April 12, 2022 / 16:24 IST

Rahul Sharma, C0-Founder, Equity 99:

Market is under pressure on account of inflation worries ahead of US inflation data release. Even March CPI inflation is set to increase to 6.37 percent from 6.07 percent in February. Along with this RBI hawkish turn at its policy review on April 8 and few sectors expected to have an adverse effect in their quarterly results due to commodity price rise and inflation, have put added pressure on the market.

Benchmark index corrected almost 0.5%. The Mid and Small caps were also seen under pressure today. Investors are advised to maintain liquid cash in hand to take advantage of any falls in quality stocks due to poor performance in quarterly results. We expect some volatility in market on account of weekly expiry.

For Nifty50, 17400 will act as very strong support on breaking which we might see 17310 levels and if this level is also breached than next stop will be around 17260 levels. On upper side 17650 will act as very strong resistance, if Nifty goes beyond these levels than next stop will be around 17800, which if broken will take markets to 17990 levels.

April 12, 2022 / 16:20 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Concerns of a slowdown in consumer spending following a rise in fuel prices ahead of earning seasons hit investors' sentiments today. Nifty, which post gap down opening, broke 17600, the crucial support level. Realty and Metal indices shed over 2.5 percent whereas banking stocks recovered sharply from the day's lowest levels.

Technically, after a long time, the Nifty has closed below 10-days SMA. We are of the view that the broader market texture is still weak and any fresh uptrend rally is possible only after 17620 breakouts. Below these levels, we could see further weakness till 17400-17350.

On the flip side, if Nifty succeeds to trade 17620 then it will move up to 17700 and 17800. The market texture is volatile hence level based trading would be the ideal strategy for the traders.

April 12, 2022 / 16:01 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty broke down from an Inside bar pattern that was formed on the daily chart on April 11. The selling pressure, however, was absorbed near the 20 DMA, which induced the bulls into action.

Consequently the index managed to hold on to the level of 17500 on a closing basis. The overall structure suggests that with the recent minor degree dip, the index has reached lower end of the short term consolidation.

17500-17400 is a crucial support zone from where the index can take a leap towards 18000 on the upside. Thus, the risk reward at this level is quite attractive to initiate a fresh long position from short term trading perspective.

April 12, 2022 / 15:52 IST

Kunal Shah - Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty Bulls came back strong in the second half and outperformed the Nifty Index. The index is near the resistance zone of 38000 and needs to take out this level decisively for the bulls to gain full control.

The lower zone of 37400-37300 is acting as a demand area and a close below it will trigger fresh selling pressure.

April 12, 2022 / 15:51 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Hyperinflation & risk of a policy rate hike are placing the global market on its toes and are impacting the performance of equities with a rise in yield.

Inflation in India is also expected to be on the higher side in Q1FY23, it is expected to subside due to a reversal of commodity prices and improvement in supply. The domestic market is also cautious in anticipation of Q4 results.

April 12, 2022 / 15:49 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty slipped lower as it broke the support of 17600. On the lower end, it found support around 17400 before closing about 90 points off the day's low.

The bias, however, remains weak as the Nifty ended below the support of 17600, which is likely to act as resistance going forward. On the lower end, 17400 may continue to act as support below which the Nifty may witness a serious correction.

April 12, 2022 / 15:43 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities

Nifty has broken trend support of 17600 – High probability of sideways to corrective movement for the near term. Breach of 17420 can further infuse selling pressure in the short term.

Immediate resistance is placed at 17600 – if crossed can invite some short covering. Bank Nifty trades with resistance of 37920. Weak longs can be exited since volatility is expected to rise for the near term.

April 12, 2022 / 15:34 IST

Market Close:

Indian benchmark indices ended lower for the second consecutive session in the volatile trade on April 12.

At close, the Sensex was down 388.20 points or 0.66% at 58,576.37, and the Nifty was down 144.70 points or 0.82% at 17,530.30. About 1146 shares have advanced, 2193 shares declined, and 90 shares are unchanged.

Hindalco Industries, Coal India, Grasim Industries, Tata Motors and Tata Steel were among the top Nifty losers. However, Axis Bank, Kotak Mahindra Bank, Power Grid Corporation, SBI Life Insurance and Maruti Suzuki were the top gainers.

