Most metal and mining stocks have seen sharp gains in the first half of the calendar year 2021 so far (H1 CY21), supported by augmented demand globally amid constrained supply in the wake of the COVID-19 pandemic.

When the COVID-19 pandemic hit the world and economies went into the lockdown phase, economic activities were severely impacted globally but after the lockdowns were lifted and central banks of the world

announced stimulus packages, the demand for steel started to recover.

Besides, China's decarbonisation mission has also created a demand-supply mismatch which seems to have augured well for the Indian steelmakers. With fewer steel exports, Indian steel companies have greater freedom to raise prices.

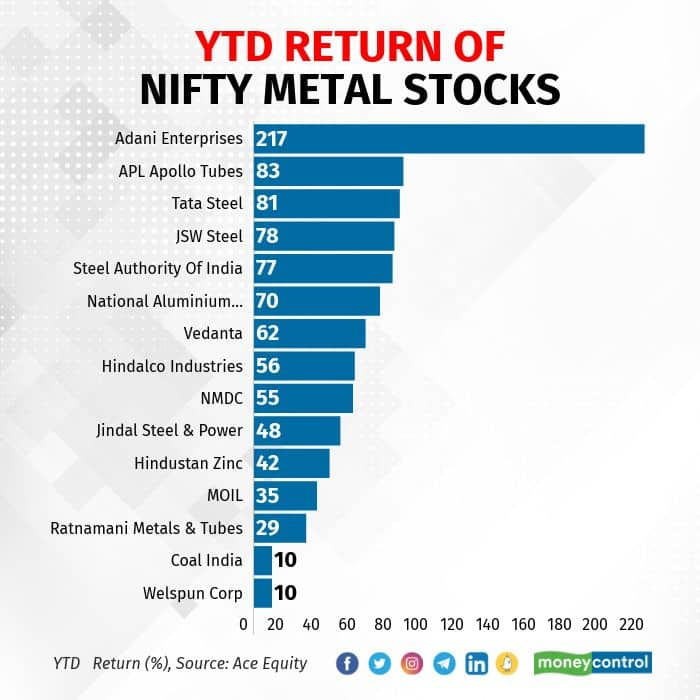

As of June 25, the Nifty Metal index has jumped 61 percent in this calendar year so far, with stocks rising between 10 percent to 217 percent.

Shares of Adani Enterprises have surged 217 percent while those of APL Apollo Tubes, Tata Steel and JSW Steel have jumped about 80 percent each.

The Nifty Metal index has outperformed other sectoral indices on NSE this year so far. The benchmark Nifty50 is up 13 percent while the second-best performer among the sectoral indices, the Nifty PSU Bank index, is up 43 percent.

Strong demand scenario after economic activities picking pace amid constrained supply is the biggest reason that boosted metal stocks, said experts.

"The metal prices have rallied since the last quarter of the previous calendar year on account of strong demand from China because of its stimulus package and recovery in global demand post the pandemic," Milan Desai, Lead Equity Analyst at Angel Broking, pointed out.

"Tight demand-supply scenario has resulted in a sharp increase in prices across steel, copper, and aluminium, aiding profitability of Indian metal companies. Indian metal companies are using this opportunity to deleverage their balance sheet which coupled with a strong earnings outlook has led to re-rating seen in these stocks," said Desai.

Gaurav Garg, Head of Research at CapitalVia Global underscored the steel industry is benefiting from a favourable demand-supply balance in western steel markets. Steel rates have remained high as a result of all of this.

An increase in the price of metals leads to better realizations for the metal companies, thus enhancing their profits.

The road aheadAnalysts are positive about the prospects of the metal sector as metal prices are expected to remain elevated due to increased economic activities and strong demand.

"Outlook for the sector is positive as prices are expected to remain high. Few concerns like China increasing supply, releasing their metal reserves and Fed policy can hinder the stability in prices at high levels which in turn can hurt the metal companies' profitability bit," said Nitin Shahi, Executive Director of FINDOC.

"Stay invested in the sector as demand is of no concern over next few years but be flexible and adjust your positions in case of any fundamental change in the sector as companies profitability relies only on metal prices. Other than that any correction in the broader market may impact sentiments," said Shahi.

Desai also believes the demand scenario is strong and Indian metal producers are in a sweet spot.

"We expect demand environment to remain strong in India which will pick up post-monsoon. Overall, supply restrictions and global inflationary pressures will keep metal prices elevated thus improving the profitability of Indian metal companies," said Desai.

Desai is of the view that the current quarter has seen a further increase in realisations which will more than offset the increase in the cost of production for aluminium.

As for steel, prices in China have stabilised recently due to a crackdown on speculation but Indian prices are still at discount to international prices.

Garg pointed out that depending on how long the cycle continues, the sector's high net debt from the previous decade may be reduced to very low levels in the coming year or two.

"The cycle may correct, but given the current magnitude, even a 12-quarter cycle period would render the Indian steel sector leverage. Even if the cycle weakens, the advantages of deleveraging would boost sentiment," he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.