February 21, 2022 / 16:41 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty witnessed another session of volatility as the benchmark index made a low of 17070 and moved up to 17351 before closing around 17200.

The vicious volatility in Nifty may continue till the time it remains within the range of 17000 and 17350. A decisive move beyond either band may induce direction move in the market.

February 21, 2022 / 16:40 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets remained volatile in continuation to the trend and lost nearly half a percent. After the weak start, rebound in select banking, IT and auto majors gradually pulled the index higher however resumption of selling pressure in the final hours again trimmed all gains. Finally, the Nifty index ended lower by 0.3% to close at 17,231 levels.

Markets are in wait and watch mode in line with global peers and closely monitoring the Russia-Ukraine crisis for cues. Meanwhile, the volatile swings in the index combined with the selling in broader markets are making traders’ life difficult. We thus recommend limiting positions and keeping the existing hedged until the markets stabilise.

February 21, 2022 / 16:38 IST

Prashanth Tapse, Vice President (Research), Mehta Equities:

The anxiety and pessimism from last three trading sessions did pass on to today’s trade as well as Nifty was seen wobbling and traded choppy. The benchmark Nifty is actually seen having a difficult time staging a meaningful rebound. Blame it ‘Russia-Ukraine tensions’ and also the ‘Fed's hawkishness’ is still reverberating negative sentiments.

Technically speaking, Nifty’s the long term charts are still painting a bearish picture; downside risk seen at 16401 mark. From a chartist standpoint, the technical landscape will improve considerably only above Nifty 17807 mark. For Tuesday’s trade, until Nifty’s 17421 mark is resistance, volatility will be hallmark and the perma-bulls should strictly not assume any intraday strength as light at the end of the tunnel. Expect waterfall of selling below Nifty 17057 mark.

February 21, 2022 / 16:08 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

In an extreme volatile trading session, benchmark equity indices ended lower for the fourth consecutive session on Monday amid volatility due to the ongoing Ukraine-Russia situation. Media and metal stocks registered profit booking at higher levels while select buying interest was seen in banking and financial stocks.

Technically, after morning fall, Nifty took the support at 17070 and revered sharply, but one more time it failed to close above 20-days SMA which is grossly negative.

On daily charts, it has formed Long leg Doji formation the pattern suggest indecision of bulls and bears.

We are of the view that, 17250-17300 would be the immediate resistance level on the Nifty. For the bulls above the same, the index could move up to 17375. On the flip side, trading below 17100 may increase further weakness till 17050-17000.

February 21, 2022 / 16:03 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices started weak taking cues from negative global peers but in between recouped most of its losses on reports of likely meeting between Biden and Putin over the Ukraine issue.

However, the market could not stretch the direction and turned negative as uncertainty in the global markets continued. Investors stood sidelined impacting volumes. The market is expected to be volatile due to the upcoming Fed meeting and state election results

February 21, 2022 / 15:57 IST

Palak Kothari, Research Associate at Choice Broking:

On an hourly chart, the index has been trading with lower highs & lower lows formation which points out a weakness for an upcoming session. Furthermore, the index has traded below the middle band of Bollinger which suggests downside movement in the counter.

On a daily chart, the index has been trading below 21*50-DMA with the negative crossover which suggests weakness for the next session.

Moreover, the daily momentum indicator Stochastic & MACD were also trading with a negative crossover which adds weakness in prices.

At present, the index has support at 17000 levels breaching below the same can show further downside till 16900-16800 levels while resistance comes at 17500 levels. On the other hand, Bank Nifty has support at 36800 levels while resistance at 38500 levels.

February 21, 2022 / 15:34 IST

Market Close

Benchmark indices ended lower for the fourth consecutive session on February 21 amid volatility on the back of Ukraine crisis.

At close, the Sensex was down 149.38 points or 0.26% at 57,683.59, and the Nifty was down 69.60 points or 0.40% at 17,206.70. About 678 shares have advanced, 2693 shares declined, and 116 shares are unchanged.

Coal India, Hindalco, UPL, ONGC and Adani Ports were the top Nifty losers. Gainers included Wipro, Infosys, Shree Cements, Power Grid Corp and ICICI Bank.

