The sluggish Q2 earnings season, moderating economic growth, global volatility and lofty valuations put a staggering halt to the Nifty 50's bull run in recent months. The weak quarterly show also triggered a a downgrade in the Bloomberg consensus estimate for the Nifty 50, which now projects a lower-teen CAGR for FY25-26.

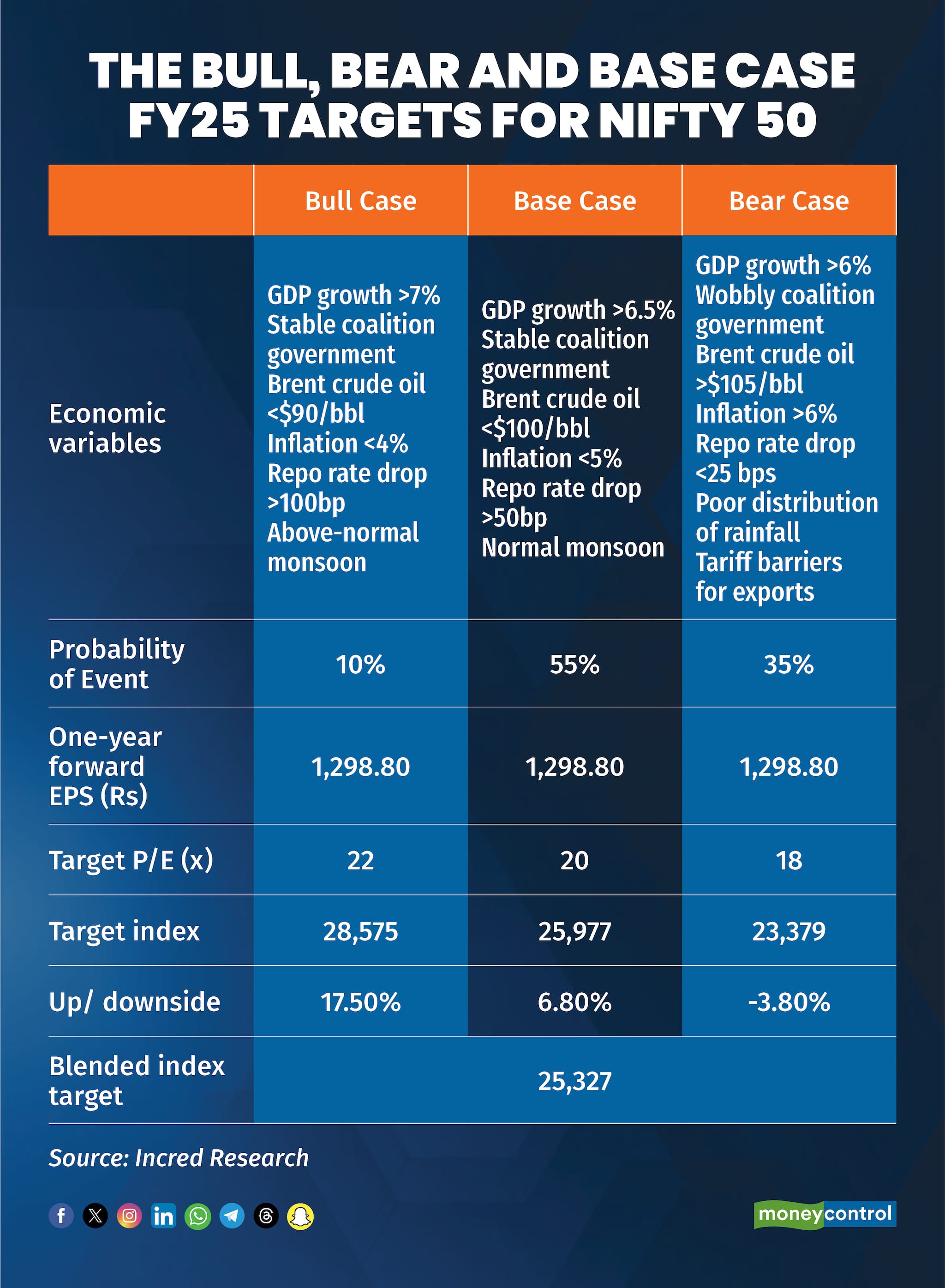

With limited relief anticipated ahead, analysts have been forced to give a re-look to their Nifty 50 targets for FY25. Likewise, Incred Equities also reduced its estimates by 3 percent and now forecasts a blended target of 25,327 for the Nifty 50 by the end of FY25, reflecting a modest 4 percent upside from the current level.

