March 24, 2021 / 13:59 IST

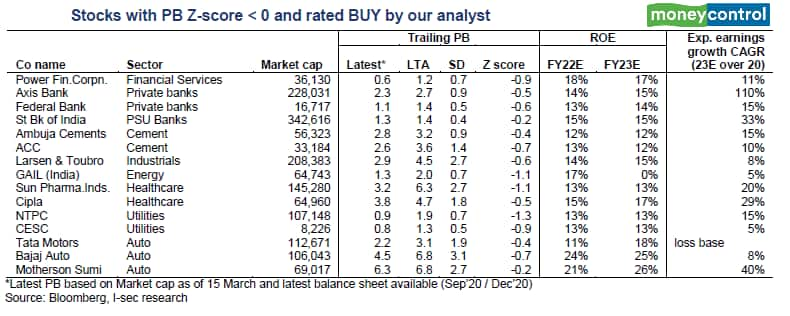

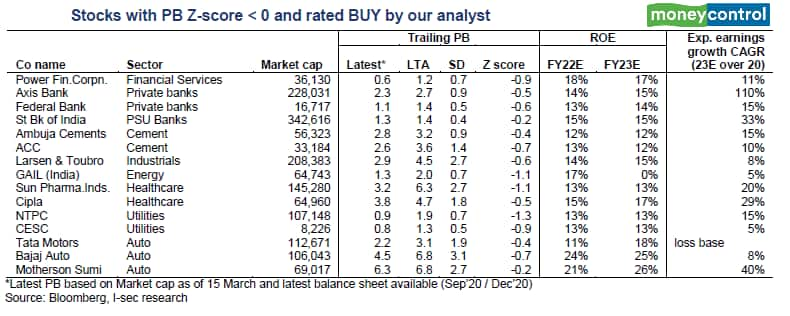

The long debate about Growth vs Value might not come to an end anytime soon, but investors who are looking to create wealth over a period of time could look at value plays. Let’s first understand what growth and value are. Growth stocks are those that have the potential to outperform the market over a period of time while value stocks are those trading below their intrinsic value. Experts feel that value companies could make a comeback in FY22. A recent note by ICICIdirect highlighted that value stocks started to outperform in a sustained way in FY21 after a decade of underperformance. Different people have different definitions/ interpretations of value and growth. For example, a good growth company with good management in a sector with huge future potential can be a value stock for someone with a long-term horizon even if it appears expensive on valuations today. “Generally speaking, growth stocks have done well for a long time now and most of them are well-discovered and expensive. I think with ample liquidity, globally, value stocks should make a comeback in FY22,” Prasanna Pathak, Head of Equity & Fund Manager, Taurus Mutual Fund, told Moneycontrol. Despite the rally and bull market environment, the chasm between value and growth still remains at a two-decade high -- in both the global and the Indian context. At least 51 percent of the NSE200 universe has a negative ‘Z-score’ on P/B ratio, which is significantly higher than that in the previous phases of bull markets such as in 2010 (40 per cent) and 2007 (20 per cent), ICICIdirect note highlighted. A negative Z-score indicates lower-than-average valuations for a stock compared to its long-term history. Stocks with a negative P/B Z-score and robust fundamentals (indicated by BUY ratings by our analysts) are the best bets in an environment of ‘value rotation’ and economic growth revival. Top picks within the NSE200 universe include financials - SBI, Axis Bank, PFC, and Federal Bank; Industrials - L&T, Ambuja Cement, and ACC; Oil & Gas - GAIL; Utilities - NTPC, and CESC; Auto - Tata Motors, Motherson Sumi, and Bajaj Auto; Pharma - Cipla and Sun Pharma.

Using an Z-score solves the ‘relative valuation’ conundrum, which makes one asset appear cheaper than the one which could be in a ‘bubble zone’ – a recipe for disaster in investing. Data suggests that the current bull market has a much higher proportion of stocks with a P/B Z-score of less than 0 as compared to the 2010 bull rally and significantly higher than the 2008 peak. Price-to-book or P/B is a much steadier number than P/E, especially in the current environment as earnings are getting heavily impacted by economic upheavals due to extreme events like COVID as highlighted by the ICICIdirect report.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Using an Z-score solves the ‘relative valuation’ conundrum, which makes one asset appear cheaper than the one which could be in a ‘bubble zone’ – a recipe for disaster in investing. Data suggests that the current bull market has a much higher proportion of stocks with a P/B Z-score of less than 0 as compared to the 2010 bull rally and significantly higher than the 2008 peak. Price-to-book or P/B is a much steadier number than P/E, especially in the current environment as earnings are getting heavily impacted by economic upheavals due to extreme events like COVID as highlighted by the ICICIdirect report. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Using an Z-score solves the ‘relative valuation’ conundrum, which makes one asset appear cheaper than the one which could be in a ‘bubble zone’ – a recipe for disaster in investing. Data suggests that the current bull market has a much higher proportion of stocks with a P/B Z-score of less than 0 as compared to the 2010 bull rally and significantly higher than the 2008 peak. Price-to-book or P/B is a much steadier number than P/E, especially in the current environment as earnings are getting heavily impacted by economic upheavals due to extreme events like COVID as highlighted by the ICICIdirect report. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.