January 10, 2022 / 16:22 IST

Parth Nyati, Founder, Tradingo:

The Indian equity market is continuing its northward journey and outperforming global markets where Nifty and Sensex manage to close above the 18000/60000 mark respectively. No sectorial index ends into red and market breadth was also strong which is a good sign.

The market is showing strong strength despite rising covid cases and outperforming most of our global peers because the market is complacent about Covid cases as the hospitalization and mortality rate is very low.

Technically, Nifty manages to close above the psychological level of 18000 however 18100/18200 are immediate resistance levels; above this, we can expect a swift move towards a new all-time high. On the downside, 17800 is immediate support while 17640/17500 are major support levels.

Bank Nifty is outperforming where 38300-38500 is an immediate resistance zone; above this, we can expect a rally towards 39500/40000 levels. On the downside, 38000-37750 is an immediate demand zone while 37300-37000 is the next support zone.

January 10, 2022 / 16:19 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets opened on a positive note following mixed to marginally positive Asian market peers as investors await more U.S. inflation data. During the afternoon session markets were trading in fine fettle as sentiments’ were upbeat after three months of selling spree, foreign investors have turned net buyers in the first week of January by infusing Rs 3,202 crore in Indian equities.

Additional support came as total employment generated by nine select sectors stood at 3.10 crore in the July-September 2021 quarter, which is 2 lakh more than that of the April-June period, according to a quarterly employment survey by the labour ministry.

Traders also took solace as India has begun administering booster doses of the COVID-19 vaccine to frontline workers and vulnerable elderly people.

January 10, 2022 / 16:08 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Markets witnessed further upsurge and the key element was that both the benchmark indices managed to close above the psychological levels of 60,000 and 18,000 despite lingering concerns of steadily rising Omicron variant cases.

The Nifty is clearly witnessing short term resistance of 17930 and after the intraday breakout, it maintained a breakout continuation formation throughout the day. On daily and intraday charts, the market is still holding higher high and higher low formation which is broadly positive.

For day traders, now the support has shifted to 17900 from 17700 and above the same the bullish sentiment is likely to continue up to 18075-18150 levels. If the index slips below 17900, the market could retest the level of 17800-17760.

January 10, 2022 / 16:06 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty, post a gap up opening, consolidated near the swing high of 17944. Towards the end of the session it got stretched beyond the 18000 mark. The Fibonacci retracement shows that the index is heading towards the 78.6% retracement of the October – December decline. Thus there is some more upside potential till 18140 in the short term before the index gets into a brief consolidation.

The upside potential holds true as long as the Nifty trades above the immediate support zone of 17900-17880. On the other hand, breach of this support zone would drag the index into a sideways action. The crucial support for the short term is placed at the swing low of 17655.

January 10, 2022 / 15:57 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The Nifty has been successful in closing above the 17950 level - this should allow the index to scale up further to levels closer to 18300-18400.

The overall mood of the market seems jubilant and hence intraday corrections can be looked at as buying opportunities. As long as 17700 holds on a closing basis, the trend is positive.

January 10, 2022 / 15:52 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Amid weak global markets and rising covid cases, the domestic market displayed strong momentum on expectations of a healthy start to the earnings season. PSU Banks led the sectorial rally as reports suggested an increase in FPI limits while the realty sector followed the trend on robust sales numbers and expectations of support measures in the upcoming budget.

Globally, bourses were muted as reports of record-high Eurozone inflation at 5% kept investors on edge while awaiting the release of the US inflation data later this week which is expected to remain elevated.

January 10, 2022 / 15:43 IST

S Ranganathan, Head of Research at LKP securities:

Indices were up a percentage ahead of the Third Quarter Earnings season this week despite a rise in covid cases. Nifty reclaimed the 18K mark today as Banks led the rally on expectations of better loan growth with provisional numbers pointing towards an improved third quarter performance.

Auto stocks rebounded strongly as did the Small & Midcap indices with advance-decline ratio showing a healthy trend in afternoon trade.

January 10, 2022 / 15:34 IST

Market Close:

Benchmark indices ended higher on January with Nifty retesting 18000 led by the PSU Bank, IT, Auto, Capital Goods, Power stocks.

