Chandan Taparia

The chart patterns that we will be discussing in this article are Diamond Bottom and Diamond Top.

They are further subdivided under categories of Upward Breakout and Downward Breakout. A Diamond shaped appearance confirms the formation of this pattern.

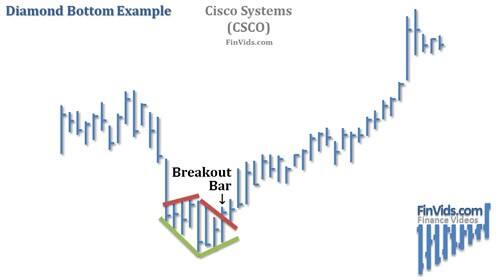

Diamond Bottom

The Diamond Bottom formation occurs after a downward price movement or a downtrend. The upward breakout is a short-term bullish reversal pattern, while the downward breakout is a short-term bearish continuation pattern. The diamond bottom begins by widening out and tracing higher highs and lower lows, then the process reverses.

The price range narrows until the breakout occurs. Volume usually trends downward over the course of the pattern, but need not. The average width of the diamond formation is about a month long.

Diamonds having a rising volume trend in bull markets performed best post breakout; diamonds in bear markets did best with a falling volume trend. For a breakout to occur from the end of the diamond it takes about just three-four days.

Diamond Top

The Diamond Top formation occurs after an upward price movement or an uptrend. The upward breakout is a short-term bullish continuation pattern, while the downward breakout is a short-term bearish reversal pattern. The fluctuations of minor highs and lows form a diamond shape when the peaks and valleys connect.

The price range narrows until the breakout occurs. The volume trend is receding, especially in the latter half of the formation when the price is narrowing.

The breakout volume is usually high but is not a prerequisite to a properly behaved diamond. Support and resistance for diamond tops commonly appear at the top of the formation. Diamonds in bear markets do best with a falling volume trend. Bull markets are either unchanged or do better with a rising volume trend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.