Having said that, there still exists an influx of market-moving triggers that will play a decisive role in shaping the Nifty 50's trajectory hereon. Here are three possible scenarios outlining the index's trajectory by the end of FY25.

The Bull Case: A Happy Ending

The Bull Case: A Happy EndingAs the name goes, the bull case scenario takes into account the most optimistic economic variables that may influence the trajectory of Nifty 50. This scenario assumes that the Indian economy navigates the current global volatility with resilience, outperforming consensus expectations by achieving GDP growth of over 7 percent, bolstered by an above-normal monsoon and Brent oil prices remaining below $90 per barrel. Another key factor that analysts at Incred Equities assume is that the Reserve Bank of India delivers rate cuts of over 100 basis points cumulatively while reigning in inflation below 4 percent.

Accordingly, in the bull case, Incred Equities forecasts the Nifty 50 to climb 17.5 percent from current levels, closing FY25 at 28,575 with a price-to-earnings ratio of 22x. However, the brokerage considers this optimistic scenario rather unlikely, assigning it a mere 10 percent probability of materialising.

The Base Case Scenario: A Reality CheckWhile the some green shoots of recovery are expected to make way for India Inc in the second half of the current fiscal, drastic changes are unlikely to occur in terms of earnings growth. Going by the current economic indicators which highlight urban consumption slowdown, sluggish wage growth, persistent food inflation and a high base, analysts at Incred Equities anticipate India to register a GDP growth over 6.5 percent in FY25 as part of its base case scenario. The GDP growth, according to Incred, is likely to be coupled with Brent oil prices sticking below $100 per barrel, a normal monsoon, below 5 percent inflation and 50 bps cumulative rate cuts by the RBI.

Under these circumstances, Incred expects the Nifty 50 to close this fiscal at 25,977, reflecting a 6.8 percent upside from current levels, while commanding a P/E of 22x. Moreover, analysts at the firm see the maximum probability of this scenario panning out.

The Bear Case: Scary TimesConsidering uncertainties such as geopolitical tensions in the Middle East, the return of Donald Trump as US President, and a NDA coalition government at the center, this scenario accounts for a bearish trend impacting the Nifty 50. Analysts factor in the possibility that a shaky coalition government, export tariff barriers, Brent oil prices surging above $105 per barrel, and uneven rainfall distribution could significantly hinder India's growth in this scenario. Additionally, Incred Equities projects inflation rising above 6 percent, limiting the RBI's ability to cut rates by more than 25 basis points if these challenges come to fruition.

Based on this, the bear case scenario, though not so unlikely as the bear case, projects the Nifty 50 settling FY25 at levels around 23,379. This would mark a near 4 percent downside from current levels, with a P/E of 18x.

Headwinds still persistThe sharp correction of around 3 percent since the Nifty's peak in mid-September has brought valuations below its 10-year average of 20x one-year forward P/E. Despite the correction though, analysts at Incred Equities anticipate high volatility in the index to persist due to global market uncertainties and India’s premium valuation as compared to other Asian counterparts. However, with key state elections behind, hopes of a shift towards the government's policy actions, which are crucial for meeting budgeted spending targets and aligning GDP growth and inflation with consensus expectations, offer some comfort.

Having said that, local and global headwinds persist too and factoring that in, Incred Equities also trimmed its bull-case probability to 10 percent from the earlier 20 percent while raising its bear-case probability to 35 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.