After taking a breather, buying in equity markets resumed in the week that ended on June 19 with the Nifty50 and BSE Sensex gaining nearly 3 percent despite India-China border tensions and rapid rise in COVID-19 cases.

The rally, which indicated that the market could be focusing on economic growth after the novel coronavirus-triggered nationwide lockdown, was majorly led by banking and financials, and Reliance Industries (RIL) which lifted sentiment after becoming net debt-free through rights issue and stake sale in Jio Platforms.

Watch: Business Insight | How Reliance Industries became net debt-free

Given last week's rally, experts predict some consolidation in absence of major events this week. They are also expecting volatility due to expiry of June derivative contracts. Traders will monitor the escalating tensions between India and China along the Line of Actual Control (LAC).

"Any increase in tensions and indication of drying up of liquidity can have an immediate impact on the markets. Considering the volatility and the unknowns, this seems to be a sell-on-rise market and investors would do well to keep booking their profits," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Here are 10 key factors that will keep traders busy this week:

India-China border tensions

Investors and traders will continue to monitor the situation along the India-China border in Ladakh's Galwan Valley, though both sides have agreed that the situation would be handled in a responsible manner.

India expects the Chinese side to sincerely follow the understanding reached between the foreign ministers, to ensure peace at the border — essential for stability in bilateral relations.

FII flow

Overall, foreign investors do not expect the geopolitical situation between India and China to worsen significantly. However, they will continue to monitor it as it remains a matter of concern.

FIIs turned net sellers for last week, partially due to this issue as they net sold Rs 4,925 crore worth of shares in first three days of the week. However, they made a buying of Rs 1,603 crore in last two trading sessions later.

"I don't think as yet it has any implications. It has been a long standing issue. Thankfully, geographically distant from centre. If it can escalate, I think it is a worry for the people. But still I think hoping for the things will passed at the moment, it is a slight concern but not affecting any our decision making our investments in either India or China," Hugh Young, Managing Director at Aberdeen Asset Management Asia told CNBC-TV18 during the week.

COVID-19 pandemic remains a worry

Confirmed cases of COVID-19 have seen a significant rise in June as the Centre and state governments eased lockdown measures.

India reported over 10,000 new cases of COVID-19 on each day last week. This remains a matter of concern for the market to some extent. Experts feel that this may be limiting the market upside. India has reported nearly four lakh COVID-19 cases, including almost 13,000 deaths, so far. In terms of the total number of reported cases, India is only behind the United States, Brazil and Russia.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

A positive factor, however, is that India's recovery rate now stands at 54 percent and is increasing further.

Globally too, there are concerns of a second wave. The global COVID-19 tally stands at 87.6 lakh, including 4.6 lakh deaths.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Hope of economic recovery

The hope of economic recovery has also been one of the major factors supporting the market. The Centre and state governments, having eased lockdown measures in June, have indicated that they want to reopen the economy further in most parts of the country. Thus, the market will be waiting for details of the next phase of 'unlock', which will give direction, experts feel.

"Across the world, markets are trying to decode how the easing of lockdown restrictions will help revive economic demand. However, the current response seems to be a mixed bag across the world and foresight remains blurry as to how quickly the revival in economies pan out. It insinuates a long drawn journey which ultimately will be reflected in the stock prices. Prices are expected to just drag around for some time till clarity in the real economy emerges," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

Earnings

More than 600 companies will release their quarterly earnings scorecard this week, which include majority of midcap and smallcaps, besides a few largecaps. Hence, there could be more stock-specific action.

ITC, Asian Paints, GAIL India, Coal India, IOC, Bank of Baroda, Bank of India, Berger Paints, Dhanlaxmi Bank, Info Edge, Skipper, Aster DM Healthcare, DB Corp, Indian Bank, Union Bank of India, Canara Bank, Future Consumer, General Insurance Corporation, India Cements, Indoco Remedies, PFC, Prestige Estates Projects, Sobha, United Breweries, Apollo Hospitals Enterprise, Ashok Leyland, Container Corporation, Hindustan Aeronautics, IDFC, Emami, Glenmark Pharma, HUDCO, IRCTC, Kajaria Ceramics, NALCO, Oil India, Ruchi Soya Industries, Sun TV Network, Avanti Feeds, BEML and NHPC, among others, are some of the stocks to watch out for.

Oil prices

Oil prices gained for last seven out of eight consecutive weeks and have been around $38-42 levels for couple of weeks given the optimism over re-opening of economies globally and supply cuts, but experts feel the upside is unlikely to continue amid fear that continuous spread of coronavirus could dampen the global recovery hope.

Oil hovering around these levels remains a favourable thing for India as the country imports 85 percent of requirement, and hence that has also been supporting the market. International benchmark Brent crude futures ended at $42.19 a barrel on June 19.

Technical view

The Nifty50 gained 2.7 percent for the week and 1.5 percent on June 19, forming bullish candle on weekly as well as daily charts which indicated that bulls still have upper hand at Dalal Street.

The index has not only closed above crucial resistance of 10,200 but also has managed to trade above 100 DMA. Hence experts feel the index could move above 10,300 in the coming week but whether it could sustain above or not would be key to watch out for given the rally last week. On the downside, key support would remain at 10,000.

"The positive sequential movement like higher tops and bottoms is intact and currently, Nifty is on the way towards new higher top above 10,330 levels. A sustainable move above this area could pull towards 10,550-10,600 levels by next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

F&O expiry

The June futures & options contracts will expire on coming June 25 and traders will roll over their positions to next month. Hence, there could be volatility around this event.

The options data indicates that the maximum open interest on the Put side is still placed at 9,500 strike. Fresh Put writing was seen at 10,000 strike which has the second-highest open interest and also likely to act as a major support this week.

The maximum open interest on the Call side is placed at 10,500 strike followed by 11,000.

"So the overall option data indicates that the bulls are having the upper hand and Nifty may trade in a broader range of 10,000-10,500," Nilesh Ramesh Jain, Derivative and Technical Analyst at Anand Rathi said.

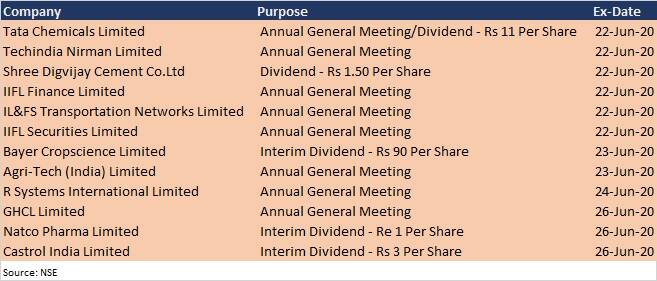

Corporate action and macro data

Here are key corporate actions taking place this week:

On the macro front, foreign exchange reserves for the week that ended on June 19 and current account data for Q4FY20 will be released on June 26.

Global cues

Here are key global data points to watch out for this week:

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.