Rakesh Jhunjhunwala, popularly known as the big bull of D-Street, increased his stake in 4 companies and cut holding in 8 companies in the December quarter as compared to September quarter.

Indian market registered flat return in 2018 with Nifty posting a marginal gain of about 3 percent, but the real carnage was seen in the broader market.

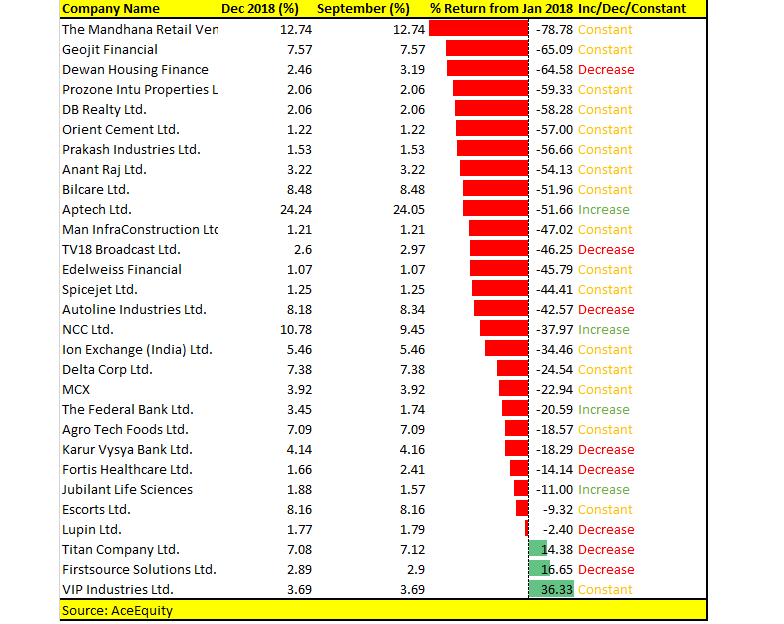

A similar picture could be seen in the portfolio of the big bull where 26 companies posted negative returns since January 2018.

As many as 29 companies in Jhunjhunwala’s portfolio released their shareholding data for the quarter ended December as of January 25. Of the 29 companies, only three have delivered positive returns in the last one year.

According to Forbes India, the ace investor is ranked 61 among billionaires in India with a net worth of USD 2.7 billion.

In terms of shareholding, Jhunjhunwala raised stake in 4 companies — Aptech, NCC, Federal Bank and Jubilant Life Sciences.

He reduced his stake in eight companies including Dewan Housing Finance. The stock slipped over 60 percent in the last one year. Jhunjhunwala reduced his holding from 3.19 percent in the September quarter to 2.46 percent in the December quarter.

The housing finance company last week reported a 36.7 percent decline in its net profit to Rs 313.60 crore for the quarter ended December 2018. The Mumbai-based company had posted a net profit of Rs 495.44 crore in the third quarter of last fiscal.

Other companies in which Jhunjhunwala reduced his stake include TV18 Broadcast, Autoline Industries, Karur Vysya Bank, Fortis Healthcare, Lupin, Titan Company, and Firstsource Solutions.

Jhunjhunwala has brought down his stake from 8.45 percent in Titan Company in December 2017 quarter to 7.08 percent in December 2018 quarter.

As many as eight analysts have a buy rating on Titan, while 15 have an outperform rating, only 1 analyst has an underperform rating on the stocks, according to Reuters data.

Earlier this month, Titan released its guidance for December quarter which was taken positively by most brokerages. Morgan Stanley marinated its overweight rating with a target price of Rs 1,250, while Citigroup has a buy rating with a target of Rs 1,020.

Jhunjhunwala kept his stake constant in as many as 17 stocks which include The Mandhana Retail (down 78 percent in the last one year), followed by Geojit Financial Services, DB Realty, Orient Cement, Prakash Industries, Edelweiss Financial and MCX.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.