February 16, 2021 / 16:23 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets ended almost unchanged in a range-bound session as participants chose to book some profits off the table. Initially, supportive global cues led to a firm start however profit-taking at the higher levels trimmed all the gains as the day progressed. In continuation to the prevailing trend, sectoral indices traded mixed wherein IT, FMCG and banks were the top losers while metals, oil & gas and power ended with gains.

Markets are rewarding handsomely to those who are spending time on the selection of stocks and we expect this trend to continue. Also, we’re seeing buying interest across the board but on a rotational basis. Traders should align their positions accordingly and keep a close watch on global indices for cues.

February 16, 2021 / 16:22 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Market, though volatile, kept its momentum during the morning hours, however, failing to hold on to it due to a weak opening of European markets. The downfall was aggravated by private banks, IT and FMCG stocks while mid and small caps continued their outperformance. Increased interest was seen in PSU Banks as the government shortlisted four banks for privatisation. The Indian market has been absorbing the global trend these days and we expect that to continue due to the lack of any major domestic event.

February 16, 2021 / 16:19 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index opened a day with gains but unable to hold the gains for long and witnessed a profit booking and closed a day on flattish at 15,318. Though after spike in volatility index managed to hold above the important support which is at 15,250, going forward also it will act as immediate support followed by 15,100 odd levels holding above said levels we may see current momentum to extend further towards immediate hurdle zone of 15,400-15,500 zone.

February 16, 2021 / 16:11 IST

S Ranganathan, Head of Research at LKP Securities:

While the closing today may not be reflective of the day's action, the street went berserk on Metals & Public Sector Enterprises. Despite bouts of profit booking throughout the day, the resurgence of corporate earnings coupled with continued FPI flows kept the bullish undertone intact.

February 16, 2021 / 16:09 IST

Jateen Trivedi, Senior Research Analyst at LKP Securities:

Rupee traded weak near 72.70 as Crude prices scale higher giving some base resistance near 72.50-72.60 zone for the rupee. Going ahead 72.50 will keep acting at base resistance whereas 72.85-72.95 as support.

February 16, 2021 / 15:52 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research Limited.

Nifty 50 Index is still holding above the support level of 15,250. It is critical to sustaining above the 15,250 level to keep the short-term positive trend intact. It has observed volatility to expand in today’s trading session indicating profit booking and stock distribution at a higher market level. Investors should buy on a breakout of 15,370 and look for an exit around 15,520. Overall, the investor should maintain a stop at 15,250.

February 16, 2021 / 15:36 IST

Market Close:

Benchmark indices snapped three day winning streak and ended flat in the highly volatile session on February 16.

At close, the Sensex was down 49.96 points or 0.10% at 52,104.17, and the Nifty was down 1.20 points or 0.01% at 15,313.50. About 1354 shares have advanced, 1573 shares declined, and 160 shares are unchanged.

ICICI Bank, Axis Bank, Eicher Motors, Nestle and Infosys were among major losers on the Nifty, while gainers included Power Grid, ONGC, Hindalco, Tata Steel and NTPC.

Among sectors, selling witnessed in the IT, banking and FMCG sectors, while metal, pharma, energy and infra sectors ended in the red. BSE Midcap and Smallcap indices ended in the green.

February 16, 2021 / 15:32 IST

Bitcoin within a whisker of $50,000

Bitcoin hit a new record high $60 shy of $50,000 on Tuesday, extending a sharp rally that has been mostly fuelled by big investors beginning to take digital assets seriously.

The first and most famous cryptocurrency, bitcoin hit $49,938 and has gained roughly 70% this year, most of that after electric carmaker Tesla said it bought $1.5 billion in bitcoin and would accept the currency as payment.

February 16, 2021 / 15:27 IST

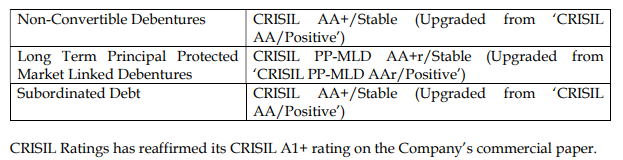

CRISIL Ratings has upgraded its ratings of Muthoot Finance

February 16, 2021 / 15:22 IST

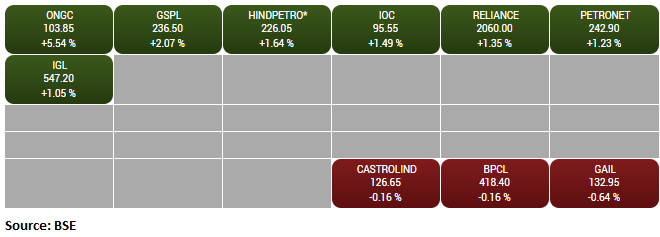

BSE Oil & Gas index rose over 1 percent supported by the ONGC, GSPL, HPCL and IOC:

February 16, 2021 / 15:19 IST

R Systems International Q3

Share price of R Systems International fell 5 percent despite company posted 8.3 percent jump in its December quarter numbers. Its Q3 net profit was up at Rs 29.4 crore against Rs 27.1 crore and revenue was up 5.5% at Rs 236.6 crore versus Rs 224.3 crore.

February 16, 2021 / 15:13 IST

Rupee Updates

: Indian rupee is trading flat at 72.71 per dollar, amid volatile trade seen in the domestic equity market. It opened marginally higher at 72.65 per dollar versus Monday's close of 72.69.