February 10, 2023 / 16:35 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities

Benchmarks failed to end on a bullish note amidst the Adani-Hindenburg rout. It was a muted session overall as the street struggled to come out of the Adani crisis as Adani Green Energy, Adani Transmission and Adani Total Gas hit their respective 52-week lows on the BSE in Friday's intra-day trade.

Technically, bullishness could be seen as long as Nifty holds above its make-or-break support at 17,551 mark. The immediate goalpost for the index is seen at 18,000 mark and then aggressive targets at the psychological 18,300 mark. For Nifty to bounce hard, BankNifty needs to outperform.

February 10, 2023 / 16:31 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty fell marginally on Feb 10 after a two day rise due to weak global cues. At close, Nifty was down 0.21% or 36.9 points at 17856.5. Volumes on the NSE have again fallen post the reduction in newsflow. Broad market indices ended in the positive even as advance decline ratio ended at 1.08:1.

Global markets were mostly lower as investors fretted about the potential for further Federal Reserve tightening and the effect on the economy.

Nifty witnessed a small 74 point high low range on Friday which is the lowest since Dec 14, 2022 likely due to reduction of volatility.

On a weekly basis, the Nifty ended just 0.01% higher – essentially flat, after a week of gain. It also made a lower top, higher bottom compared to the previous week. This narrowing of range over daily and weekly time frame could portend higher moves/breakout in Nifty on either side. Till then, Nifty could remain in the 17651 – 18061 band in the near term.

February 10, 2023 / 16:28 IST

Rupak De, Senior Technical Analyst at LKP Securities

The index remained volatile within a small range as the benchmark index remained within the bands of 17,650 and 17,950. During the week, the Nifty closed above the 14DMA, suggesting a near-term bullish trend. Besides, the index ended the week above 17,800, which again points towards a strong weekly close.

The momentum indicator RSI is in bullish crossover and rising. On the higher end, resistance is visible at 17,950-18,000; a sustained basis breakout above 18,000 may open the gate for 18,350-18,400. On the other hand, failure to move beyond 18,000 may attract selling pressure in the market.

February 10, 2023 / 16:26 IST

Joseph Thomas, Head of Research, Emkay Wealth Management

The equity markets continued in the corrective mode after the Fed and the RBI announced further hike in the base rate. What was surprising was the firmer tone of both the central banks regarding inflation containment, as both sounded quite determined to hike rates again if data points favor the same.

The corrective downward movements would render the domestic markets less expensive in terms of valuations, and greater participation is expected of investors through graduated investments in the coming months.

The trajectory of the US Dollar especially the Dollar Index is being tracked by investors and analysts alike to deduce the prospects for local currencies as it is crucial for overseas investors.

February 10, 2023 / 16:23 IST

Amol Athawale, Deputy Vice President - Technical Analyst, Kotak Securities

Technically, last week, the index took the support near 17,650 and reversed but it failed to close above 17,900, the important resistance mark. Currently, the Nifty is consolidating near the 20-day SMA and it also formed inside the body candle on weekly charts.

For the traders now, 17,900 would be the immediate breakout level to watch out, above the same the index could move up to 18,200. On the flip side, fresh selloff is possible only after the dismissal of 17,750. Below the same selling pressure is likely to accelerate and the index could slip till 17,650-17,500.

February 10, 2023 / 15:58 IST

Alert | Moody's moves Adani Green outlook to negative from stable

February 10, 2023 / 15:55 IST

Vinod Nair, Head of Research at Geojit Financial Services

Domestic indices lost ground following the global rout as investors speculated over the prospects of further policy tightening.

Worries of a looming recession escalated as the President of Richmond Fed added to the hawkish comments by the Fed speakers.

The announcement by MSCI to reduce the weighting of four Adani Group companies further hurt sentiments at home.

February 10, 2023 / 15:50 IST

Shrikant Chouhan, Head of Equity research (retail), Kotak Securities

During this week, the benchmark BSE-30 and Nifty-50 were almost flat. However, the BSE Midcap and BSE Small-cap index saw positive gains during the week.

Sector-wise, BSE Metal and BSE Power index witnessed sharp correction, whereas BSE Healthcare, BSE IT, BSE capital goods, and BSE Realty reported gains this week.

FPI flows in India remained negative. Q3FY23 earnings of Nifty-50 stocks reported so far have been broadly on expected lines.

RBI monetary policy committee raised the repo rate by 25 bps and remained concerned about core inflation.

International oil prices rose this week with Brent Crude now trading close to $86-87 per barrel. As the Q3FY23 result season comes towards an end, the investor focus will now shift towards domestic and global macro factors.”

February 10, 2023 / 15:48 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index on the daily chart continued to consolidate between the 41,200-41,800 zone. The undertone remains bullish as long as the index holds the support of 41,200 and one should keep a buy-on-dip approach.

If it breaks 41,800 on the upside, will witness a sharp short covering on the upside towards the 43,000 level.

February 10, 2023 / 15:32 IST

Rupee Close:

Indian rupee closed flat at 82.50 per dollar against previous close of 82.51

February 10, 2023 / 15:30 IST

Market Close

Benchmark indices ended lower in the volatile session on February 10 with Nifty around 17,850.

At Close, the Sensex was down 123.52 points or 0.20% at 60,682.70, and the Nifty was down 37 points or 0.21% at 17,856.50. About 1821 shares have advanced, 1547 shares declined, and 148 shares are unchanged.

Adani Enterprises, HCL Technologies, Hindalco Industries, Tata Steel and Coal India were among the biggest losers on the Nifty, while gainers included Tata Motors, UPL, Cipla, Hero MotoCorp and L&T.

Among sectors, power index down 0.8 percent, metal index fell 1.5 percent each, while realty index added 1.5 percent.

The BSE midcap index ended flat, while smallcap index rose 0.4 percent.

February 10, 2023 / 15:23 IST

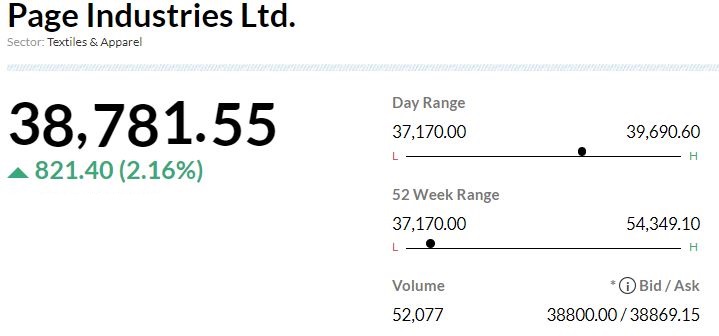

Citi On Page Industries

-Buy rating, target cut to Rs 47,000 from Rs 56,000 per share

-Revenue missed estimates by 5% led by 11% YoY volume decline

-Major disappointment was on EBITDA & net profit

-Management attributed high-cost inventory & lower absorption of overheads for margin contraction