The market made a strong comeback in the week that ended on May 29, despite the rapid rise in the number of confirmed COVID-19 cases.

The Nifty50 and BSE Sensex rose 6 percent backed by positive global cues amid stimulus in China and in European nations, and rally in banking and financials. The benchmark indices had fallen in previous three consecutive weeks.

While hopes for more sector-specific reforms and measures also boosted sentiment, rising concerns over United States-China relations capped gains.

The rally seen last week may not be sharp in the coming days given the extension of lockdown in containment zones till June 30 and rise in new novel coronavirus infections, though some countries in the West have started re-opening economies. Thus, volatility is expected to continue till the market gets confirmations about further easing of lockdown restrictions and a vaccine, experts feel.

On June 1 (Monday), the market will first react to Q4FY20 Gross Domestic Product (GDP) data, downward revision of data of the last three quarters, and the lockdown extension.

"On a fundamental level, there are no reasons for the rally to sustain, and investors are advised to remain cautious. Economic data and its commentary, and the new lockdown norms, based on the spread of infections, can have an impact on the markets," Vinod Nair - Head of Research at Geojit Financial Services told Moneycontrol.

Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote also feels this bull bear tussle phase is likely to continue for a few more months before investors can see any significant lasting up move in the indices. He has advised investors to be patient and to wait till markets adjust to ground realities.

FII inflow was strong in the week gone by, with net buying at over Rs 8,000 crore including the Bharti Airtel stake sale deal.

Here are 10 key factors that will keep traders busy this week:

Rising COVID-19 cases

Despite measures, the number of COVID-19 cases being reported every day has been rising. Now, 6,000-7,000 cases are being reported on a daily basis as compared to 3,000-5,000 per day in the previous week.

India's tally has crossed 1.7 lakh-mark which includes nearly 5,000 deaths. However, the recovery rate remains strong at around 45 percent.

Globally, there have been over 60.5 lakh confirmed cases of COVID-19. At least 3.69 lakh people have died so far.

Hence, the market may not rejoice till the COVID-19 infections in India cross the peak and there is a full re-opening of the economy, experts feel.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Lockdown

The nationwide lockdown, now termed 'Unlock 1', has been extended till June 30 in containment zones. The Ministry of Home Affairs (MHA) has said all activities outside containment zones will be reopened in a phased manner starting from June 8.

Religious places, hotels and restaurants, shopping malls will be reopened in phase one. However, this will be done in consultation with states and Union Territories (UTs).

Also read | Unlock 1.0: Can I step out? Which shops are open? Important questions answered

Monsoon

Monsoon is the next key factor to focus on in the coming weeks as it is critical for agricultural production. Timely arrival of monsoon will ensure kharif crops get sown properly.

The monsoon is expected to arrival in Kerala on June 1. However, private agency Skymet Weather has already declared arrival on monsoon in Kerala.

If monsoon is normal, agricultural production would also be strong which would ultimately help revive rural economy.

Earnings

We will enter the last phase of March quarter earnings season this week, which has been extended by a month by the Securities and Exchange Board of India (SEBI) due to the nationwide lockdown.

Over 75 companies will declare their quarterly results this week including the largecaps such as the State Bank of India (SBI), Larsen & Toubro, Britannia Industries, Aurobindo Pharma and BPCL.

Among others, InterGlobe Aviation, V-Guard Industries, Dhampur Sugar Mills, Granules India, Marksans Pharma, Motherson Sumi Systems, Spandana Sphoorty Financial, SPARC, PI Industries, SRF, Alkem Laboratories, Greaves Cotton, Gujarat Gas, HFCL, RPG Life Sciences, Karnataka Bank, Relaxo Footwears, Usha Martin, etc. will also announce earnings.

Auto sales

After a washout in April, given the re-opening of shops, freeing of agriculture activities from lockdown in orange and green zones and hope of normal monsoon and a good rabi harvest, there has been an increase in inquiries for passenger vehicles and two-wheelers in May, especially in rural areas.

But on the actual sales front, there could be significant decline in two-wheeler, passenger vehicle and commercial vehicle sales. While tractor segment saw good business, sales remained low on YoY basis.

Japanese brokerage firm Nomura expects 84 percent decline in two-wheeler sales YoY in May, 75 percent fall in passenger vehicle and 15 percent drop in tractor sales. But, "there is virtually no demand for new trucks, hence we expect only around 500/1000 units of MHCV sales for Ashok Leyland/Tata Motors."

US-China relations to sour further?

Given US President Donald Trump's aggressive stance against China ahead of the presidential election in November, tensions between the world's largest economies is unlikely to recede, experts feel.

After China's National Assembly session last week approved a decision to create laws for Hong Kong to curb sedition, secession, terrorism and foreign interference, Trump said the US would take action to revoke Hong Kong's preferential treatment as a separate customs and travel territory from the rest of China. "Washington would also impose sanctions on individuals seen as responsible for "smothering - absolutely smothering - Hong Kong's freedom," he added.

Hence, experts feel there will be an impact on the market if tensions rise further. However, Trump has not commented on Phase 1 trade deal signed between US and China in January.

Technical view

The Nifty50 gained nearly a percent on May 30 and rose 6 percent for the week, forming bullish candle on daily as well as weekly charts.

The index has broken its range and decisively surpassed 9,500 mark last week but sustainability of this uptrend is important going ahead, hence if the index crosses 9,600 levels and holds for few sessions then the rally may continue, otherwise bears may get upper hand, experts feel.

"The short term trend of Nifty continues to be positive. The next upside levels to be watched around 9,750-9,800 in coming sessions. Any downward correction towards 9,400 could be a buy on dips opportunity for the next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

F&O cues

The Nifty started off June series on a strong note, while the rollover was strong at Nifty (75.7 percent) as well as Bank Nifty (81 percent). Option data suggested that 9,200 could be immediate support followed by 9,000 while the resistance is around 9,600.

Maximum Put open interest was at 9,000 followed by 8,500 strike, while maximum Call open interest was at 10,000 followed by 9,500 strike. Marginal Call writing was seen in 9,600 followed by 10,000 strike while Put writing was seen at 9,000 followed 9,500 strike.

"Level of 9,500 has remained the highest Call base so far and is likely to shift to higher levels if no major negative emerges from global markets. The market is responding positively towards opening of certain economies," Amit Gupta of ICICI Direct said.

"On the lower side, 9,300 should extend support. The Put open interest has increased at 9,200-9,300 strikes," he added.

India VIX reached to 30 levels, which is supportive factor for bulls.

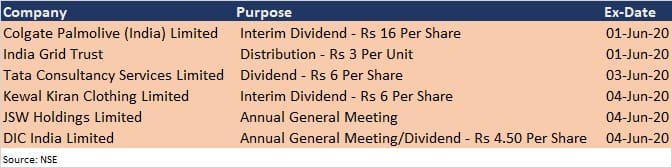

Corporate action and macro data

Here are key corporate actions taking place this week:

On the macro front, Markit Manufacturing PMI data for May will be released on June 1 and Services PMI for May on June 3, while foreign exchange reserves data for week ended May 29, and deposits and bank loan growth for fortnight ended May 22 will be announced on June 5.

Global cues

Here are key global data points to watch out for this week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.