Taking Stock | Market ends marginally higher; mid, smallcaps shine

The BSE midcap and smallcap added nearly a percent each... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,267.66 | 449.53 | +0.53% |

| Nifty 50 | 26,046.95 | 148.40 | +0.57% |

| Nifty Bank | 59,389.95 | 180.10 | +0.30% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 852.10 | 27.75 | +3.37% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| HUL | 2,260.60 | -45.00 | -1.95% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10536.50 | 269.60 | +2.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 54490.80 | -128.85 | -0.24% |

Markets traded volatile on the weekly expiry day and ended almost unchanged. Upbeat global cues triggered a gap-up start which further strengthened with renewed buying in the IT majors. However, profit taking in the banking, financials and auto heavyweights pared all the gains as the day progressed. Finally, the Nifty index settled at 18035.85 level. Meanwhile, the broader indices outperformed the benchmark index and gained in the range of 0.7%-1%.

The underperformance of banking majors is capping the recovery while IT, energy and auto majors are playing their parts on rational basis. Amid all, we reiterate our target of 18200 for the Nifty and suggest focusing on buying opportunities on dips.

The Indian rupee makes a comeback after three days of a down streak following stronger regional currencies, better-than-expected trade balance numbers and lower crude oil prices. The local unit also got support from dollar inflows as foreign institutions turned buyers into domestic equities in the last couple of days.

In the near term, spot USDINR has resistance at 82.95 and support at 82.30. The bias remains positive for the pair as long as it trades above 82.30, the 50 days simple moving average.

The Nifty opened on a positive note and witnessed price action during the first half of the session. It witnessed some profit booking around the zone of 18,100 - 18,150 and as a result the Nifty gave up most of the gains though closed the day on a positive note.

The hourly momentum indicator has triggered a negative crossover which indicates that a consolidation is likely in the near term.

On the way down the Nifty can retest the breakout zone of 18,000 – 17,950 where support in the key hourly moving averages are placed. The daily momentum indicator still has a positive crossover and thus incase of a dip it should be bought into and the strategy to trade would be to buy on dip near the support zone 18,000 – 17,950.

Today the Nifty has achieved our short term target of 18,100 and hence we revise the target upwards to 18,300 with a reversal of 17,850.

The domestic market absorbed the buoyancy in the global market, led by IT stocks, while upstream oil companies gained as a result of the slash in windfall tax.

After robust jobs data, strong retail sales numbers in the US showed proof of resilience in the US economy amidst concerns over elevated inflation numbers. However, the gains were capped by worries that a stronger economy would attract a tighter monetary policy.

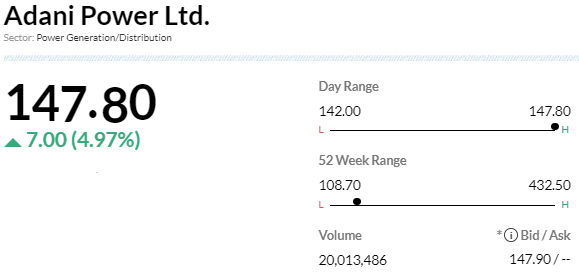

Markets ended marginally higher in a trading session marked with extreme volatility. Traders seem to be taking a cautious stance, especially after the rout in Adani group stocks in recent weeks.

With inflation levels once again inching up, there are concerns that central banks worldwide could continue their rate hiking trend, which could further hurt growth and dampen sentiment.

On the technical front, a small bearish candle on daily charts is indicating a range bound activity in the near future. For the bulls, 17,950-17,900 would act as a key support zone while 18,150-18,200 would be the crucial resistance zone. However, below 17,900, the uptrend would be vulnerable.

The Bank Nifty is struggling to cross 42000 level. The main reason is that FIIs are selling stocks under financial names. Banking stocks performed well in 2022 while IT stocks performed poorly; therefore, we are seeing a tactical shift by FIIs at the beginning of 2023.

