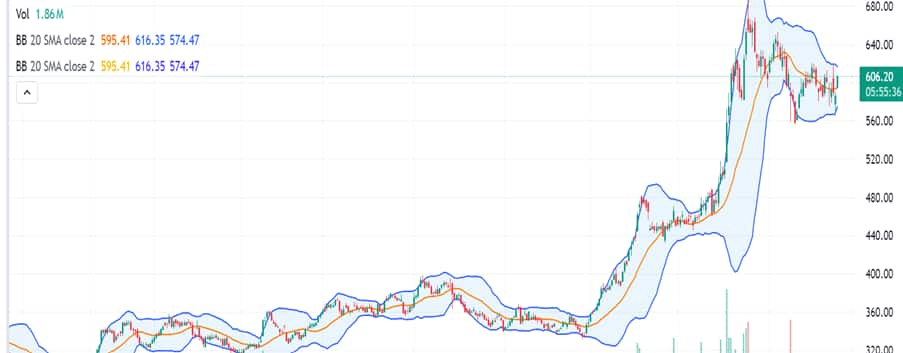

BPCL shares have been on a bullish run for the past few weeks and are trading well above the major moving averages on the daily charts. The counter witnessed strong trading volumes in the last few sessions and is expected to surpass the near-term resistance levels of 610 on the daily charts.

Arun Kumar Mantri, founder of Mantri Finmart, suggests a 'Buy' a call option to capture the bullish momentum.

Trade details:Position: BUY BPCL MAY 610 STRIKE CE

Entry: 26-27

Target: 36-49

Stop loss: 16

Holding period: 4-5 trading sessions.

Bharat Petroleum Corporation LimitedTechnical view

Bharat Petroleum Corporation LimitedTechnical viewMantri said, “The stock is looking very bullish on all timeframes and is hovering in the cluster of major moving averages. The counter is making intraday highs even in volatile market conditions. There is also an initial stage of formation of consolidation breakout and the stock is expected to test Rs 615-620 levels in the next 3-4 trading sessions. The support for the stock is placed around Rs 590-552 on the lower side while resistance is at Rs 620.”

Based on option chain analysis Mantri highlights that 600 PE of BPCL April series has a strong Open Interest (OI) of more than 8.4 lakh shares indicating short covering may take place in the stock once the stock crosses and sustains above 610 in the coming trades. On the flip side, 610-620 CEs of the stock have the highest OI affirming support of breakout zones on the higher side.

“We expect the stock to witness long formation followed by short covering in the options space. Short-term traders may look upon ATM CE of 610 of next month of May series for the short-term perspective,” said Mantri.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.