Metal stocks have been among the top performers of late thanks to improvement in demand, the shift of business from China to India and low base due to the March 2020 sell-off.

Base metals outperformed and reached a multi-year high in FY21 on a weak dollar and strong manufacturing and economic data from China and the US after vaccine news surfaced, Sunilkumar Katke, Head, Commodity & Currency, Axis Securities, told Moneycontrol.

“The demand is outpacing supply this year as overall output is also low compared to previous years due to mining lockdowns. The US spending on infrastructure and electric vehicle (EV) revolution to support overall base metal prices in FY22, especially copper and nickel prices,” he said.

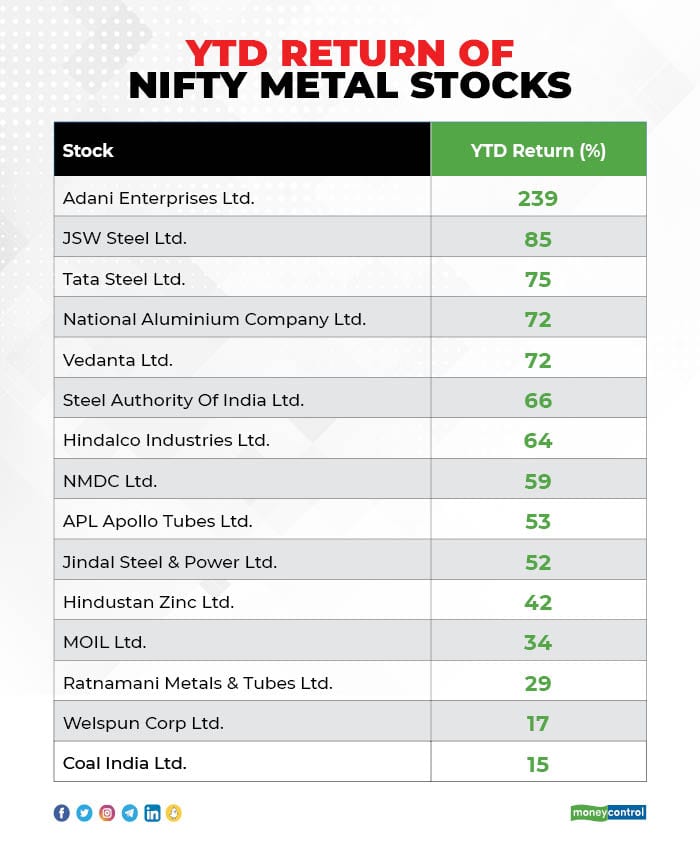

The Nifty Metal index is up 63 percent year-to-date (YTD) with stocks like Adani Enterprises surging as much as 239 percent.

Shares of JSW Steel, Tata Steel, National Aluminium, Vedanta, SAIL, Hindalco and NMDC have jumped between 59-85 percent.

However, some steel stocks have seen mild correction in the recent past but brokerages are positive on the sector and believe the correction has offered a good opportunity to enter the sector.

"We witness correction in steel stocks from mid-April when China tried to restrict the sharp move in Chinese steel prices. However, that could not change the world's ex-China demand-supply dynamics and prices remain firm globally (world-excluding-China). We believe stock correction provides a very good buying opportunity," said brokerage firm Centrum Broking in a report.

"We believe that valuing companies at P/B is a conservative approach especially if one is comfortable even on FY23 earnings. We continue to value the stocks on FY23E EV/EBITDA basis and sees 25-45 percent upside in stocks like Tata Steel, SAIL and JSPL," Centrum said.

Centrum values stocks on an FY23 EV/EBITDA basis, taking normalised EV/EBITDA multiple (5.5-7 times). Centrum sees a rare combination of growth capex along with deleveraging which ideally should command premium multiple to the historical average.

"We recommend buying steel stocks. We revised the earnings of steel companies earlier post their Q4FY21 results. Tata Steel, SAIL and JSPL are Centrum's top picks in order of preference.

Analysts believe the metal sector, along with IT, pharma and banks will drive earnings growth in the coming quarters.

"Banks, metals, IT, pharma, housing real estate, building materials and autos should drive earnings growth in the second half of FY22 (H2FY22)," said Manish Sonthalia, Head Equities - PMS, Motilal Oswal Asset Management Company.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.