Despite the record-breaking streak domestic equity indices have been seeing, and markets remaining optimistic on global cues and local growth, concerns remain over the markets’ valuations, experts said.

Are the markets overvalued?

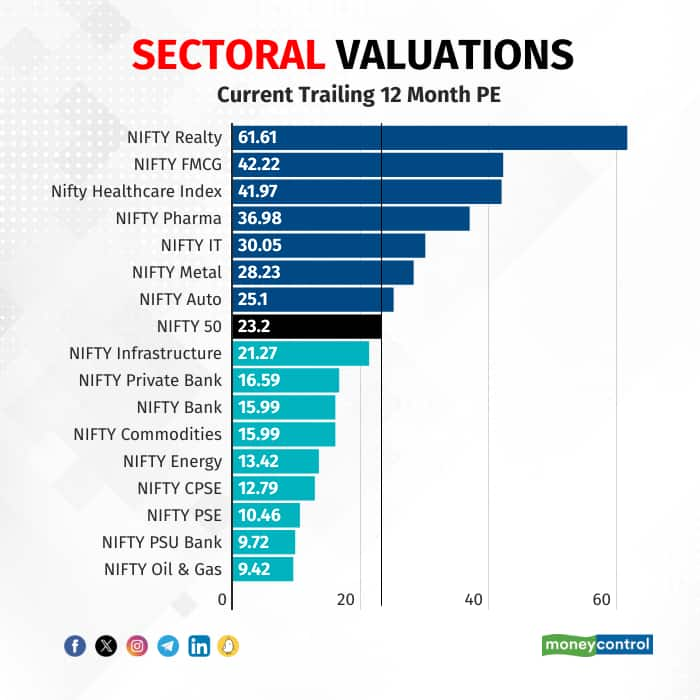

Based on trailing earnings, Nifty's current PE is 23.2, which is higher than the two-year average PE of 21.6. Based on forward earnings, the Nifty is trading at 21x FY25 and 18x FY26 PE. Overall, current earnings multiples are about 10-12 percent higher than the 10-year average earnings multiples.

While some investors feel that current valuations are unjustifiable going by the historic averages, others say it may well be deserved considering the country’s economic fundamentals at this point. Atul Parakh, CEO, Bigul, said that the ongoing bull run in India is unparalleled in terms of wealth generation, which is reflected in the high market capitalisation of companies.

More importantly, “this market cap growth is backed by strong macroeconomic conditions and corporate earnings, peaking of interest rates, moderate inflation print, and ongoing policy momentum. Keeping these factors in mind, the market does not appear to be over-valued,” Parakh added.

"India's strong GDP growth, manageable fiscal situation, and controlled inflation paint a positive backdrop. This, coupled with the potential for global interest rate cuts and stable oil prices, could be a sweet spot for Indian equities," stated Trivesh D, COO, Tradejini.

That’s the reason, despite choppy FII inflows, markets are seeing broad-based buying support from domestic institutional investors. “Despite expensive valuations, investors are willing to bet big on Indian stocks on expectations of a strong growth momentum going ahead, which would augur well for equity markets,” Prashanth Tapse, Senior VP (Research), Mehta Equities.

Also Read | Motilal Oswal upgrades MCX to buy on plans to drive volumes

While those benchmark valuations can still be debated, what investors concur on is that index valuations camouflage what lies beneath.

Most experts concur that valuation of mid and small-cap segments is stretched. The next round may be spearheaded by investors looking to find safety in the large-caps as valuations are lagging behind historical average in several cases. “The focus should now likely shift to large-caps which are offering better safety margins in earnings as well as valuation,” said Tapse.

Pockets of stretched valuation

This comes as a stark contrast to the earlier leg of the rally, which saw money being pooled into mid and small-caps even though there were serious concerns regarding unattainable valuations. Despite seeing a correction in March, the small-cap universe is trading at expensive numbers, experts said.

Vikas Gupta, CEO and Chief Investment Strategist, Omniscience Capital said, “If you look at the indices, small-caps look very expensive. Investors have to be very selective at this point, trying to find stocks trading below their intrinsic value. It’s getting harder and harder.”

After the significant run up since Covid, public sector stocks are appearing overvalued and might need to see some consolidation before investors re-enter the space. It is unlikely that the share price performance seen in the past will be replicated any time soon.

Additionally, despite the resilience in the automotive sector, experts said that gains should be realised opportunistically as valuations are getting stretched.

While the large-cap banking stocks are available at cheaper compared to historical averages, the key banking index Bank Nifty might be approaching levels of stretched valuations as a result of the run-up in public-sector banks. The index hit a fresh life-time high at 48,967 on April 10.

Shrey Jain, CEO of SAS Online, a discount brokerage, said, “Despite robust fundamentals, investors may find it prudent to periodically secure profits due to stretched valuations.”

Where to find attractive valuations?

Most experts are suggesting that the most upside at the safest valuations can be found in the previously ignored large-cap banking space. The private sector banking space is poised to do well. “Our top pick in this space is HDFC Bank on the back of reasonable valuations and early signs of synergies from the merger with HDFC," said Manish Chowdhury, Head of Research, StoxBox.

He added that he believes the pharmaceutical sector is poised to do well on the back of new product launches and easing pricing pressure in the US markets.

As manufacturing picks up, the metals sector stands out for its attractive valuations and growth prospects, underpinned by a global economic rebound,” said Anirudh Garg, Partner and Fund Manager at Invasset PMS. Currently, non-ferrous metals are seeing buying interest, but ferrous metals remain under pressure, according to an analyst at Axis Securites.

Garg added that the defence, shipping and manufacturing presented some viable investment opportunities, with current valuations suggesting limited downside risks. The railway sector remains in the wait-and-watch mode, since the sector and stocks may require further time to align with their intrinsic values.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.