Benchmark indices ended higher on first day of the new financial year with Nifty comfortably closing near 17,700.

At close, the Sensex was up 708.18 points or 1.21% at 59,276.69, and the Nifty was up 205.70 points or 1.18% at 17,670.50. About 2564 shares have advanced, 645 shares declined, and 84 shares are unchanged.

NTPC, BPCL, Power Grid Corporation, IndusInd Bank and SBI were among the top Nifty gainers.

Hero MotoCorp, SBI Life Insurance, Sun Pharma, Tech Mahindra and Titan Company were the top losers.

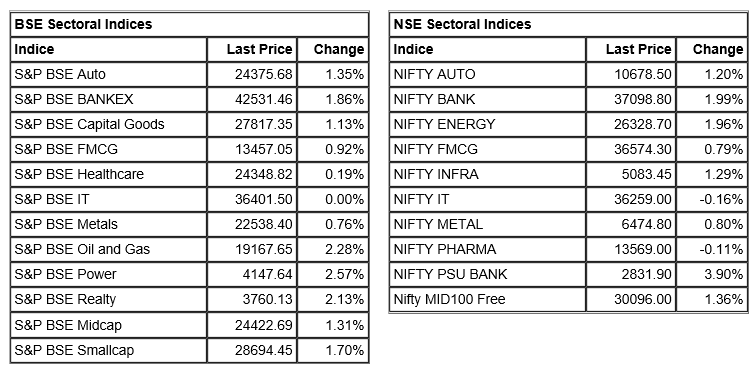

All the sectoral indices ended in the green with auto, bank, oil & gas, realty, power and PSU Bank indices up 1-4 percent.

BSE midcap and smallcap indices added over a percent each.

Bharat Electronics (BEL) rose 2 percent after company achieved a turnover of about Rs 15000 crore (Provisional & Unaudited), during the Financial Year 2021-22, against the previous year's turnover of Rs 13,818 crore, despite challenges posed by the COVID-19 pandemic and global semiconductors shortage.

NCC share price added 11 percent after company received one new order for Rs 323.65 crore (exclusive of G5T) in the month of March, 2022. This order pertains to Buildings Division.

Ujjivan Small Finance Bank share price rose 9 percent as Care Ratings has reaffirmed its CARE A+; Stable rating on the Long Term Bank Facilities of Rs 500 crore of the bank.

Bank of Baroda rose nearly 4 percent after bank completed acquisition of 13,93,26,923 equity shares being the 21% stake of Union Bank of India in IndiaFirst Life Insurance Company Limited after receiving the regulatory approvals.

SpiceJet share price added nearly 5% after company's officials said that salaries of captains to be increased by minimum 10%. However, salaries of first officers to be increased by minimum 15% & 20% for trainers.

Ashok Leyland gained 1.5 percent after company in the month of March 2022 sold 20,123 units against 17,231 units in March 2021, growth of 17 percent.

Tech Mahindra shares ended in the red after Mr. M. Damodaran retired as an Independent Director of the company with effect from March 31, 2022 upon completion of his tenure of the second term.

Ruchi Soya Industries shares fell 2 percent after company fixed the issue price of its FPO. The board at its meeting has approved issue price at Rs 650 per equity share for its follow-on public offer.