Brushing off concerns of geopolitical tensions, fall in GDP growth, rising oil prices as well as muted earnings from India Inc. for the quarter ended June, midcap and smallcap stocks surged to fresh record highs.

The S&P BSE Sensex and Nifty50 are still trading 2-3 percent short of their respective record highs but the S&P BSE Midcap index rose to a fresh all-time high of 15,906.14, and the S&P BSE Smallcap index hit 16,446 for the first time ever.

Tracking the momentum, as much as 97 stocks hit a fresh 52-week high on the BSE which include names like Andhra Cement, Andhra Petrochemicals, Bajaj Finance, Bharti Agri, Bombay Dyeing, Cian Agro, Colgate Palmolive India, Future Enterprises, Goa Carbon etc. among others.

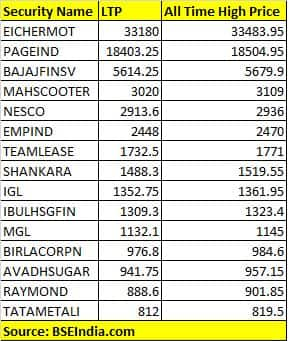

Out of 97 stocks as much as 35 stocks rose to fresh all-time high which includes names like Bajaj Finserv, Eicher Motors, Future Consumer, Indiabulls Housing Finance, Teamlease, Tata Metaliks, Manappuram Finance etc. among others.

The Nifty50 was trading above its crucial psychological; resistance level of 9950 and over 70 stocks hit a fresh 52-week high on NSE which include names like Page Industries, Nestle India, Nesco, IGL, Birla Corp, Jindal Worldwide, Raymond, Pidilite Industries, Phillip Carbon, Blue Star, Tata Steel, JSW Steel, Hindalco, TBZ etc. among others.

Midcaps stocks have caught fancy of Indian retail investors, fund managers, as well as foreign investors back in the year 2014 soon after Narendra Modi, took charge at the center as Indian Prime Minister.

The outperformance has not stopped since then. The premium to the Nifty has now widened to 22 percent. Over the last 12 months, midcaps have delivered 19 percent return, as against 13 percent by the Nifty, and about 10 percent by the S&P BSE Sensex.

“Over the last five years, midcaps have outperformed the Nifty by a whopping 70 percent. Midcaps now trade at a 22 percent premium to the Nifty on a P/E basis,” Motilal Oswal Securities said in a report.

Cheap valuations were one of the prime reason why investors flocked to midcaps as well as a rise in liquidity both domestic as well as global. Pro-growth reforms introduced by the Modi-led government also led to rise in sentiment with respect to small and midcap companies.

Investors are advised to book some profits especially in those stocks which might be looking stretched in terms of valuations.

"Returns on small and midcap stock returns depend on earnings growth which can be strong despite a weak economic environment or vice-versa," Pramod Gubbi, Head of Equities, Ambit Capital told Moneycontrol.

"But, in general, it is worth taking profits of small and midcaps, given punchy valuations, even after the recent underperformance," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.