After outperforming benchmark indices in the last 5 years, midcaps struggled in the last two months weighed down by muted global cues and fierce selling by foreign institutional investors (FIIs).

But, the party may not be over for the bulls who love the midcap space, suggest experts. Even though the investor would prefer largecaps more in 2018 thanks to attractive valuations, but select midcaps could do well.

“Since the last one year both mid-cap and small-cap stocks have outpaced the benchmark Sensex beating concerns over valuations and fundamentals,” Amarjeet Maurya- Sr. Equity Research Analyst - Mid Caps at Angel Broking told Moneycontrol.

“Going ahead, we believe the quality of midcap and small cap stocks would outperform the index mainly due to strong earnings momentum, better ROE, and relative releasable valuation,” he said.

Valuations of Indian equities have moderated from the recent highs. The Sensex trades at a 12-month forward P/E of 17.7x, at a 2 percent premium to its long-period average of 17.3x. Sensex P/B of 2.6x is at its historical average.

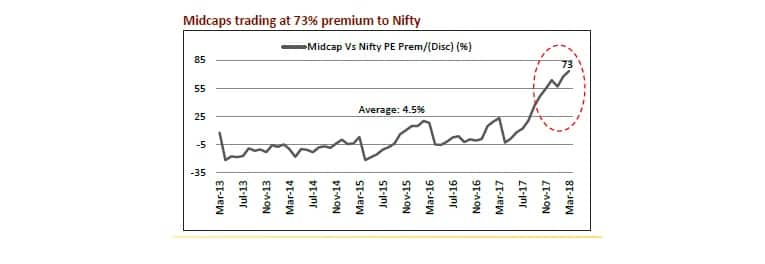

Specifically, from the broader market perspective, midcaps have struggled over the last few months, resulting in its underperformance versus large-caps. “Over the last 12 months, midcaps have delivered 9 percent returns, as against 10 percent by the Nifty. However, over the last five years, midcaps have outperformed the Nifty by 75 percent,” Motilal Oswal said in a report.

In March 2018, Nifty Midcap100 was down 4.6 percent, as against Nifty’s fall of 3.6 percent. Midcaps now trade at a 73 percent premium to the Nifty in terms of P/E, added the report.

“In most of the bull markets, midcaps have outperformed large gaps. This is more the keys in emerging economies. Small caps too have done well but lag midcaps overall,” Harendra Kumar, Managing Director-Institutional Equities at Elara Equities told Moneycontrol.

“So it’s a prudent strategy to have a slightly higher share in midcaps if one wants to maximize their returns,” he said.

Here is a list of top 10 stocks which can return up to 35 percent in the next 12 months. For simplicity, we have taken stocks which have a market cap of less than Rs 10,000 crore.

Safari Industries Ltd: BUY| Target Rs650| Return 15%

Angel Broking maintains a buy rating on Safari Industries with a target price of Rs650. Safari Industries Ltd (Safari) is the third largest branded player in the Indian luggage industry. The restructuring has helped it in posting a CAGR of 42 percent in revenue and 46 percent in PAT over 2012-17.

Angel Broking expects its revenue to grow by 23 percent CAGR over FY2017-20E on the back of growth in its recently introduced new products.

Safari currently trades at a P/E of 42x FY2019E and 30.8x its FY2020E EPS which looks attractive looking at its strong brand play story emerging in the luggage industry.

HSIL: BUY| Target Rs510| Return 29.7%

Angel Broking maintains a buy rating on HSIL with a target price of Rs510. HSIL Limited (HSIL) is an Indian company, which offers sanitaryware products, faucets, and glass bottles.

The company has entered into new segments like consumer, pipes and caps and closures which will drive the further growth. Angel Broking expects HSIL to report net revenue CAGR of 12 percent to Rs2,905 crore over FY2017-20E.

On bottom-line front, the brokerage firm expects CAGR of 15 percent to Rs154 crore over FY2017-20E owing to improvement in operating margins.

Blue Star Ltd: BUY| Target Rs867| Return 11.5%

Angel Broking maintains a buy rating on Blue Star (BSL) with a target price of Rs867. BSL is one of the largest air-conditioning companies in India. With a mere 3 percent penetration level of ACs compared to 25 percent in China, the overall outlook for the room air-conditioner (RAC) market in India is favourable.