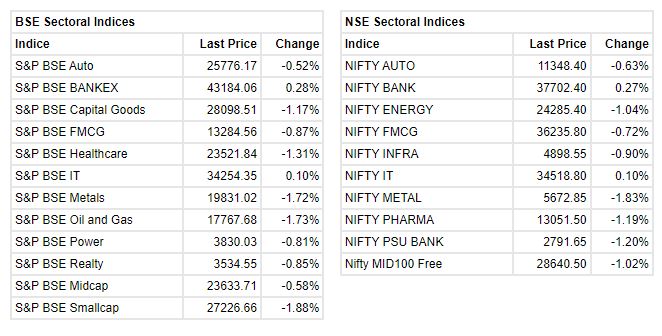

Except bank, all other sectoral indices ended in red with capital goods, FMCG, metal, oil & gas, pharma, power, realty down 1-2 percent. BSE midcap and smallcap indices fell by 0.8-2.2 percent.

February 21, 2022 / 15:24 IST

Equitas Small Finance Bank QIP closes; issue price at Rs 53.59:

The merger committee of the board of directors of Equitas Small Finance Bank has, at its Meeting held on February 19, 2022, approved the allotment of 10,26,31,087 equity shares of face value Rs 10 each to eligible Qualified Institutional Buyers at the issue price of Rs 53.59 per equity share (including a premium of Rs 43.59 per Equity Share) and reflects a discount of Rs 2.81 (i.e. 4.98%) on the floor price of Rs 56.40 per equity share, aggregating to Rs 5,499,999,952.33 only, pursuant to the ssue.

The issue opened on February 14, 2022 and closed on February 18, 2022.

Equitas Small Finance Bank was quoting at Rs 55.70, up Rs 2.25, or 4.21 percent on the BSE.

February 21, 2022 / 15:19 IST

Wall St futures, euro rally on Biden-Putin summit hopes

US stock index futures rallied, the euro rose and global stocks steadied on Monday as a glimmer of hope emerged for a diplomatic solution to the Russia-Ukraine standoff.

U.S. President Joe Biden and Russian President Vladimir Putin have agreed in principle to hold a summit on the Ukraine crisis.

The Kremlin said there were no concrete plans in place for a summit, but that a call or meeting could be set up at any time.

A summit would be held only if Russia did not first invade Ukraine, which Western countries have said it could do at any moment despite repeated denials. Russia extended military drills in Belarus due to end Sunday, and Western countries say it has continued to build up troops on the Ukraine border.

February 21, 2022 / 15:16 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets opened in red tracking global cues as investors continue to monitor Ukraine crisis amid rising tensions of potential invasion keeping investors on the edge for second consecutive week.

During the afternoon session market pared some losses as buying in frontline stocks were aiding sentiment. Traders took some solace with Crisil Research’s statement that India's industrial activity is expected to gather pace in the coming months owing to a gradual pick-up in consumption as well as investment demand.

However, the relief rally couldn't hold long and markets drifted lower in closing session as fresh news over Ukraine crisis dampened the fragile sentiments.

February 21, 2022 / 15:11 IST

Buzzing:

Shares of Butterfly Gandhimati Appliances rose nearly three percent on February 21 after Moneycontrol reported that Crompton Greaves Consumer Electricals is likely to buy out a controlling stake in the company.

Crompton Greaves Consumer is looking to buy more than 50 percent stake in the consumer appliance company for Rs 1,450 crore, which is likely to trigger an open offer to public shareholders, the report said.

Currently, promoters of Butterfly Gandhimati hold 64.78 percent stake which is likely to become a minority holding once the deal goes through. Butterfly Gandhimati’s market capitalisation currently stands at Rs 2,318 crore.

February 21, 2022 / 15:09 IST

Gujarat Mineral gets clearance to mine at Tadkeshwar lignite mines

Gujarat Mineral Development Corporation (GMDC) has received an amendment to its environment clearance from the Ministry of Environment and Forest to mine up to a depth of 135 meters from its earlier approved depth of 94 meters at the Tadkeshwar, Lignite Mines.

Gujarat Mineral Development Corporation was quoting at Rs 137.55, up Rs 2.25, or 1.66 percent on the BSE.

February 21, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices were trading flat in the highly volatile market amid selling seen across the sectors, barring banks.

The Sensex was down 110.24 points or 0.19% at 57722.73, and the Nifty was down 58.70 points or 0.34% at 17217.60. About 659 shares have advanced, 2617 shares declined, and 110 shares are unchanged.