Are you scared because you own non-banking finance company stocks (NBFCs) in your portfolio? Or, are you looking to invest money in NBFCs which are now trading at attractive valuations?

Well, experts feel that the pain in NBFC stocks is likely to continue in the near term and any corrections in some of the stocks are a golden opportunity to buy.

As many as 60 stocks in the NBFC space have fallen up to 50 percent so far in September which includes names like Dewan Housing Finance (down 47 percent), followed by Reliance Capital (down 28%), and Bajaj Finance (down 16 percent).

The recent correction on the back of debt market liquidity concerns prompts the analyst community to review a few strong NBFCs.

Several factors including business tailwinds, robust operating models catering to the retail segment and parental support provide comfort to banks/debt markets and ensure that liquidity remains strong; stress, if any, remains only to near-term net interest margin (NIM), suggest experts.

“We don’t find liquidity risk to any of the NBFCs under-coverage due to factors discussed above. However, the risk-averse stance of debt markets will likely lead to higher funding costs in the near-term,” Kotak Institutional Equities said in a note.

“We are building NIM compression into our forecasts, though we do not rule out any near-term risk due to vagaries in the bond market. However, supported by our thesis of strong fundamentals and business trends of NBFCs under coverage, we prefer to look beyond near-term volatility and find value gradually building up in select stocks,” it said.

Experts feel that well-run NBFCs with proven business models across cycles and those focusing on the retail segment that have generally lower credit and concentration risks may be less affected.

Kotak highlights NBFCs which have strong parentage i.e. sovereign/ large financial institutions like LIC Housing Finance, PFC and REC and business houses like Aditya Birla Finance, Bajaj Finance, Cholamandalam, Mahindra Finance, will continue to earn support from debt markets and banks.

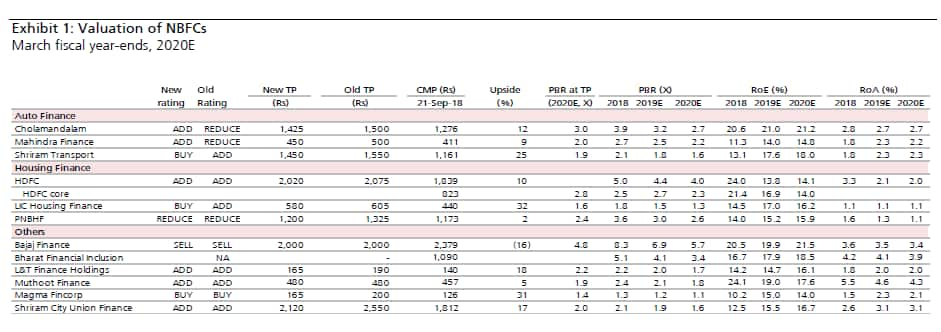

Kotak Institutional Equities lists top 7 stocks which are still a great buy at current levels and even on declines:

HDFC: Retain ADD| LTP: Rs 1835| Target: Rs 2,020| Return 10%

HDFC is a large borrower in the bond market with 54 percent borrowings from NCDs and CP, however, overall investor comfort on HDFC will ensure liquidity for the company.

Besides, the company has a dynamic deposit mobilization program which can be scaled up if the debt market fund dries up (as seen in FY2008).

The company had a surplus 15 percent in the one-year bucket in March 2018. Nevertheless, we cut our estimates by 2 percent to reflect lower NIM. HDFC’s core business will trade at 2.8X FY2020E book. Our investment thesis on subsidiaries remains unchanged.

LIC Housing Finance: Upgrade to buy| LTP: Rs 438|Target: Rs580| Return 32%

LIC Housing Finance has the highest dependence on the bond market at 87% of total borrowings. However, comfort in its strong parentage ensures steady funding availability for the company. In fact, PSU banks prefer lending to LIC over other private NBFCs during the period of crises.

However, marginal spreads are currently thin and the company will need to raise home loan rates over the next few weeks. We build NIM compression into our estimates (EPS down 3-5%) but don’t rule out further near-term downside risk.

The company saw a 54% deficit in the first bucket in March 2018, lower than 100%+ deficit in the first bucket during the previous few years. According to the management, high prepayments in home loans help in managing liquidity and hence it keeps the deficit in the first bucket.

However, current valuations (1.3X FY2020E book) factor in the aforesaid risk if one looks at the medium-term. A large retail book (79% home loans and 16% LAP) provides comfort.

L&T Finance Holdings: Retain ADD| LTP: Rs 140| Target: Rs165| Return 17%

Tailwinds in rural business, cleaner book post-write-offs in the wholesale book will drive 18-19% RoE over the medium-term. At the target of Rs160, the lending business will trade at 2.2X book FY2020E.

Reduction in TP from Rs190 reflects a lower multiple for the lending business on the back of an increase in the cost of equity. Its exposure to NCDs is high at 45 percent; however, its parentage provides comfort to debt investors.

Magma Fincorp: Buy| LTP: Rs 126| Target: Rs 165| Target: Rs 31%

We continue to believe that recent operational changes under the new management will boost the profitability of Magma over the next two years, even as loan growth may remain muted in the near-term.

We expect the company to deliver medium-term RoE of about 15 percent. Our revision in the target to Rs165 from Rs200 reflects a higher cost of equity. Being a smaller NBFC, the company is a bit more vulnerable to vagaries in debt market but a lower bond market exposure (23% of total) provides comfort.

Mahindra Finance: Upgrade to ADD| LTP: Rs 411| Target: Rs 450| Return 10%

The rural cycle remains strong. Strong rural cash flows will boost the near-term growth of Mahindra Finance even as NIM may remain under pressure due to competition from banks and NBFCs like L&T Finance.

Its exposure to NCD is 44 percent and CP is high at 16 percent. From a liquidity point of view, the Mahindra Group provides comfort; the company is running positive ALM in the first two buckets.

We expect the company to deliver 16-17 percent medium-term RoE and 21 percent EPS CAGR during FY2020E-21E. At our RGM-based TP, the stock will trade at 2.1X FY2020E book; we add Rs65 as the value of the subsidiaries. Our earnings are keenly sensitive to government spending in rural areas.

Shriram City Union Finance (SCUF): Retain ADD| LTP: Rs 1820| Target: Rs 2120| Return 16%

We believe that SCUF has a strong franchise of lending at the lower-end of the market. Improving growth in business loans will drive 21 percent loan book CAGR and 27 percent EPS CAGR during FY2019-21E. We expect near-term RoA to remain strong at 3 percent and RoE moderate at 16-17 percent.

Shriram Transport Finance: Upgrade to Buy from ADD| LTP: Rs 1161| Target: Rs 1550| Return 33%

Shriram Transport Finance trades at 1.6X book FY2020E. We expect the company to deliver 17-18 percent medium-term RoE. We expect CV sales to moderate hereon, though we note that loan growth will remain strong at 17-18 percent during FY2019-21E on the back of a strong business in used CVs.

Increase in axel load norms will partially offset the pressure of higher fuel prices and augur well for asset quality performance even as NIMs in CV business remains under pressure. As on March 2018, the company has a negative ALM gap in 1HFY19, which is fully covered in 2HFY19.

Increasing competition from banks and the organized sector over the medium term poses a key risk. Besides, its large size and limited segments of operations is a concern. However, these risks are reflected in current valuations, in our view.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!