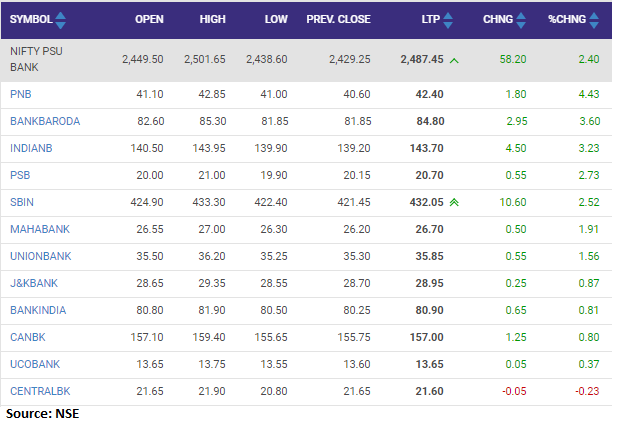

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

Markets made a smart comeback after yesterday's slide and gained over half a percent. After the initial uptick, the benchmark gradually inched higher as the day progressed and settled around the day’s high. Among the benchmark indices, Nifty ended at 15,738 levels, up by 0.7%. On the sector front, all the other indices, barring auto, ended in positive wherein healthcare, metals and realty were among the top gainers. The broader indices also witnessed sharp recovery and edged higher in the range of 1.3-1.7%.

Markets are keenly eyeing the domestic developments viz. unlocking by states and progress of vaccination programs for cues. Going ahead, we feel the update on the monsoon will also be closely watched by the participants. Major global indices are currently seeing consolidation which may continue to trigger volatility in our markets too. Amid all this, we reiterate our bullish view and suggest using dips or further consolidation to accumulate quality stocks.

The markets have reclaimed the 15700 level which is a positive sign. Yesterday we bounced from the 15600 support which was a crucial move by the index. This reconfirms that the trend is positive.

The Nifty should be headed to 15900-16000 and 15600 continues to be the important level of support. Any intra-day dip or correction can be utilized to go long on the markets.

Automotive component manufacturer Sansera Engineering has filed draft red herring prospectus with the capital markets regulator Sebi to raise funds via initial public offering.

The IPO comprises a complete offer for sale of 1,72,44,328 equity shares by existing shareholders. Investors Client Ebene (CEL), and CVCIGP II Employees Ebene (EEL) will sell up to 86,35,408 and 48,36,723 equity shares, respectively, via offer for sale. Read More

Indian rupee ended lower by 9 paise at 73.06 per dollar, amid buying saw in the domestic equity market.It opened flat at 72.95 per dollar against Wednesday's close of 72.97 and traded in the range of 72.94-73.12.

The market witnessed some lackluster movement and an attempt to hold the support level around of 15650. Trading above 15650 is positive from a short-term perspective. Sustaining above 15650 levels, we expect the market to gain momentum, leading to an upside projection of 15900 levels.

The momentum indicators like RSI, MACD start showing signs of recovery after the sharp fall witnessed yesterday. There is no divergence signal, alerting any potential deep correction.

Benchmark indices ended higher on June 10 with Nifty above 15,700 led by the realty, PSU bank, metal and pharma names.

At close, the Sensex was up 358.83 points or 0.69% at 52,300.47, and the Nifty was up 102.40 points or 0.65% at 15,737.80. About 2254 shares have advanced, 699 shares declined, and 116 shares are unchanged.

Bajaj Finance, Bajaj Finserv, SBI, Divis Labs and IndusInd Bank were among top gainers, while losers included ITC, Bajaj Auto, Adani Ports, UPL and Eicher Motors.

Among sectors, metal, pharma, PSU Bank and realty indices are up 1-3 percent. BSE Midcap and Smallcap indices rose 1 percent each.

Bitcoin surged around 8 percent to about $36,700 on June 10, according to the pricing on Coindesk at 2 pm Indian Standard Time. The world's biggest and most popular cryptocurrency is up around 30.8 percent from the year's low of $27,734 on January 4.

Century Plyboards' Q4FY21 net profit was up at Rs 86.6 crore against Rs 37 crore in the same quarter last year. Its revenue was up 40.5% at Rs 745 crore versus Rs 530.2 crore.

Century Plyboards was quoting at Rs 433.55, up Rs 22.80, or 5.55 percent on the BSE.

Alkem Laboratories announces the launch of Perampil (Perampanel) tablets 2 mg/4 mg/6 mg to make the treatment accessible to patients and healthcare providers improving their quality of life. Alkem has launched Perampil, at 2 mg – Rs. 49/strip of 7 tablets, 4 mg– Rs. 180/strip of 15 tablets and 6 mg – Rs. 300/strip of 15 tablets, to improve patient access, company said in the release.

Alkem Laboratories was quoting at Rs 3,133.55, up Rs 35.85, or 1.16 percent on the BSE.

Benchmark indices are trading higher with Nifty above 15700 level supported by the metal and PSU Banking stocks. The Sensex was up 336.02 points or 0.65% at 52277.66, and the Nifty was up 96.30 points or 0.62% at 15731.70.

Bajaj Finance, Divis Labs, Bajaj Finserv, SBI and IndusInd Bank were among major gainers on the Nifty, while losers were ITC, Bajaj Auto, Eicher Motors, UPL and Adani Ports. Metal, pharma and PSU Bank indices gained 1-2 percent.