January 04, 2022 / 16:47 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Bulls further tightened its grip on the market as investors lapped up stocks by taking positive cues from global markets. There could be bouts of volatility going ahead as concerns over rising inflation, higher interest rate scenario and increasing cases of Omicron variant would keep investors on the edge.

The Nifty opened with a positive note and successfully cleared the key resistance level of 17700. On intraday charts, the index has formed a promising breakout continuation formation which is broadly positive.

For day traders, the support has shifted to 17700 from 17550. As long as the index is trading above 17700, the chances of it hitting 17850-17890 levels would turn bright. However, below 17700, a strong possibility of a quick intraday correction up to 17625-17580 is not ruled out.

January 04, 2022 / 16:33 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded buoyantly and ended higher for the third consecutive day. Upbeat global cues led to a firm start, which further strengthened with healthy buying in energy, banking, and IT majors. Consequently, Nifty closed around the day’s high to settle at 17,800 levels. However, the broader markets witnessed a mixed day and ended in the range of 0.1-0.2%.

Markets are currently following their global counterparts while the domestic factors are showing mixed indications. Besides, the earnings season is also around the corner and it seems that participants are expecting a positive trend. Apart from the banking majors, the rotational buying in the index heavyweights from the other sectors is helping the index higher. Nifty has the next hurdle at the 18,000 mark while 17,600 would act as a cushion in case of any dip. We would advise aligning positions according to the trend.

January 04, 2022 / 16:14 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty continued with its winning streak for yet another session. On the way up, it had surpassed certain crucial short term hurdles, which fueled the rally. As a result, the index is looking to extend beyond 61.8% retracement of the entire Oct – Dec decline.

The Nifty is poised to test 18000 on the upside. The hourly chart shows that upper end of a rising channel is also present near 18000 mark. Thus, over there, the Nifty is likely to consolidate its recent gains.

On the flip side, the short term support zone shifts higher along with the key hourly moving averages & the lower channel line. It currently stands near 17600-17500.

January 04, 2022 / 15:54 IST

Sachin Gupta, AVP, Research at Choice Broking:

The benchmark index was up consecutively for the second day in a row as heavy weight Reliance Industries supported the upside move with 2% gains.

Technically, the Nifty index has managed to sustain above the prior swing high of 17639.50 levels, which indicates a bullish presence for the coming day. Moreover, the Nifty has also moved above Upper Bollinger Band formation and 50-Days Simple Moving Averages that suggests a bullish trend.

A MACD is showing good strength with positive crossover and RSI reading is above 60 marks. At present, the index has support at 17600 levels, while resistance at 18000 levels. On the other hand, Bank Nifty has support at 36300 levels while resistance at 37500 levels.

January 04, 2022 / 15:52 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

We have achieved the 17800-17850 target for the index! There might be some level of resistance between 17800-17950, but eventually, the market might want to scale higher to 18050-18100. Any dip or intraday correction can be utilized to add long positions on the Nifty.

January 04, 2022 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Tracking strong momentum of global peers, domestic bourses witnessed a smooth sail, steered by index heavyweights and gains in financials & consumer durables. Despite surging covid cases, investor sentiments remain positive globally as reports suggest lower impact of the new variant on economic recovery.

However, India’s unemployment rate rose to 7.9% in December as compared to 7% in November owing to muted economic activity in rural and urban India amid rise in Omicron cases.

January 04, 2022 / 15:45 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Strong move has been witnessed in Nifty as it managed to close a day at 17806 with gains of more than one percent and formed a bullish candle for the third consecutive session.

Now on immediate basis index has formed a base near 17700-17600 zone, holding above said support zone, we may see some more extension in current pullback towards 18k mark.

On the higher side immediate hurdle is coming near 17900-18000 mark, also overall structure looks buy on dip.

January 04, 2022 / 15:35 IST

Market Close:

benchmark indices ended higher for the third consecutive session on January 4 supported by the power, oil & gas and banking names.

At close, the Sensex was up 672.71 points or 1.14% at 59,855.93, and the Nifty was up 179.60 points or 1.02% at 17,805.30.

NTPC, ONGC, SBI, Power Grid and Titan Company were among the top Nifty gainers, however, losers were Tata Motors, Coal India, Sun Pharma, Tata Consumer Products and Shree Cements.

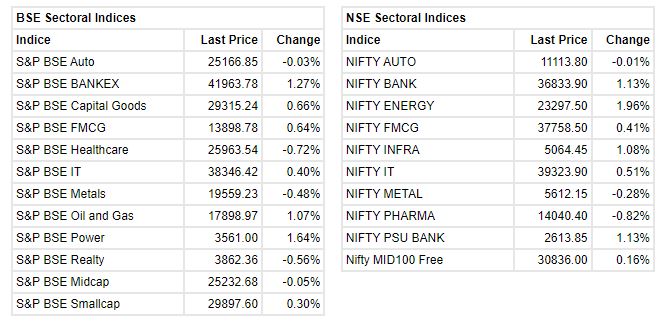

Except Metal and Pharma, all other sectoral indices ended in the green with Bank, Oil & gas and Power indices rose 1-2 percent. BSE midcap index ended flat and smallcap inex gained 0.39 percent.

January 04, 2022 / 15:26 IST

Buzzing:

Goldman Sachs (Singapore) Pte.- ODI acquired 30,02,214 equity shares in the company at Rs 46.6 per share via block deal on the BSE. Zaaba Pan Asia Master Fund was the seller.

Lemon Tree Hotels Ltd. was quoting at Rs 49.45, up Rs 1.25, or 2.59 percent.

January 04, 2022 / 15:21 IST

BSE Oil & Gas index rose 1 percent supported by the ONGC, RIL, Gujarat Gas

January 04, 2022 / 15:16 IST

Megasoft signs lease agreement for property at Nanakramguda, Hyderabad

Megasoft has concluded and signed a Lease agreement for the third and final block (Block 3) for its share, and part rental payments are expected to be received from QL of 2022 after adjusting for the rent-free period.

THe company is in the process of negotiation and finalization of accounts with its JDA Partner M/s Darshita Infrastructure Pvt Ltd (Salarpuria Sattva group) to conclude on its final shqrc and payments to be settled, details of which will be published in the financial year end acconts (2021-22).

Megasoft touched a 52-week high of Rs 83.60 and was quoting at Rs 83.60, up Rs 3.95, or 4.96 percent on the BSE.

January 04, 2022 / 15:08 IST

Railtel Corporation of India board meet on January 10 to consider interim dividend

A meeting of the board of directors of Railtel Corporation of India is scheduled to be held on January 10, 2022, to consider declaration of interim dividend, if any, for the financial year 2021-22, company said in its release.

Railtel Corporation of India was quoting at Rs 119.50, up Rs 2.45, or 2.09 percent on the BSE.

January 04, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices gained further ground with Sensex up more than 500 points and Nifty above 17700 led by the bank, oil & gas and power stocks.

The Sensex was up 642.41 points or 1.09% at 59825.63, and the Nifty was up 164.50 points or 0.93% at 17790.20. About 1680 shares have advanced, 1450 shares declined, and 79 shares are unchanged.