All banks are coming out with strong earnings, but the market had already factored in good numbers. The Adani Saga caused some concern in the banking industry as well. However, the outlook for the banking sector is still promising, and valuations are still not near the peaks of their good times; therefore, this consolidation or correction is a buying opportunity.

In the near term, 42000-43000 will act as a resistance area, but above this, we can expect fresh bullish momentum towards the 45000 level. On the downside, 40,000 will act as a strong base.

Indian rupee closed higher at 82.71 per dollar against previous close of 82.80.

benchmark indices ended on flat note in the volatile session on February 16.

At Close, the Sensex was up 44.42 points or 0.07% at 61319.51, and the Nifty was up 20 points or 0.11% at 18,035.80. About 1814 shares have advanced, 1562 shares declined, and 154 shares are unchanged.

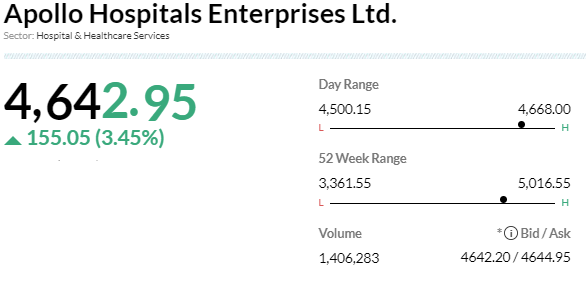

ONGC, Tech Mahindra, Apollo Hospitals, Divis Labs and Nestle India among the major gainers on the Nifty, while losers were BPCL, Bajaj Finance, HUL, HDFC Life and M&M.

Among sectors, information technology, metal and Realty up 1 percent each.

The BSE midcap and smallcap added nearly a percent each.

-Buy rating, target raised to Rs 5,375 per share

-Q3 Revenue above estimates, EBITDA in-line but profit missed on higher taxes

-EBITDA was dragged down by highest ever quarterly investments for Apollo 24/7

-Quarterly investments have peaked and will come down as per management

-Company guided for Healthco breakeven by Q4FY24 & higher hospital occupancy from 4QFY23

-FY24/25 EBITDA estimate move up by 7%/8%

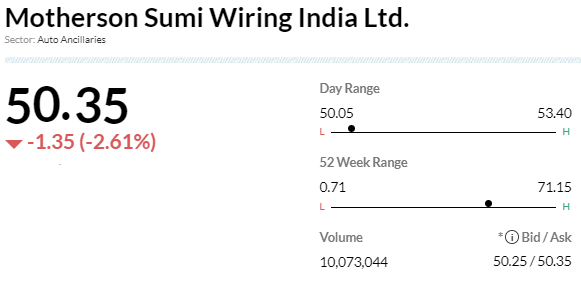

-Initiate buy rating, target at Rs 62 per share

-Leadership in wiring harness, sumitomo’s high voltage expertise to aid EV share

-Premiumisation, autonomous/connected features, EVs to drive WH content

-Company to deliver 27% FY23-25 EPS CAGR; value at 35x FY25

-Expect premium valuation to sustain, given high growth visibility, expanding market share in EVs

Adani Power has called off its plan to acquire a coal plant project in central India, according to people familiar with the matter, as billionaire Gautam Adani looks to rein in spending and rebuild investor confidence in the wake of a bruising short seller report.

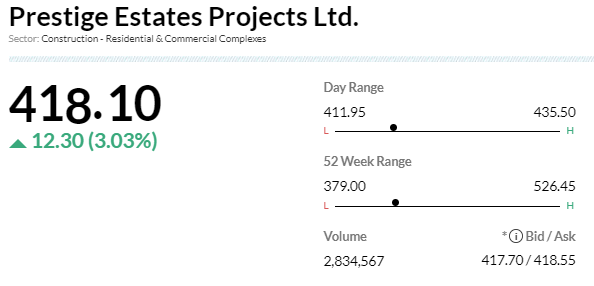

-Buy rating, target at Rs 566 per share

-Strong presale momentum continues but margin remains elusive

-Likely to beat guidance

-Raise presale estimate, valuation remains attractive

-Company trades at a significant discount to its peers