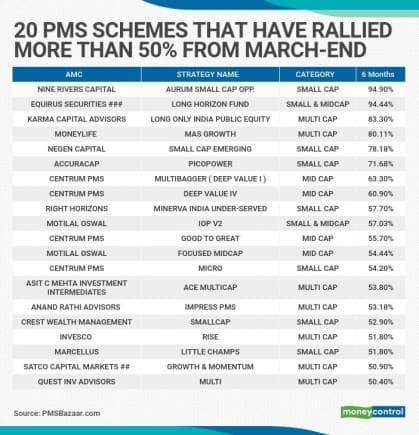

Indian market rallied by about 30 percent in the first six months of the current financial year. In the same period, 80 Portfolio Management Services (PMS) schemes outperformed the index. Top 20 of these 80 schemes gave returns of 50-100%.

The flow of global liquidity into Indian market and the expectations of recovery in economy as the Indian government initiated ‘Unlock’ supported the sentiment. The recent microdata suggests that green shoots are visible, which should support the bullish sentiment.

“Indeed, the economy is showing green shoots. The data releases since September have been especially encouraging. More importantly, anecdotes and commentary from management teams seem to suggest a strong sequential recovery. This has been a tad quicker than our expectations,” Unmesh Sharma, Head- Institutional Equities, HDFC Securities told Moneycontrol.

“The outlook on festive season sales also seems positive. Needless to say, this has reflected in stock valuations along with the fact that global central banks seem to have under-written the availability of liquidity,” he said.

Bulls managed to push the index above crucial resistance levels after falling in double digits in March. The S&P BSE Sensex now trades above 40,000 while Nifty50 is trading around 11800-12000 levels.

Although benchmark indices are still trading below their lifetime highs, the action on D-Street was more stock-specific, which portfolio managers leveraged on to generate strong alpha in the last six months.

Portfolio Management Services cater to wealthy investors and the professional fee charged by them is slightly higher than regular mutual funds (MFs). The minimum investment in a PMS scheme is Rs 50 lakh in India.

PMS schemes that gave more than 50 percent return include Nine River Capital’s AURUM Smallcap theme that delivered nearly 95 percent return in the last six months.

Aurum Small cap opportunities strategy is built out of 12-15 high conviction small-cap stocks with a market cap of more than Rs 2500 cr, and an investment horizon of 3-5 years for each stock.

The other PMS schemes which rallied more than 50 percent include Equirus Securities Long Horizon Fund. The fund focuses on making concentrated bets for the long term, in high quality publicly listed Indian companies at reasonable valuations.

Karma Capitals’ Long Only India Public Equity fund rose over 83 percent. The fund aims to achieve long-term capital appreciation by investing with patience and discipline.

Moneylife MAS Growth Fund which was the top performer among all PMS schemes in September delivered over 80 percent return in the last six months. The fund focuses on investing in quality growth stocks with an investment horizon of over 5 years.

Has the investment scenario changed?

The outbreak of COVID-19 has pushed the world and investment scenario to a new normal. Many portfolio managers have made some tweaks to their selection criteria while making buying or selling decision but the core value of sticking to fundamentally strong companies remain unchanged.

In the business of investment management, a disciplined approach to investing and operating within the ‘circle of competence’ is of utmost importance.

“At SageOne, we continue to stick to our investment philosophy to invest in superior and reasonably valued businesses and holding them till the business fundamentals confirming our thesis,” Sharad Pachisiya, CEO at SageOne Investment Advisors LLP told Moneycontrol.

“This is what we understand best and it has worked for us across market cycles. The COVID-19 event has helped us sharpen our investing framework and made us more agile,” he said.

Fundamental criteria for stock picking remains consistent across cycles. Most analysts prefer Growth at a Reasonable price which includes stocks with good visibility on Cash flows, balance sheet strength, and management quality.

“In the near term, the key criteria where we have increased our weight are management quality (with a focus on adaptability to rapidly changing circumstances); strength of balance sheet (does it stand scrutiny and our stress tests); higher visibility of cash flows,” says Sharma of HDFC Securities.

“We also differentiate between temporary beneficiaries of the pandemic- these benefits are priced in our view. While there are no distinct parallels in markets, observations in the general economy post the Spanish flu pandemic a century ago suggest that some effects will last for years if not decades,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.