December 06, 2022 / 16:13 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Weak sentiment prevailed through the session as investors offloaded shares in rate-sensitive such as banking, automobile and realty stocks on the eve of RBI's credit policy announcement. In the past, we have seen investors turning cautious ahead of a key event and booking some profit to avoid getting caught off guard.

If the rate hike is above the Street expectations, investors may press the panic button, which could accelerate the selling pressure.The currency market too witnessed hectic activity as rupee breached 82 mark, fuelling concerns of overseas investors cutting their positions in local equities.

Currently, the market is trading near the 10-day SMA (Simple Moving Average) indicating strong possibility of a trend reversal in the near future.

For traders, 18,700 would be the key level to watch out, as above the same we could see a fresh uptrend rally till 18,800-18,850. On the flip side, a fresh round of selling pressure is possible only after the dismissal of 18,600, and below the same the index could slip till 18,500-18,480.

December 06, 2022 / 16:11 IST

Ajit Mishra, VP - Technical Research, Religare Broking:

Markets traded lackluster and lost nearly half a percent, tracking feeble global cues. After the gap-down start, the Nifty hovered in a narrow range till the end and finally settled at 18,642.75 levels.

Most of the sectoral indices traded in line with the benchmark and ended lower wherein IT, media and metal were among the top losers. The broader indices too witnessed profit taking and shed nearly half a percent each.

Markets are digesting the recent gains and it may take a few more sessions to resume the trend. Meanwhile, traders should focus on managing positions and gradually adding quality names from across sectors. The decline in the auto and IT majors is offering a good opportunity to accumulate while pharma is not showing any sign of a reversal yet.

December 06, 2022 / 16:08 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Bears kept pushing domestic indices lower amid unfavourable global cues, with significant selling in metals and IT stocks. The mood was dampened by renewed concerns over policy tightening by the Fed in response to strong economic data out of the US. However, while easing COVID curbs in China benefited the demand outlook, fresh sanctions on Russian oil further added volatility to global oil markets.

Investors at home await the RBI policy meet tomorrow, which is expected to slow the pace of rate hikes, in light of easing food prices.

December 06, 2022 / 16:01 IST

Mohit Nigam, Fund Manager & Head - PMS, Hem Securities

Indian markets continued to tumble under selling pressure in the late afternoon session in response to negative global cues. Strong US services data aroused concerns about whether the Federal Reserve would decide to scale back the extent of its interest rate increases so soon, which led market investors worldwide to maintain their cautious stance.

In 2022–2023, the World Bank increased its GDP growth prediction for India up to 6.9 percent, noting that the country's economy was demonstrating more resilience to global shocks. It haddecreased its earlier prediction of 7.5% GDP growth for India to 6.5% in October. The forecast has now been increased to 6.9% for 2022–2023.

On the international front, European and Asian markets were both trading down as fresh worries that the US Federal Reserve may raise interest rates more than anticipated eclipsed rising confidence regarding China's economic reforms.

On the technical front, immediate support and resistance in Nifty50 are 18,550 and 18,750, respectively. For Bank Nifty immediate support and resistance are 42,900 and 43,400, respectively.

December 06, 2022 / 15:55 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index saw mild profit booking a day before the key event of RBI policy. The index is stuck in a broad range between 42,800-43,500 and a break on either side post the event will witness some trending moves.

The undertone remains bullish and if holding long positions the level of 42,800 should act as a strict stop loss. The index if breaks above 43,500 will witness a sharp short covering move on the upside towards 44,200-44,500 levels.

December 06, 2022 / 15:51 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty moved down yet again to test the key support at 18,600. The bulls managed to defend that support for the second consecutive session.

Channel study shows that the index has reached near lower end of rising channel on the hourly as well as daily chart. Thus, this is a high probability level for the index to start the next leg on the upside.

Initial resistance zone is at 18,700-18,730. Overall, the Nifty is expected to surpass the recent high of 18,888 & target 19,000 in the short term. The reversal for this bullish stance has been placed below 18,500 on a closing basis.

December 06, 2022 / 15:45 IST

Rupak De, Senior Technical Analyst at LKP Securities

Investors mostly remained on the sidelines as they preferred waiting for the RBI monetary policy announcement. The Nifty found support around the previous low before closing a bit higher.

The trend may remain sideways as long as the index remains within the bands of 18,600-18,800. Any decisive move on either side will induce a directional move.

December 06, 2022 / 15:34 IST

Rupee Close:

Indian rupee closed 82 paise lower at 82.61 per dollar against previous close of 81.79.

