Emerging market underperformance was on; owing to a surge in global liquidity, the emerging market basket started moving, India was left behind and post Feb, India also jumped in to the catch up trade, and FII flow of $7.1 billion in the current quarter helped pull our markets higher.

The flows will play a part in influencing returns as we are a deficit economy and traditionally have been investment starved which is why we have always had to import investment from FIIs and somewhere down the line these flows may slow down.

But on the other hand, the rest of the world is highly predisposed to sending money to India as there is confidence amongst the global community that India can grow faster than rest of humanity which growing at 3-4 perceny and as long as that stands true we will continue to attract further inflows to support our market.

Data suggests that global investors are only running a neutral position towards India and they are neither underweight nor overweight and we account for only 1% of the global equity index

Valuations in neutral range and can improve with earnings

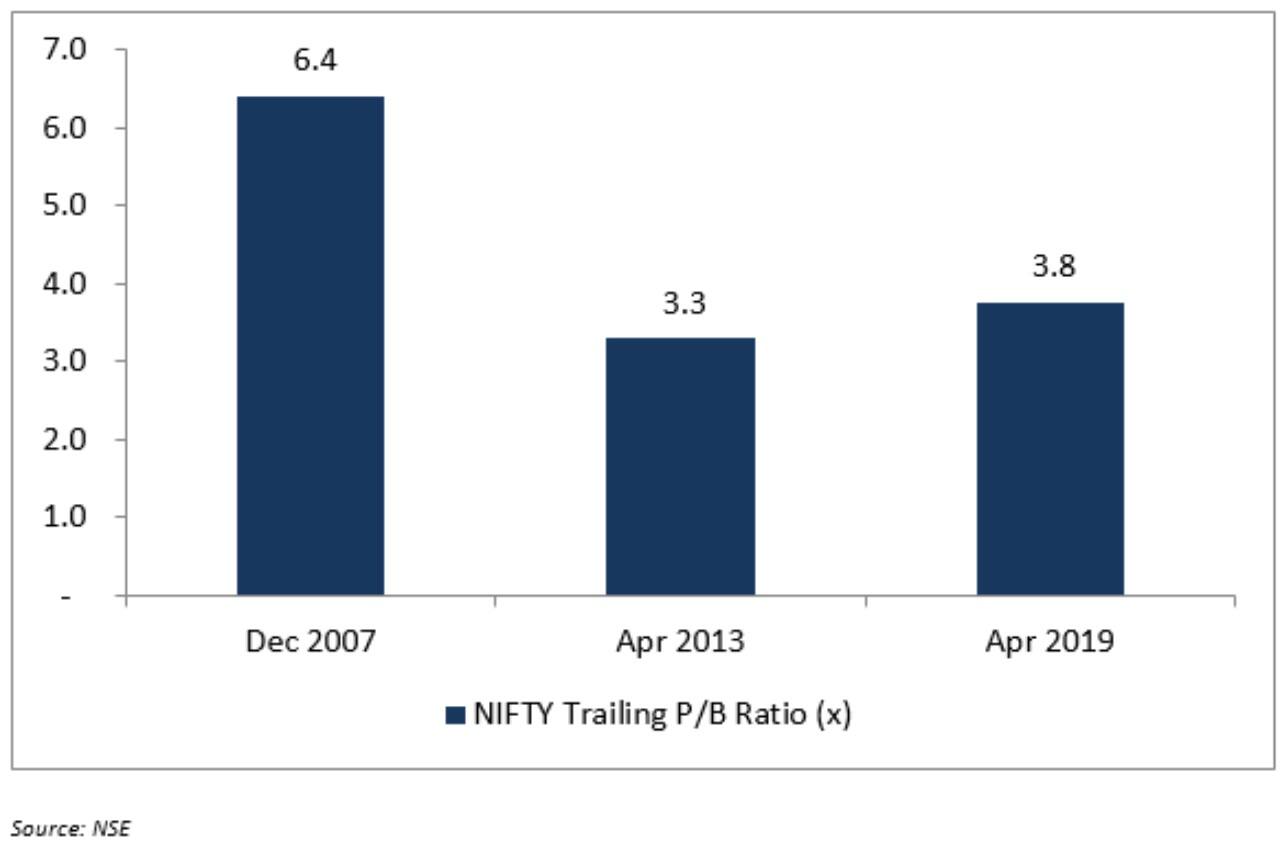

Valuation wise the NIFTY looks expensive at 29x but then if one looks at the price to book ratio, we are trading at 3.8x book which smack in the middle of its range of 2x-7x, so from that viewpoint we are in a neutral range.

The headline valuation is high because earnings have remained depressed for the past 7- 8 years and once we see a meaningful recovery in earnings, valuations will rationalize.

This is clearly visible from the trend in corporate profit to GDP which is at a multi-year low. But however we expect earnings to recover in 2019 meaningfully and estimate a 25% growth in NIFTY earnings led by private banks, cement, media and other sectors.

More liquidity expected in the system

More liquidity expected in the systemThe RBI recently cut rates by 25 bps and that was well received by the market. A closer look at RBIs commentary would indicate that the current governor is a tad more dovish than his predecessors, albeit the RBI is yet to change its stance officially.

The market is expecting at least two more rounds of rate cuts this year that should ensure that the system will be flushed with liquidity and some bit of that would find its way to the market.

Secondly, we believe a large number of domestic investors have been sitting on the sideline waiting for the election overhang to subside. We are hitting the last lap of the election 2019 saga and come 23rd May a lot of bunched up domestic flows that were sitting on the fence will rush into the market creating a bigger wave of liquidity for the markets to cheer.

Increase allocation to equity to profit from earnings & momentum.The time is ripe to increase investments into equity and remain invested in the market. The best course of action is to trust our Plus Delta portfolios investment process that follows long term trends and invests into stocks exhibiting a good mix of growth potential and fresh upside momentum.

We believe the market is perfectly poised with an earnings recovery round the corner combined with momentum that will be aided by strong flows. Our model seeks to catch those stocks that have all elements in place ie strong earnings, robust trends and evidence of momentum.

The author is the Fund manager of Plus Delta Portfolios- PMS vertical of Growth AvenuesSubscribe hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.