At close, the Sensex was up 650.98 points or 1.09% at 60,395.63, and the Nifty was up 190.60 points or 1.07% at 18,003.30. About 2472 shares have advanced, 948 shares declined, and 88 shares are unchanged.

UPL, Hero MotoCorp, Titan Company, Tata Motors and Maruti Suzuki were among the top Nifty gainers. Losers were Wipro, Nestle, Divis Labs, Asian Paints and Power Grid Corp.

All the sectoral indices ended in the green with PSU Bank, IT, Auto, Capital Goods, Power, Bank, Realty indices up 1-3 percent. BSE midcap and smallcap indices were up 0.7-1 percent.

January 10, 2022 / 15:27 IST

CLSA India says Budget 2022 to focus on boosting demand in economy

Brokerage firm CLSA India expects the Union Budget 2022-23 to bring in measures that will boost the consumption demand in the economy.

The brokerage firm noted that demand has started to constrain economic growth in India with first advance estimate for 2021-22 indicating private consumption expenditure has declined 2.9% in real terms.

“We expect Budget 2022 to boost demand with cuts in oil taxes, lower income taxes and incentives to real estate. The issuance of NABFID infrastructure bonds to fund public investment would create fiscal space to support consumption,” the brokerage firm said.

January 10, 2022 / 15:22 IST

Edelweiss partners with Indian Bank for priority sector lending

Edelweiss Housing Finance Limited (EHFL) and ECL Finance Limited (ECLF), today announced a strategic co-lending agreement for Priority Sector Lending with Indian Bank. The lenders recently signed a MoU under RBI’s CLM, significantly expanding the portfolio of lending products available to the target customers, increasing their access to credit, company said in its release.

Edelweiss Financial Services was quoting at Rs 73.85, up Rs 0.30, or 0.41 percent on the BSE.

January 10, 2022 / 15:17 IST

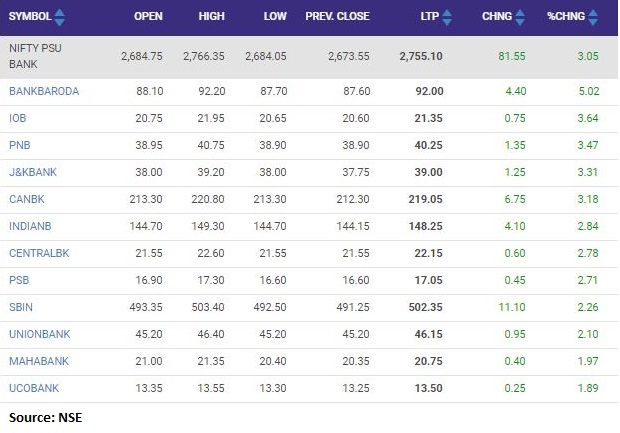

Nifty PSU Bank index rose 3 percent supported by the Bank of Baroda, IOB, PNB

January 10, 2022 / 15:15 IST

Fitch rates State Bank of India's proposed senior bonds 'BBB-(EXP)'

Fitch Ratings has assigned a 'BBB-(EXP)' expected rating to State Bank of India's (SBI, BBB-/Negative) proposed senior unsecured notes, which will constitute its direct, unconditional, unsubordinated and unsecured obligations and will at all times rank pari passu among themselves and with all of SBI's other unsubordinated and unsecured obligations. The notes will be issued by SBI's London branch.

State Bank of India was quoting at Rs 502.75, up Rs 11.45, or 2.33 percent.

January 10, 2022 / 15:12 IST

JBM Auto arm acquires 51% stake in JBM Green Energy

JBM Auto has announced the acquisition of 51% stake in JBM Green Energy Systems Private Limited and JBM EV Industries Private Limited through its subsidiary JBM Electric Vehicles Private Limited, company said in its press release.

Post this stake acquisition, JBM Green Energy Systems Private Limited and JBM EV Industries Private Limited have become the indirect subsidiary companies of JBM Auto Limited, it added.

JBM Auto touched a 52-week high of Rs 1,490.70 and was quoting at Rs 1,490.70, up Rs 70.95, or 5.00 percent.