December 06, 2022 / 15:30 IST

Market Close

: Benchmark indices ended lower in the volatile session on December 6 with Nifty around 18650.

At close, the Sensex was down 208.24 points or 0.33% at 62,626.36, and the Nifty was down 58.20 points or 0.31% at 18,642.80. About 1565 shares have advanced, 1825 shares declined, and 135 shares are unchanged.

BPCL, Tata Steel, Hindalco Industries, Dr Reddy's Laboratories and UPL were among the top Nifty losers. The gainers included Adani Enterprises, HUL, Bajaj Auto, Nestle India and Power Grid Corporation.

On the sectoral front, metal and information technology indices shed 1 percent each, while PSU bank index up 1 percent.

The BSE midcap and smallcap indices ended in the red.

December 06, 2022 / 15:21 IST

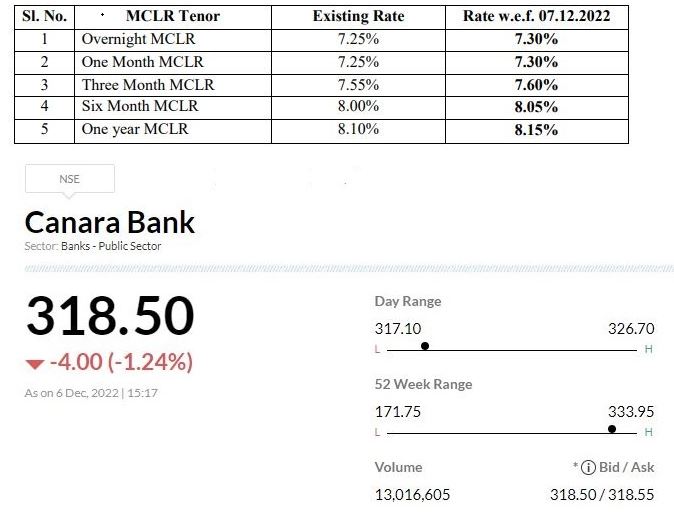

Canara Bank has revised Marginal Cost of Funds Based Lending Rate (MCLR) with effect from December 7

December 06, 2022 / 15:16 IST

Sharekhan keeps 'Buy' on HUL, target Rs 3,005

-Maintain 'Buy' recommendation on the stock with an unchanged price target of Rs 3,005

-Expect HUL’s revenues and PAT to grow at CAGR of 14% and 16% respectively over FY2022-25E

-HUL remains preferred pick in the consumer good space because of market share gains, expandingdistribution reach of 9 million outlets, strong cash flow generation and consistent dividend payout

Hindustan Unilever was quoting at Rs 2,651.50, up Rs 31.80, or 1.21 percent on the BSE.

December 06, 2022 / 15:14 IST

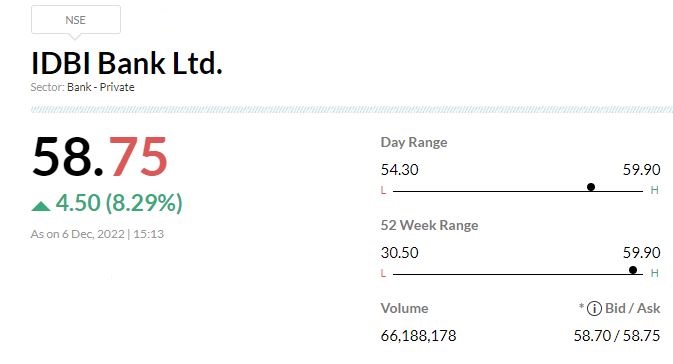

Govt to allow foreign funds to own over 51 percent in IDBI Bank

Government will allow a consortium of foreign funds and investment firms to own more than 51 percentin IDBI Bank, clarified DIPAM on Tuesday.The current guidelines of the Reserve Bank of India restrict foreign ownership in new private banks. The central bank's residency criteria for promoters applies only for newly set up banks and would not apply to an existing entity like IDBI Bank, it explained.

December 06, 2022 / 15:11 IST

Airtel has launched ‘Airtel World Pass’ across 184 countries

“At Airtel, our mission is to solve customer problems so that our experience speaks for itself. The feedback that we have heard on international travel related concerns has compelled us to launch a defining proposition for our customers – the Airtel World Pass," said Shashwat Sharma, Director Consumer Business, Bharti Airtel.

Bharti Airtel was quoting at Rs 833.30, down Rs 10.60, or 1.26 percent.