As we approach the Union Budget of 2025, a majority of market experts do not foresee another hike in capital gains tax. Instead, most believe that the finance minister will prioritise measures aimed at reviving earnings growth.

India Inc is currently navigating its sharpest slowdown in earnings growth since the post-COVID period, grappling with waning pent-up demand, faltering urban consumption, geopolitical uncertainty, and an unfavourable base effect.

Analysts at Bank of America Securities noted that tightened fiscal and monetary policies in the last few months has added to the normalising private sector growth, and some course correction, both in terms of capex spending and consumption support can help, and be considered in the upcoming budget.

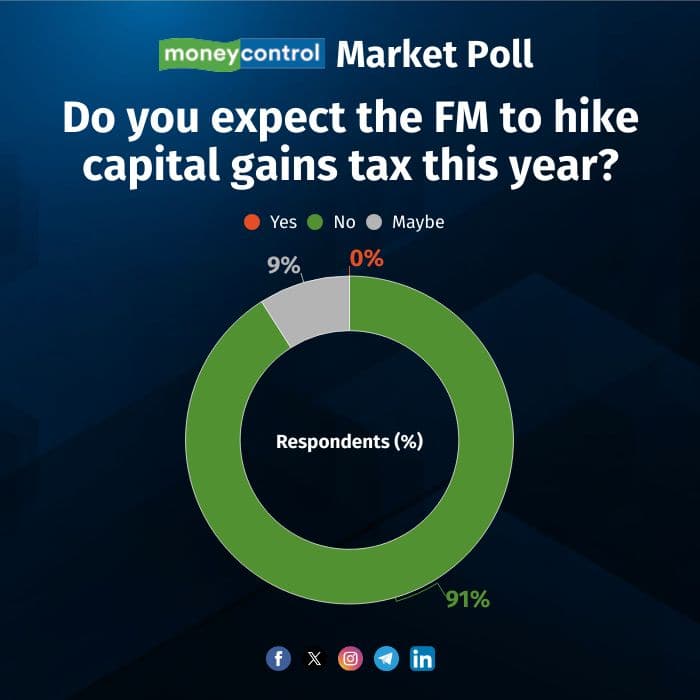

According to Moneycontrol's latest Market Poll, a staggering 91 percent of respondents believe that the finance minister will not raise capital gains tax this year. Interestingly, remembering last year’s surprise hike, the remaining 9 percent went with a 'maybe', with none offering a definitive 'yes' on the prospect of a tax hike.

The latest Moneycontrol Market Poll saw participation of nearly 45 respondents across categories including broking firms, mutual funds, AIFs, PMS and independent experts.

While consensus clearly indicates a clear expectation of no capital gains tax hikes, it also warrants some caution as an unexpected tax hike in tax could spur a sharp negative reaction, a possibility that cannot be entirely ruled out. A look back at last year’s Budget, which caught markets off guard with a tax hike, highlights the unpredictability of such moves.

In Budget 2024, the finance minister raised the short-term capital gains tax on equities held for less than a year from 15 percent to 20 percent, while the long-term capital gains tax on holdings sold after one year increased from 10 percent to 12.5 percent.

Also Read | MC Market Poll: Budget 2025 expected to prioritise fiscal consolidation, capex, say experts

"Any move aimed at hiking the capital gain tax will dampen the sentiments in the near-term and may lead to a reduction in fund flows, be it institutional investors or retail investors who have been investing big time in mutual funds," said Rahul Jain, President & Head, Nuvama Wealth.

Interestingly enough, a majority of investors surveyed by Moneycontrol believe it is India Inc's sluggish earnings growth that is the biggest risk for the domestic market, eating away investor enthusiasm over equities.

Anticipating the government to take stock of the growth slowdown, a majority of respondents, at 44 percent expect the Budget to most likely announce measures to help revive corporate earnings. However, whether those measures will actually translate into 15 percent earnings growth for companies remain dubious, experts believe.

Then there's another group of respondents--21 percent--that believe the Budget could not fix the structural earnings slowdown while 19 percent felt it could. Lastly, the remaining 16 percent held a totally contrarian stance, stating that earnings revival would hinge on external factors.

Also Read | MC Market Poll: Majority of experts not expecting hike in capital gains tax in Budget 2025

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.