Except bank, all other sectoral indices ended in the red with IT, metal, realty, oil & gas and capital goods indices down 1-3 percent. BSE midcap and smallcap indices shed over a percent each.

April 12, 2022 / 15:23 IST

CLSA view on Tata Consultancy Services

CLSA has maintained outperform call on Tata Consultancy Services and raised target price to Rs 4,000 from RS 3,850 per share.

There was a strong hiring and orderbook, but margin volatility is an overhang.

The company has reported healthy 3.2 percent QoQ constant currency revenue growth, orderbook is 40 percent above run-rate of the past four quarters but we trim our FY23/FY24 EPS forecasts by 1.6 percent/0.4 percent, said CLSA.

However, improved revenue visibility is a near-term comfort, it added.

April 12, 2022 / 15:19 IST

Equity infusion to improve Adani Transmission's rating headroom: Fitch Ratings

A USD 500 million investment in Adani Transmission Limited (ATL, BBB-/Negative) by International Holding Company (IHC), the investment arm of the Abu Dhabi royal family, will increase ATL’s rating headroom by improving its leverage and coverage ratios, Fitch Ratings says.

Adani Transmission touched a 52-week high of Rs 3,000 and was quoting at Rs 2,709.40, down Rs 46.15, or 1.67 percent on the BSE.

April 12, 2022 / 15:16 IST

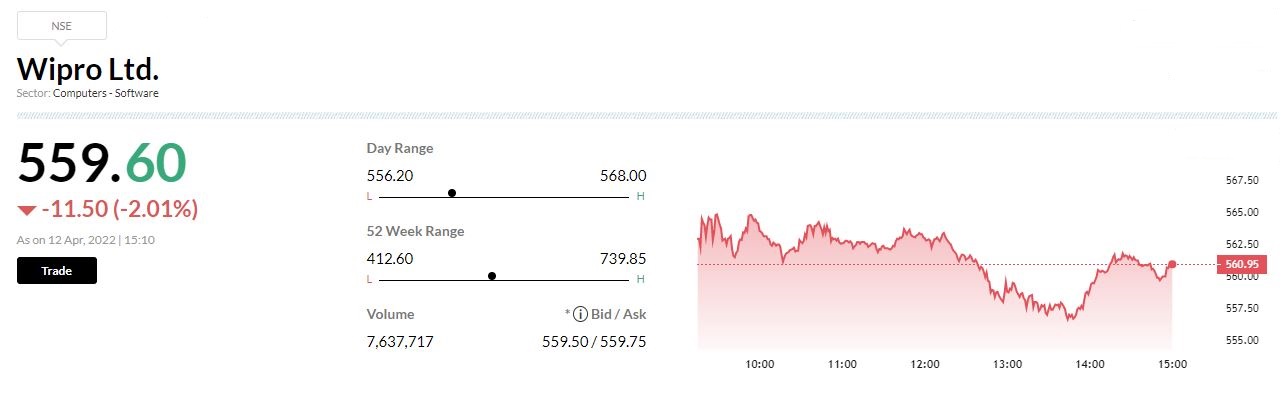

Wipro acquires Convergence Acceleration Solutions:

Bengaluru-based IT services firm Wipro acquired US-based consulting firm Convergence Acceleration Solutions (CAS) for $80 million to drive large-scale business and technology transformation for clients.

The company will pay $50 million upfront and the remaining $30 million will be payable over three years. “The joint entity will provide clients with services ranging from strategy development and planning to execution and implementation,” Wipro said in a statement.

April 12, 2022 / 15:13 IST

Nomura's view on Tata Consultancy Services

The broking firm Nomura has kept the 'neutral' rating on Tata Consultancy Services and raised target to Rs 3,930 from Rs 3,890 per share.

It expect EBIT margin to drop 40 bps YoY to 24.9 percent in FY23 as Q4 results modestly beat consensus on revenues.

Nomura increases FY23-24 EPS estimates by 1 percent.

Tata Consultancy Services was quoting at Rs 3,697.25, up Rs 0.85, or 0.02 percent on the BSE.