The Nifty gained for the third day in a row on April 1, the first trading session of new fiscal year 2024-25. The benchmark index made an all-time high of 22,529.95 and finally ended the day with the gains of 135 points at 22,462. Broader market indices rose more than the Nifty as the advance-decline ratio improved dramatically to 4.86:1 for the BSE, highest in 13 years since April 4, 2011.

The short-term trend in the NSE bellwether is positive as the Nifty is placed above its important short-term and medium-term moving averages. Momentum indicators and oscillators show strength in the current uptrend.

In the Option segment, we have seen aggressive Put writing at the 22,000-22,200 levels. This level coincides with the 11-day and 20-day EMA (exponential moving average) which are placed at 22,176 and 22,145. Therefore, on the downside, the 22,000-22,200 levels would act as a strong support.

Traders are advised to accumulate longs in the Nifty with a stop-loss of 22,000 on a closing basis. On the higher side, we expect the index to reach 22,800-23,000 levels in the coming weeks.

The broad market indices like NSE Midcap 100 and Smallcap 100 have formed higher bottom reversals. The recent downward corrections seem to have ended and the sharp upside bounce could be in store for the coming weeks. It’s time to accumulate selective midcap and smallcap stocks for a reasonable upside for the coming month.

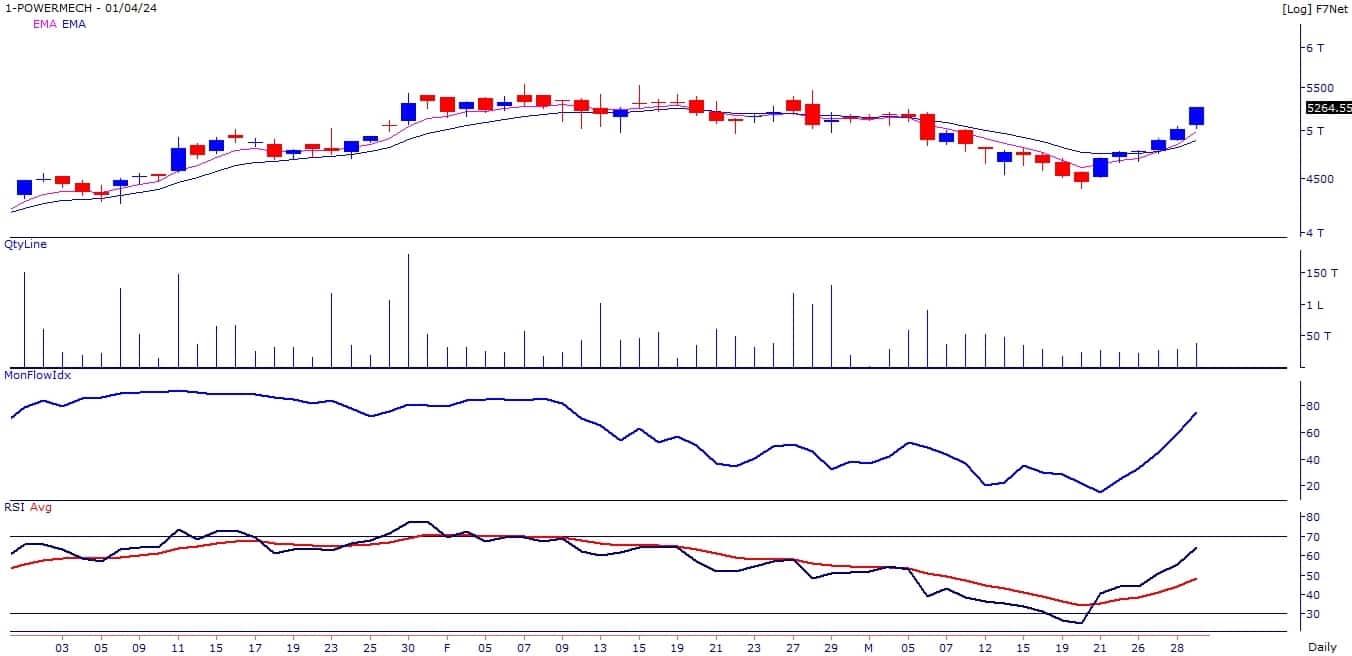

Here are three buy calls for the next 3-4 weeks:Power Mech Projects: Buy | LTP: Rs 5,265 | Stop-Loss: Rs 4,900 | Target: Rs 5,660, 5,800 | Return: 10 percentShort-term trend in the stock turned positive as it closed above its 11-day and 20-day moving averages. Primary trend of the stock is positive as it trades above the important medium and long term moving averages.

Momentum indicators and oscillators like RSI (relative strength index) and MFI (money flow index) are in the rising mode and placed above 60 on the weekly and monthly chart, indicating strength in the stock.

Short-term trend in the stock turned positive as the stock price has closed above its five-day and 11-day EMA with higher volumes. The stock has formed multiple bottoms around Rs 195-odd levels.

Momentum indicators and oscillators like MFI (money flow index) and RSI (relative strength index) are sloping upwards on the daily chart, suggesting strength in the current bullish trend reversal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.