After stellar gains in four consecutive derivatives series, the Nifty 50 witnessed a breather in the August F&O series, falling over 2 percent.

Now, the rollover of short positions to the September F&O series and the fall in foreign institutional investors' (FIIs) long-to-short ratio suggest that the lacklustre trend for the benchmark index is likely to continue for yet another month.

While the August F&O series was marked by the liquidation of long positions by FIIs, the rollovers to the September series reflect a rise in short bets taken by FIIs.

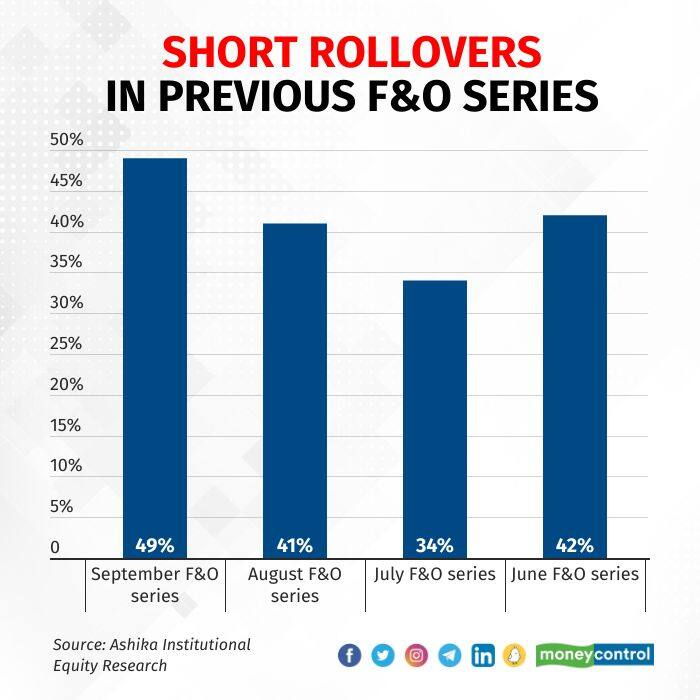

A report by Ashika Stock Broking suggests that the net short positions of FIIs at the start of the September F&O series stand at 49 percent, up from the 41 percent seen at the beginning of the previous series.

Likewise, the FIIs’ long-to-short ratio in index futures stood at 1.02, the lowest level recorded at the start of the past three F&O series.

According to Motilal Oswal Financial Services Ltd (MOFSL), rollovers for the Nifty50 stood at 78 percent, which aligns with its quarterly average of 77 percent. However, it was still well below the 84 percent rollovers seen at the start of the August F&O series.

Market-wide rollovers also stood at 90 percent, in line with the average rollovers of the last three series at 90 percent, according to data from Nuvama Alternative & Quantitative Research.

Nifty to be locked in a rangeGoing by the positions taken by traders in the derivatives segment, the MOFSL report noted that call writing was seen at 19,400, followed by 19,300 while put writing was seen at 19,200 and then 19,100 at the start of the September F&O series.

Based on options data, the firm expects the Nifty 50 to hover in a broader trading range of 19,000-19,700 points, while in the near term, the index can be seen caught between 19,100 and 19,500. Analysts at Nuvama further believe that any negative developments in the near term could also push the Nifty 50 towards the 18,600 level.

A seasonality check of the last 26 years also doesn't offer much confidence as September has given a positive return of just 0.96 percent, with the Nifty 50 closing the month on a positive note 56 percent of the time.

Viraj Vyas, technical and derivatives analyst at Ashika Stock Broking, also feels that the headline index needs to stage a price-intense move above 19,400, which can then provide a much-needed breather from the volatility witnessed in the last few weeks. Regardless, he is also of the view that the underlying sentiment remains positive and that may prompt any dip towards the 19,000 levels to get bought.

Brokerage firm Religare Broking also sees the 19,400 level as pivot for the month and believes till the time Nifty 50 remains below that mark, the sentiment in the market will be 'sell-on-rise'.

Can outperformance continue in the broader market?While the bears clearly had an upper hand when it comes to the blue-chip index's performance in the August F&O series, bulls were seen clinching a victory in the broader market.

Nuvama highlighted the broader market's ascent to new peaks in the August series, even in the face of large-caps struggling to maintain the all-time highs set in the prior series. The Nifty Smallcap 100 and Nifty Midcap 100 outperformed their large-cap peer by around 7 percent each in the August series.

Also Read | Defying odds: Mid, small-cap stocks shine amid market turbulenceYES Securities believes that the positive internal strength of the broader indices against the benchmark index indicates that further outperformance is possible. However, bouts of profit-taking cannot be ruled out, and, hence, investors can look at those pullbacks as a buying opportunity, the firm stated.

Nuvama also anticipates a positive trend for stocks that are probable candidates for an MSCI inclusion in November 2024. They include Polycab, Tata Communications, Persistent Systems, APL Apollo, One97 Communications, and Macrotech Developers, whose prospects of an MSCI inclusion can be seen as an opportunity to buy the stocks, Nuvama said.

On the sectoral front, a long build-up was seen in automobiles, media, consumer durables, telecom, capital goods and realty, while information technology, pharma and metals witnessed the covering of short positions.

Infra, energy, banks, financial services, and oil & gas saw fresh additions of short positions, whereas long unwinding was seen in FMCG, consumption and chemical stocks.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.