Aided by increasing contribution from the Unitary Products, Angel Broking expects the overall top-line to post revenue CAGR of 19 percent over FY2017-19E and margins to improve from 5.8 percent in FY2017 to 6.6 percent in FY2019E.

Siyaram Silk Mills Ltd: BUY| Target Rs851| Return 36%

Angel Broking maintains a buy rating on Siyaram Silk Mills (SSML) with a target of Rs851. SSML has strong brands which cater to premium as well as popular mass segments of the market.

Further, SSML entered the ladies' salwar kameez and ethnic wear segment. Going forward, we believe that the company would be able to leverage its brand equity and continue to post strong performance

Going forward, the domestic brokerage firm expect SSML to report a net sales CAGR of 12 percent to 1,981 crore and adj.net profit CAGR of 16 percent to Rs123 crore over FY2017-19E on back of market leadership in blended fabrics, strong brand building, wide distribution channel, strong presence in tier II and tier III cities and emphasis on latest designs and affordable pricing points.

Music Broadcast Ltd: BUY| Target Rs475| Return 22%

Angel Broking maintains a buy rating on Music Broadcast with a target price of Rs475. Radio Industry is protected by licenses for 15 years, thereby restricting the entry of new players. This would support the existing companies to strengthen their position and maintain a healthy growth rate.

MBL outperformed its closest peer with 18.4 percent CAGR in revenue over FY2013-17 (ENIL reported 13.2 percent CAGR in revenue). Capex for 39 licenses have been done for the next 15 years, hence no heavy incremental Capex requirement would emerge.

Moreover, the maintenance Capex would be as low as Rs5-10 crore. This would leave sufficient cash flow to distribute as a dividend.

Aster DM Healthcare Ltd: BUY| Target Rs213| Return 26%

Goldman Sachs initiates a buy on Aster DM Healthcare Ltd with a target price of Rs213. Aster is likely to now enter a phase where it would have to sweat assets, improve cash flows and add leverage.

Solid demand across Gulf Cooperation Council (GCC) and India is likely to drive utilisations, said the Goldman note. It expects utilisations to improve to 65 percent over the next 3 years.

Goldman Sachs expects 17 percent revenue CAGR over the next 3 years. It expects 500 bps margin expansion over FY17-20. The valuations look attractive, and the stock is trading at a discount to Indian/GCC peers.

Westlife Development Ltd: BUY| Target Rs450| Return 34%

CLSA maintains a buy rating on Westlife Development with a target price of Rs450. Lifestyle-related diseases are on the rise, and the company’s ‘The Good Food Story’ initiative is a positive.

The management guides its journey to offer healthier options has just started. Initiatives can be taken to boost business going forward.

SpiceJet Ltd: BUY| Target Rs166| Return 25%

Edelweiss maintains a buy rating on SpiceJet with a target price of Rs166. Enthused about the growth prospects of the company, Edelweiss is of the view that robust domestic passenger growth to outstrip capacity addition.

Profit is likely to grow with improving yields, and the addition of new planes to prune costs. Edelweiss expects Volume/EPS to grow at a CAGR of 22 percent/37 percent over FY17-20.

Indiabulls Real Estate Ltd: BUY| Target Rs311| Return 72%

CLSA maintains a buy rating on Indiabulls Real Estate with a target price of Rs311. The divestment deal with Blackstone is likely to establish a valuation for Indiabulls Real Estate.

The deal is likely to mark a major strategic step in deleveraging the development business. The deal valuation of Rs 9,500 crore valuation should be accretive to Indiabulls.

Phoenix Mills Ltd: Overweight| Target Rs710| Return 22%

JPMorgan maintains an overweight rating on Phoenix Mills but raised its target price to Rs710 from Rs 605 earlier. The global investment bank expects the company to double rental growth combined with residential business to boost earnings.

The global investment bank expects 12 percent/35 percent EBITDA/Net Profit growth over the next two years. Phoenix should generate positive free cash flow from FY19.

Funds can be used for additional growth and increase dividend payouts. Phoenix remains best proxy plays on retail growth in India, said the report.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!