Muthoot Finance shares have seen increased buying interest in the May series, with the cumulative open interest in futures rising 0.53 percent. Options matrix hints at a good support base formation at 1,600 and 1,660 levels while long unwinding is witnessed in call writing positions at 1,700.

Avani Bhatt, Senior Vice president- Derivative research at JM financial recommended taking a bull call ratio spread strategy on Muthoot Finance stock to capture this momentum.

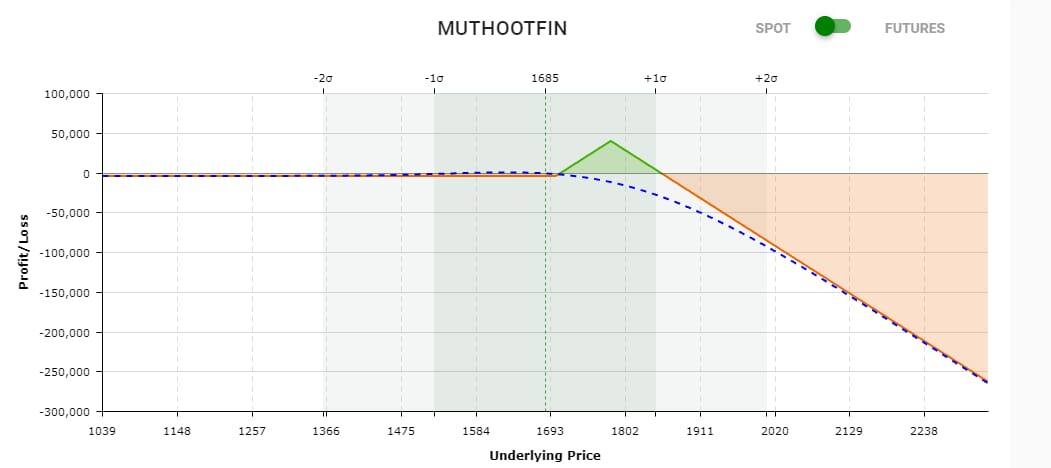

Bull call ratio spread for May series recommended by Bhatt:

Position: Buy 1 lot of MuthootFin 1700 CE at Rs 50-52

Sell 2 lots of MuthootFin 1,780 CE at Rs 25-27

Max profit expected is Rs 40,000 in the range of Rs 1,720-1,780

Zero downside risk

Margin Required: Rs.131000

Profit Potential: 30 percent on Margin

Holding Period: Until May expiry

A bull call ratio spread is an options trading strategy used when an investor is moderately bullish on the underlying stock or asset. It involves buying a certain number of call options while simultaneously selling a different number of call options with a higher strike price, and in a specific ratio.Technical viewAs per Avani Bhatt, Senior Vice President- Derivative research at JM Financial, "After testing the highs of Rs 1753, the stock retraced back to its weekly support level of Rs 1655 and bouncing back from those levels."

"Futures witnessed long addition to the tune of 0.53 percent. Options matrix hints at a good support base formation at Rs 1,600 and Rs 1660 levels while unwinding noted in call writing positions at Rs 1,700. A move above previous day’s high of Rs 1686 will trigger short covering rally that can pull the stock up towards it’s recent high of Rs 1,730/1,750, " added Bhatt.

Muthoot Finance is currently trading at Rs 1,677 at 11:05 am on May 8.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.