April 30, 2020 / 16:16 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Nifty has showed a good strength in the month of April as it expired with gains of 14 percent and formed a bullish candle after hitting its 100 MA on monthly chart. Now index has good resistance near 10k mark so one can initiate profit booking around 10k mark. If Nifty managed to break 10k decisively then we may see current move to extend further, good support for Nifty is coming near 9600-9500 zone. Until holding above said levels index has buy on dip structure intact.

Nifty Bank closed at 21534 with gains of more than 12 percent on monthly chart, support for Nifty Bank is coming near 21100-20800 zone and resistance is coming near 22000-22300 zone.

April 30, 2020 / 16:09 IST

Vinod Nair, Head of Research at Geojit Financial Services

:

Market ended positive for the fourth day in a row, on the back of positive signals from global markets. Successful trials of a Covid-19 vaccine helped the global markets gain some positivity. Domestically, indications of easing of lockdown measures and stimulus hopes helped drive the markets.

Being F&O expiry day today, short covering and roll-overs in the market also contributed to the gains. Financials and IT contributed most to the gains in the benchmark indices alongwith Reliance, ahead of its results.

Next week outlook will be driven by the way forward for resumption of business after lockdown, announcement of any stimulus package and stock specific earnings results.

April 30, 2020 / 15:59 IST

Sumeet Bagadia, Executive Director at Choice Broking:

Finally, the index settled its weekly closing as well as monthly Expiry at 9860 level with the gain of 300 points which is a good sign for an upside movement. Moreover, all the large cap constituents have given a good spurt during the trading session based on which the Index managed to give a jovial closing near to its 9900 level.

At present level, the index has strong resistance at 10,125 while downside good support comes at 9,620 level.

April 30, 2020 / 15:57 IST

S Ranganathan, Head of Research at LKP Securities:

Encouraging results from Gilead’s Drug to treat Covid-19 led to a strong opening today and market closed the April series up led by robust buying in autos, metals and technology stocks.

April 30, 2020 / 15:42 IST

Laurus Labs Q4

The company's consolidated net profit rose to Rs 110.2 crore versus Rs 43.2 crore, while revenue was up 32.1% at Rs 839.1 crore versus Rs 635.2 crore, YoY, reported CNBC-TV18.

April 30, 2020 / 15:35 IST

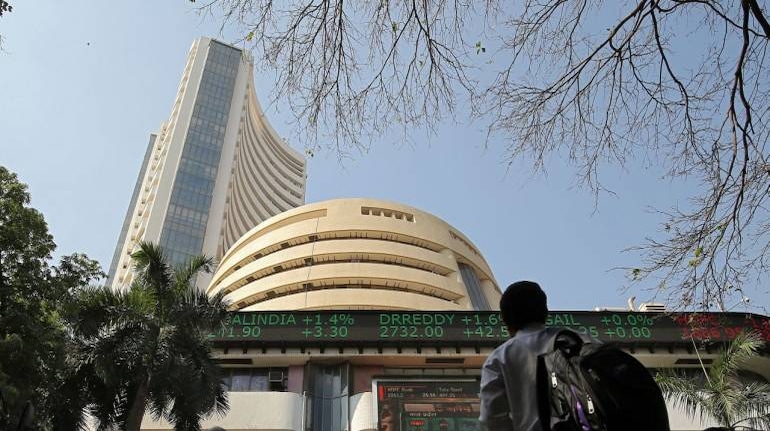

Market Close

: Benchmark indices ended higher for the fourth consecutive day with Nifty ended April series above 9850 level.

At close, the Sensex was up 997.46 points or 3.05% at 33717.62, and the Nifty was up 306.55 points or 3.21% at 9859.90. About 1316 shares have advanced, 1084 shares declined, and 165 shares are unchanged.

Tata Motors, UPL, ONGC, Vedanta and Hindalco were among major gainers on the Nifty, while losers were Sun Pharma, HUL, Cipla, IndusInd Bank and ITC.

Except pharma all other sectoral indices ended higher. BSE Midcap and Smallcap indices rose over 1 percent each.

April 30, 2020 / 15:29 IST

Aditya Birla Capital Q4

The company's Q4 net profit was down 13.6% at Rs 2.8 crore versus Rs 3.2 crore, while revenue was up 5.7% at Rs 44.5 crore versus Rs 42.2 crore, YoY, reported CNBC-TV18.

April 30, 2020 / 15:27 IST

Sanjeev Zarbade, VP PCG Research, Kotak Securities:

Most major global markets have rallied in the current week as several countries have started to talk about lifting the lockdown. It seems the worst is over so far as far as the spread of the pandemic is concerned. Reports of encouraging results about Gilead’s drug in treating Covid-19 as well as starting of human trials on Covid 19 vaccine also fuelled the rally. Improving market sentiments lifted crude oil prices.

After the strong rally from the lows of March 2020, risk of a correction has increased in the near term; though probability of the market going deep below the 30000 level looks remote. Investors should keep this in mind and trade accordingly. Yet, investment from a medium to long term perspective looks workable as we expect corporate profits to show good growth in FY22.

April 30, 2020 / 15:21 IST

ABB Power Q1

The comapny's net profit down 17.8% at Rs 29.2 crore against Rs 35.5 crore and revenue down 27.3% at Rs 811.6 crore against Rs 1,115.6 crore, QoQ, reported CNBC-TV18.

April 30, 2020 / 15:09 IST

Cadila Health signs agreement to divest stake

The company has signed the definitive agreement for sale of 2,31,33,717 equity shares of Rs 10 each fully paid‐up, representing 49% of the total paid‐up share capital of Windlas Healthcare Private Limited to Windlas Biotech Private Limited.

April 30, 2020 / 14:58 IST

Future Lifestyle Fashions appoints MD

Vishnuprasad M, Chief Executive Officer of the company has been elevated and appointed as Managing Director of the company for a period effective from April 30, 2020 till December 19, 2021, subject to the approval of the shareholders at the generalmeeting of the company.