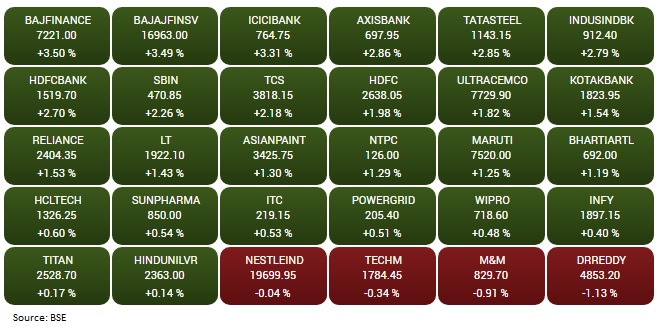

Markets started the year 2022 on a firm note and gained over one and a half percent. After a strong uptick, the benchmark moved from strength to strength, thanks to healthy buying in the banking & financial pack which was closely followed by metal and auto.

"The participation of the banking pack has changed the market mood of late while other things remain the same. However, the update on the COVID situation combined with the performance of the global markets would play a critical role ahead. Now, the next hurdle is at 17,750 in Nifty. We reiterate our view to focus on the selection of stocks while keeping a check on the leveraged positions," saidAjitMishra, VP - Research atReligareBroking