Trading for the last week started slightly higher on Monday taking the global positivity into consideration. However, markets turned a bit nervous in the initial hours to slide into the negative terrain.

In this process, the Nifty went on to drift lower towards the 17,000 mark. However, this firm psychological level proved its mettle on the same day as markets took a complete U-turn in the latter half to reclaim 17,200. This was followed by three back-to-back positive sessions, but the real momentum was lacking in heavyweight constituents.

Finally, on Friday, the broader market just took off which seemed to have some rub off effect on heavyweights too. With a good sustained buying throughout the day, the Nifty ended the week with handsome gains of 3 percent.

The new financial year kicked off with a bang as we saw some renewed buying interest across the board. In this process, the Nifty went on to surpass the 17,600 mark and thereby managed to reclaim the pre-war levels.

The India VIX has cooled off drastically and plunged below 20 mark comfortably, indicating steady nature of the market. Now since the banking space has taken the charge again, the rally should be considered healthy and due to this, we will not be surprised to see 17,800 or even the psychological mark of 18,000 in the forthcoming week.

On the flipside, 17,500 followed by 17,350 should now provide a decent support. Considering the ongoing momentum, any intra-week decline in the mentioned support zone should be used as a buying opportunity.

Throughout last week, we witnessed a good participation across sectors and especially on Friday, the broader end of the spectrum did extremely well along with financial space. Hence, along with frontline movers, traders should focus more on 'cash' segment stocks, which are all geared up to make a real move in coming days.

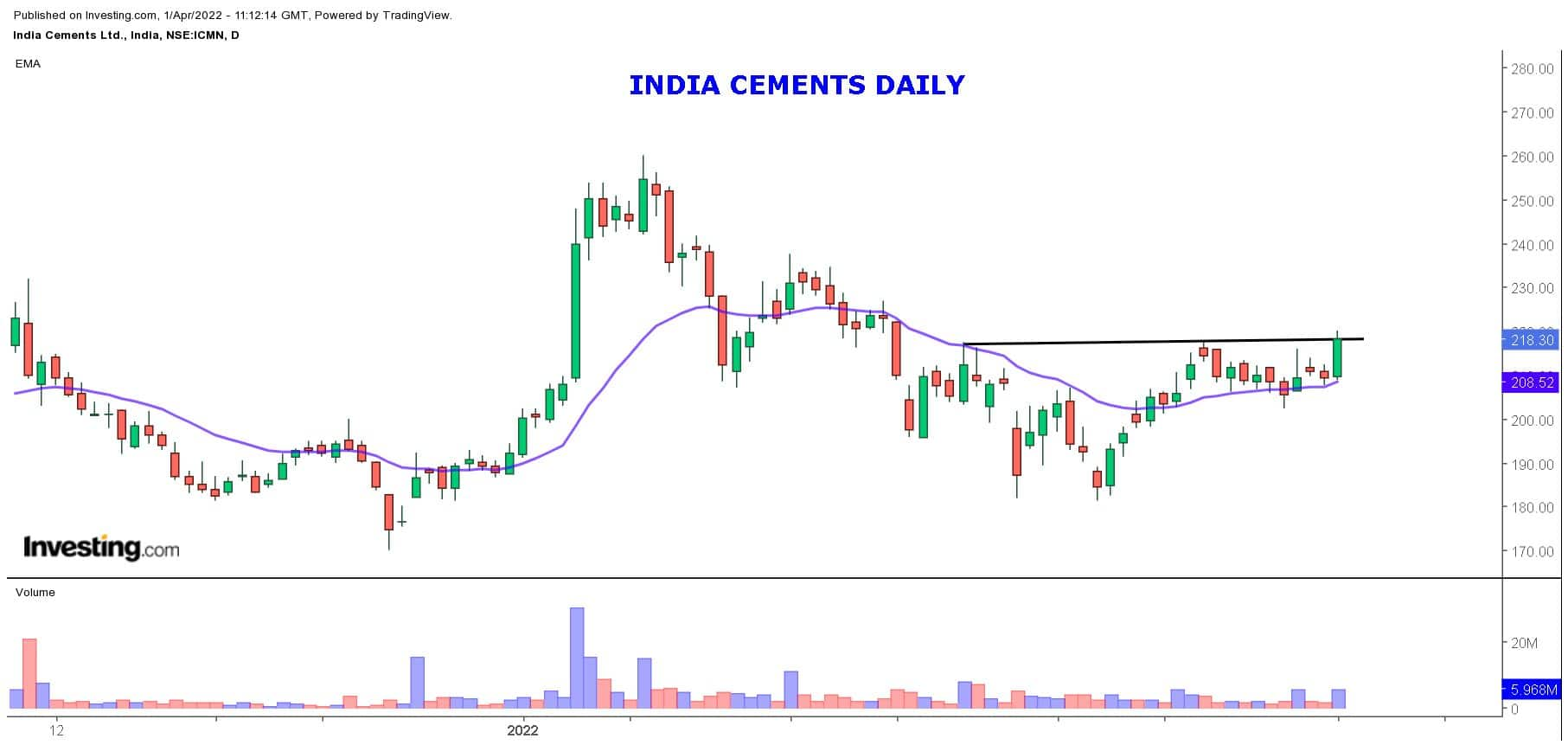

Here are two buy calls for short term:India Cements: Buy | LTP: Rs 218.30 | Stop-Loss: Rs 208.40 | Target: Rs 235 | Return: 7.6 percentOverall the cement space has undergone a massive price wise as well as time wise correction in last 4 – 5 months. However, considering the recent price behaviour, they are now seemed to be in process of finding their mojo back.

India Cements recently formed a good base around its cluster of supports and on last Friday, the stock prices finally came out of its congestion zone.

The price configuration on daily chart depicts a bullish 'Cup and Handle' pattern and since its backed by decent volumes, we recommend buying this stock for a trading target of Rs 235. The stop-loss can be placed at Rs 208.40.

This stock has done nothing since last couple of years and surprisingly is one of the worst performers in the super Bull Run the market has witnessed after the March 2020 fiasco.

On last Friday, we witnessed a first sign of some relief as prices took off to confirm a decisive price and volume breakout on daily time frame chart.

Although it would be too early to comment, we can see some encouraging signs and hence, will not be surprised to see the beginning of decent rebound in prices.

Traders can look to buy for a near term target of Rs 2,390. The stop-loss can be placed at Rs 2,195.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.